Om Freight Forwarders IPO Overview

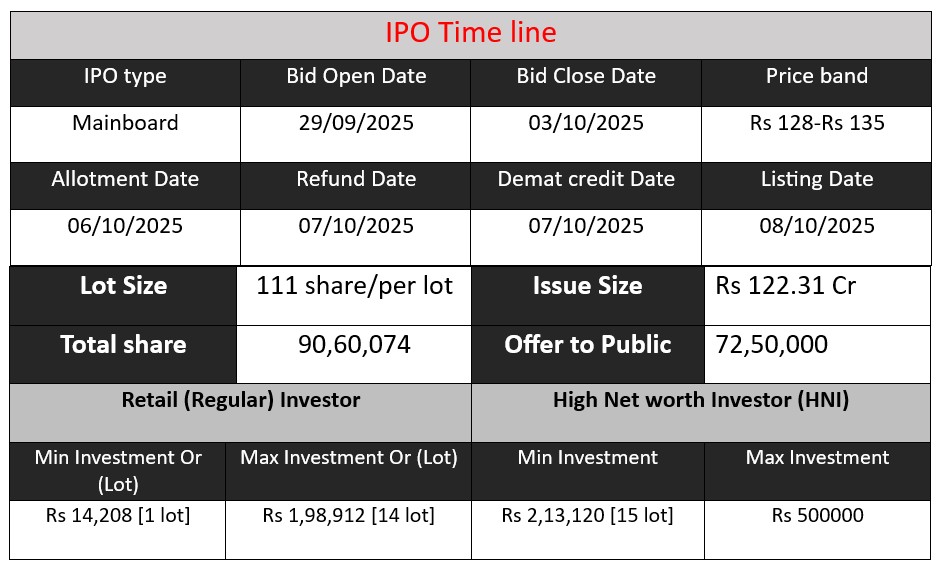

Om Freight Forwarders Ltd IPO opens on September 29, 2025, and closes on October 3, 2025. The issue size is ₹122.31 crore, comprising a fresh issue of ₹24.44 crore and an offer for sale (OFS) of ₹97.88 crore. The price band is set at ₹128–₹135 per share, with a minimum lot size of 111 shares . Listing is scheduled on BSE and NSE on October 8, 2025.

Om Freight Forwarders GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 7 | 128-135 |

| Last Updated: 3 Oct 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Om Freight Forwarders Core Business & Overview

Om Freight Forwarders Limited (often “Om Freight”). Third‐party logistics (3PL) & integrated freight forwarding services. Incorporated in 1995; it is a third‐generation company, though its domain expertise spans “over four decades”.

Headquarters & Locations: Based in Mumbai, India. It has 28 branches pan-India and overseas offices/associates in places like China, Hong Kong, UK (Europe), Singapore. It serves 700-800+ national and international locations.

Services Offered:

- International freight forwarding (air, sea)

- Customs clearance / Customs House Agent work at major air/seaports in India

- Transportation (road, rail, sea etc.), distribution & domestic logistics

- Warehousing (including bonded warehouses and general/covered/open ones)

- Project logistics (i.e. handling over-dimensional cargo (ODC), heavy lifts, breakbulk, etc.)

- Charter services (air, vessel, barges) and nominated cargo services.

Certifications / Accreditations: It is accredited under various industry bodies: IATA, FIATA, etc. It complies with custom rules, is an MTO (Multimodal Transport Operator), etc.

Strengths

From its filings and press reports, these are its key strengths:

- Comprehensive, end-to-end logistics capabilities

Because Om Freight offers everything from customs clearance, freight forwarding, transportation, warehousing, project logistics etc., it serves as a “one-stop shop” for many clients. - Strong industry experience & track record

Over four decades of domain expertise, evolved from a customs clearing agency to full logistics solutions provider. Established customer relationships. - Wide network + international reach

28 branches across India; overseas offices and associates; service reach to 700-800+ locations globally through tie-ups. This helps in cross-border, multimodal movement. - Asset base + hybrid model

The company owns specialized equipment (trailers, cranes, etc.), has its own fleet as well as uses third-party partners for capacity. The hybrid model helps in flexibility. - Diverse sector exposure

It serves multiple verticals: minerals, steel, mining, oil & gas, infrastructure, FMCG, etc. This helps reduce dependence on a single industry.

Risks

No company is without risks. For Om Freight, based on disclosures, these are some of the key risks:

- Revenue concentration

A significant portion of revenue comes from its top customers. Loss or reduction of business from any of them could materially affect results. - Geographic concentration

Maharashtra alone contributes a large share (over 85-88%) of its revenues. If Maharashtra’s economy is affected (by regulatory changes, disruptions, political or natural disasters), Om Freight would be disproportionately exposed. - Dependence on third‐party partners and lack of long-term contracts with shipping lines

While the company has built long relationships, some key service components (shipping lines, transportation partners) are not always covered by long-term contracts. This could lead to cost or supply disruptions. - Volatility in key input costs & external environment

Costs like fuel, freight rates, shipping charges, regulatory changes (customs, trade policies), global trade fluctuations can affect margins. - Cash flow / investment risk

The company’s investing activities (capex on vehicles / equipment) require substantial outlays. There are periods of negative cash flows from investing. Also trade receivables have been increasing. If not managed, these could lead to liquidity issues. - Competition risk

The logistics sector is competitive, with both domestic and international players. Competition could pressure pricing, margins, service levels.

Financial Performance Overview (₹ in Crore)

| Financial Metric | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 471.14 | 410.5 | 490.14 |

| Profit | 27.16 | 10.34 | 21.99 |

| Assets | 305.18 | 268.84 | 312.02 |

Revenue

- Revenue declined from ₹471.14 crore in FY23 to ₹410.5 crore in FY24, a drop of 12.9%.

- This indicates some temporary slowdown, possibly due to lower freight volumes, reduced shipping demand, or sectoral disruptions.

- FY25 shows strong recovery at ₹490.14 crore, an increase of 19.4% from FY24 and 4% over FY23, suggesting rebound in business and improved demand.

Profit

- Profit followed a similar pattern: dropped sharply from ₹27.16 crore (FY23) to ₹10.34 crore (FY24), a decline of 62%, indicating that cost pressures or lower margins hit earnings disproportionately compared to revenue.

- In FY25, profit improved to ₹21.99 crore (112.7% growth over FY24), but still slightly below FY23 level, reflecting better cost management and operational efficiency.

Assets

- Total assets declined in FY24 to ₹268.84 crore (12% drop), possibly due to depreciation, lower capital investment, or divestments.

- FY25 assets increased to ₹312.02 crore (16% increase over FY24), showing renewed investments in fleet, equipment, or warehousing, supporting growth.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.