LG Electronics India IPO Overview

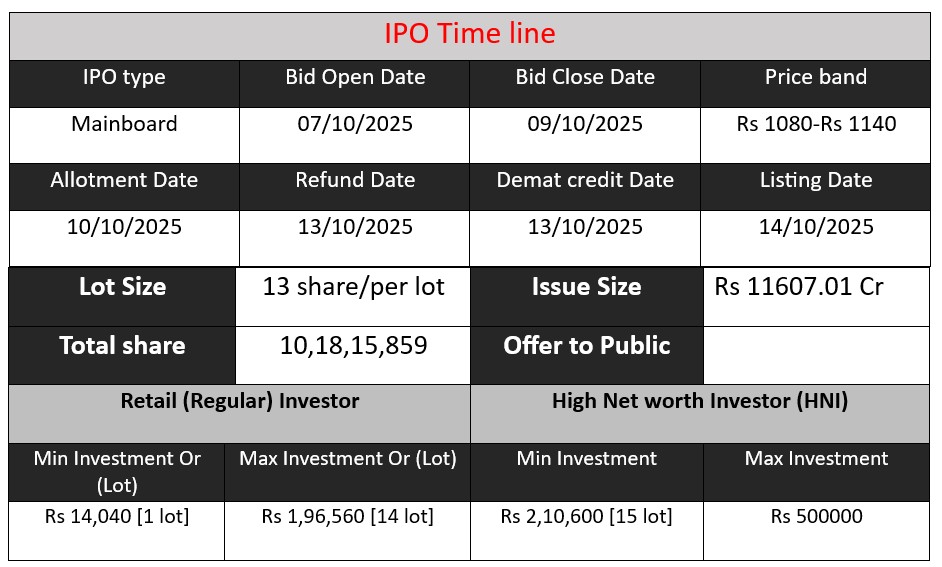

LG Electronics India IPO to open on October 7, 2025, and close on October 9, 2025, with an issue size of ₹11,607 crore. The company is offering 10.18 crore shares, representing a 15% stake. Proceeds will support business expansion, including a new manufacturing plant in Sri City, Andhra Pradesh, and strengthen operations. Investors can participate in this promising consumer electronics and home appliances leader’s public offering.

LG Electronics India GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 379 | 1080-1140 |

| Last Updated: 11 Oct 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Basic Detail

LG Electronics India Core Business & Overview

LG Electronics India Limited (LGEIL) is a wholly owned subsidiary of LG Electronics Inc., South Korea, established in 1997. Headquartered in Greater Noida, Uttar Pradesh, LGEIL has become a prominent player in India’s consumer electronics and home appliances sector.

Company Operation

LGEIL offers a diverse range of products, including refrigerators, washing machines, air conditioners, microwave ovens, and televisions. The company operates manufacturing facilities in Greater Noida, Pune, and is in the process of constructing a third plant in Sri City, Andhra Pradesh, with an investment of $600 million. This expansion aims to enhance production capacity and generate significant employment opportunities.

Strengths

- Market Leadership: LGEIL has maintained the top position in the Indian home appliances and consumer electronics market for 13 consecutive years (2011–2023), according to a Redseer report.

- Extensive Distribution Network: The company boasts the largest distribution network among its competitors, facilitating personalized consumer services across the country.

- Brand Recognition: LGEIL is recognized as a Great Place to Work®, reflecting its commitment to creating an outstanding work environment.

Risks

- Dependence on Parent Company: LGEIL relies on LG Electronics for business support and exports. Any adverse changes in this relationship could impact its operations and financial health.

- Market Volatility: The company faces risks associated with global economic conditions and exchange rates, which can affect its revenue and profitability.

- Intense Competition: LGEIL competes with other major players in the consumer electronics and home appliances sector, such as Samsung and Whirlpool, which can pressure its market share and margins

Financial Performance Overview (₹ in Crore)

| Financial Metric | FY 2022 | FY 2023 | FY 2024 |

| Revenue | 16,834.2 | 19,864.6 | 21,352 |

| Profit | 1,174.7 | 1,344.9 | 1,511.1 |

| Assets | 9,485.93 | 9,062.53 | 8,578.33 |

Revenue

- Revenue increased from ₹16,834.2 crore in FY22 to ₹21,352 crore in FY24, which is a 26.9% growth over 2 years.

- The company shows a steady increase in sales, indicating strong market demand for its products and effective distribution strategies.

Profit

- Profit grew from ₹1,174.7 crore in FY22 to ₹1,511.1 crore in FY24, a 28.6% increase over 2 years.

- The growth in profit is slightly higher than revenue growth, suggesting that LG India is improving its operating efficiency and cost management.

Asset

- Total assets declined from ₹9,485.93 crore in FY22 to ₹8,578.33 crore in FY24, a drop of 9.6%.

- This could indicate that the company is utilizing its assets more efficiently or reducing fixed asset holdings. The increasing revenue and profit despite declining assets reflects strong asset turnover.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.