VijayPD Ceutical IPO Overview

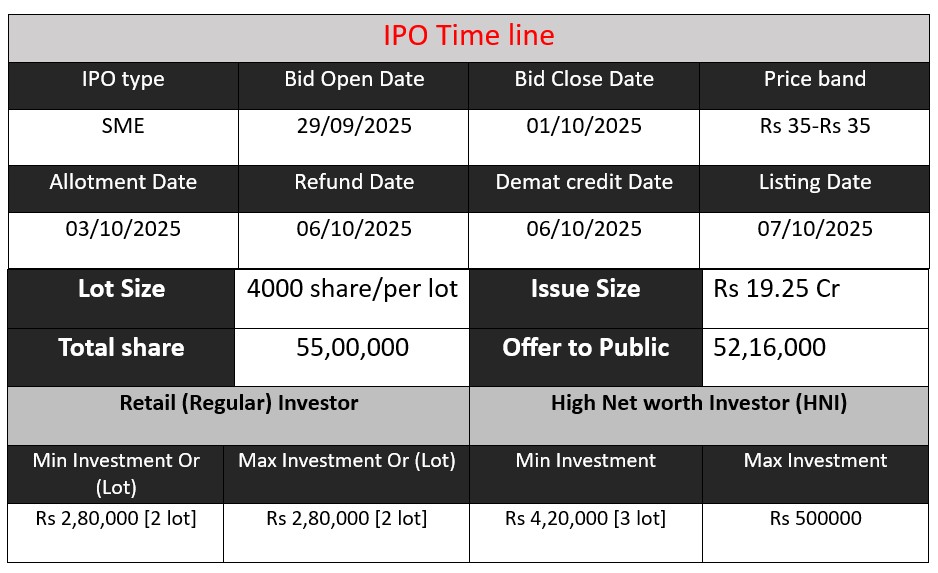

VijayPD Ceutical Limited is launching its SME IPO with an issue size of ₹19.25 crore, offering 55 lakh equity shares at a fixed price. The IPO will open on 29 September 2025 and close on 1 October 2025. Proceeds will be used for setting up API and chemical manufacturing facilities, repayment of borrowings, and general corporate purposes. Investors can subscribe on NSE Emerge for long-term pharma sector growth exposure.

VijayPD Ceutical GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 0 | 35 |

| Last Updated: 3 Oct 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

VijayPD Ceutical Core Business & Overview

VijayPD Ceutical Limited is registered in India under the Corporate Identification Number (CIN) U46497MH2024PLC421713, founded in 1971

The company address (registered) is Devraj Building, A-1, 1st Floor, S V Road, Goregaon, Mumbai, Maharashtra.

It appears that VijayPD Ceutical was formed via a conversion from Vijay Pharma (or a reorganization) and took on its current public limited form under Companies Act provisions.

Business / Sector

The company operates primarily in pharmaceutical distribution: it is a wholesaler, stockist, supplier, distributor, and B2B intermediary for pharmaceutical and healthcare products.

Beyond just distribution, it also offers services to pharmaceutical manufacturers (as their sales, marketing, supply chain support), and it distributes not only prescription medicines but also wellness products, OTC goods, diagnostic kits, consumer health goods (e.g. personal care, etc.).

As part of its IPO plan, the company intends to expand into manufacturing of APIs (Active Pharmaceutical Ingredients), intermediates, and chemicals, setting up a plant in MIDC, Shrirampur, Maharashtra.

Scale, Reach & Network

VijayPD claims a distribution network covering more than 1,000 pharmacists / retailers in its region (Western Maharashtra / Mumbai) as authorized distributors.

It serves as a stockist / distributor for 150+ pharmaceutical companies (including many large ones in the industry).

It also has a hospital & institutional procurement division serving medical institutions in Mumbai.

Management

The Managing Director is Samit Shah

Strengths

Based on disclosures and industry commentary, here are some of the company’s key strengths:

- Established distribution footprint & relationships

Because the company already acts as a distributor / stockist for many pharma manufacturers and has a network of pharmacists / retailers, it is positioned well in terms of channel relationships, trust, and integration. - Diverse product portfolio across healthcare / wellness / consumer health

By not limiting itself only to branded or prescription drugs, the company can tap into OTC, personal care, wellness, diagnostic kits, etc., which helps spread risk and opens more revenue lines. - Planned backward integration (manufacturing / API) may improve margins

The shift into manufacturing APIs / intermediates and chemicals can help reduce dependence on third-party suppliers and provide better margin control, provided execution is successful. - Geographic concentration with operational efficiencies

Because it is concentrated in Mumbai / Maharashtra, logistics / last-mile distribution may be more efficient, overheads lower, and control higher versus pan-India dispersion (though this is a double-edged advantage). - Growth momentum / improving profitability trends appear in projected financials

According to the IPO disclosures, revenue, profitability, and margins show improving trends (though historical track record is limited).

Risks

No company is without risks. Based on the IPO disclosures and analyses, here are key risk factors:

- Execution risk for manufacturing / API expansion

Moving from distribution into manufacturing APIs and intermediates is capital-intensive and challenging. Delays, regulatory issues, cost overruns, lower yields, and competition could impair margins or lead to losses. (From IPO risk disclosures) - Product returns, spoilage, damage & liability claims

As a distributor of pharmaceuticals and consumables, there is risk of expiry, spoilage, handling damage, counterfeit or defective products, or liability claims if products are found unsafe or defective. - Geographic concentration of revenue

A large share of its revenue is expected from Maharashtra / Western India. Any regulatory, economic, or competitive issues in that region could disproportionately affect its performance. - Dependence on third-party manufacturers & margin pressure

For its distribution business, the company depends on pharma manufacturers for supply, pricing, discounting, and terms. Any adverse change in those terms or increased competition among distributors could squeeze margins. (Implicit, also mentioned in risk notes) - Regulatory / compliance risk in pharmaceuticals industry

The pharma / health segment is heavily regulated (drug approvals, quality standards, licensing). Any failure to comply or changes in regulation could expose the company to fines, recalls, or disruptions. (Standard risk in pharma sector) - Limited track record as a public / scaled entity

Since the public entity is newly formed (2024), and its IPO is just upcoming, there is limited historical data for investors to assess consistency, resilience in downturns, or response to market stress.

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Total Assets |

| FY 2023 | 48.77 | 0.18 | 32.87 |

| FY 2024 | 54.33 | 1.65 | 33.27 |

| FY 2025 | 106.81 | 4.79 | 57.14 |

Revenue

- FY 2023 → FY 2024: Revenue increased from ₹48.77 crore to ₹54.33 crore, showing 11% growth.

- FY 2024 → FY 2025: Revenue jumped sharply from ₹54.33 crore to ₹106.81 crore, marking 97% growth.

The company showed moderate growth initially, but FY 2025 witnessed a big leap, likely due to scaling distribution operations or new product/service additions. This sharp rise indicates strong demand and possible early benefits of expansion plans.

Profit

- FY 2023 → FY 2024: Profit grew from ₹0.18 crore to ₹1.65 crore, a 817% rise (low base effect).

- FY 2024 → FY 2025: Profit rose further to ₹4.79 crore, showing a 190% growth.

Profitability improved significantly, reflecting better cost control, efficiency in operations, and possibly improved margins. The company is moving from a low-profit base to more sustainable earnings.

Total Assets

- FY 2023 → FY 2024: Assets increased slightly from ₹32.87 crore to ₹33.27 crore.

- FY 2024 → FY 2025: Assets rose strongly to ₹57.14 crore (72% growth).

The big jump in FY 2025 shows fresh capital investments, likely for infrastructure and expansion (possibly linked to their planned API manufacturing unit). Asset growth supports future scalability.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.