Suba Hotels IPO Overview

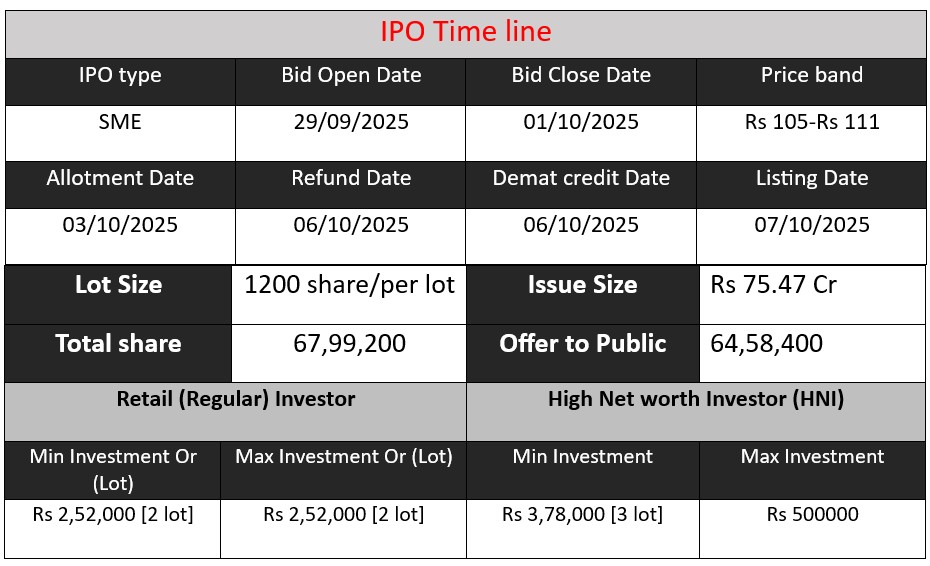

Suba Hotels Limited is launching its Initial Public Offering (IPO) to raise up to ₹75.47 crore by issuing 6,799,200 equity shares with a face value of ₹10 each. The price band is set between ₹105 and ₹111 per share. The IPO opens on September 29, 2025, and closes on October 1, 2025. The listing is scheduled for October 7, 2025, on the NSE Emerge platform. Proceeds will fund capital expenditure for hotel upgrades and general corporate purposes.

Suba Hotels GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 10 | 105-111 |

| Last Updated: 6 Oct 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Suba Hotels Core Business & Overview

Founded in 1994 by Mr. Abubaker Mehta, Suba Hotels began as Suba Guest House in Mumbai. Under the leadership of Mr. Mansur Mehta and his son, Mr. Mubeen Mehta, the company has expanded to operate over 129 properties across 72+ locations in India and Dubai. The company offers a range of hotel brands, including Suba Hotels, Click Hotels, GenX Hotels, RnB Hotels, Clarion Hotels, Quality Inn Hotels, and Comfort Inn Hotels, catering to both luxury and budget travelers.

Operations

Suba Hotels operates a diversified portfolio of hotels through various models:

- Owned Properties: Directly owned and managed by the company.

- Managed and Revenue Share: Properties managed on behalf of owners with shared revenues.

- Lease and Franchise: Leased properties and franchised operations under various brand names.

As of July 2025, Suba Hotels operates 88 hotels with 4,096 keys across more than 50 cities in India, with approximately 81% of its properties located in emerging tier 2 and tier 3 markets. The company also has 40 hotels in the pre-opening stage, adding 1,831 rooms, thereby expanding into underpenetrated regions.

Strengths

- Diverse Brand Portfolio: The company’s range of brands caters to various market segments, from budget to luxury, allowing it to appeal to a broad customer base.

- Strategic Expansion: With a presence in over 50 cities and plans for further expansion, Suba Hotels is well-positioned to capitalize on the growing demand for mid-market accommodations in India.

- Strong Leadership: The Mehta family’s long-standing involvement and leadership have provided stability and a clear strategic direction for the company’s growth.

Risks

- Market Competition: The hospitality industry is highly competitive, with numerous players vying for market share, which could impact Suba Hotels’ profitability.

- Operational Challenges: Managing a diverse portfolio across various models (owned, leased, franchised) can lead to complexities in operations and quality control.

- Economic Sensitivity: The hospitality industry is sensitive to economic downturns, which can affect travel and occupancy rates.

Financial Performance Overview (₹ in Crore)

| Financials | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 35.03 | 52.28 | 79.24 |

| Profit | 2.78 | 8.96 | 15.15 |

| Assets | 85.23 | 100.07 | 123.04 |

Revenue

Revenue has shown strong growth over the three years:

- FY 2024 vs FY 2023: (52.28 – 35.03) / 35.03 × 100 = 49.3% growth

- FY 2025 vs FY 2024: (79.24 – 52.28) / 52.28 × 100 = 51.5% growth

This indicates the company is successfully expanding its hotel portfolio and increasing occupancy and average room rates.

Profit

Profit has increased even faster than revenue:

- FY 2024 vs FY 2023: (8.96 – 2.78) / 2.78 × 100 = 222.3% growth

- FY 2025 vs FY 2024: (15.15 – 8.96) / 8.96 × 100 = 69.2% growth

The faster growth in profit relative to revenue suggests improved operational efficiency and cost management.

Asset

Assets have grown steadily:

- FY 2024 vs FY 2023: (100.07 – 85.23) / 85.23 × 100 = 17.4% growth

- FY 2025 vs FY 2024: (123.04 – 100.07) / 100.07 × 100 = 23.0% growth

Increasing assets reflect investment in hotel properties and expansion of operations.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.