Pace Digitek IPO Overview

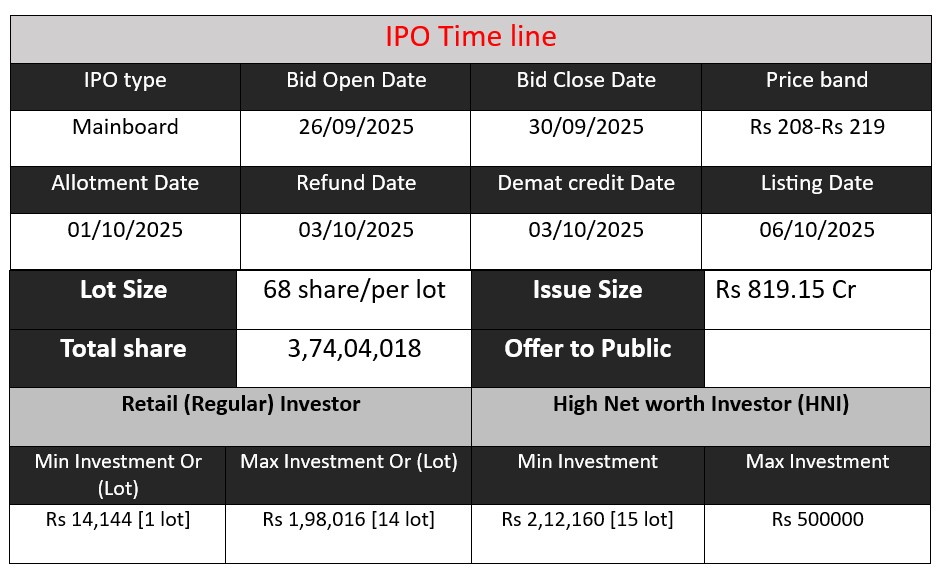

Pace Digitek IPO (₹ 819.15 cr fresh issue) offers 3.74 cr equity shares at ₹ 208–219 each. Subscription opens September 26, 2025 and closes September 30, 2025. Proceeds will fund battery energy storage system (BESS) expansion (₹ 630 cr) and general corporate purposes. The IPO is a wholly fresh issue with no offer for sale.

Pace Digitek GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 11 | 209-219 |

| Last Updated: 1 Oct 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Pace Digitek Core Business & Overview

Pace Digitek was Founded around the early 2007and has grown into a telecom infrastructure / energy solutions company.

Through its acquisition of Lineage Power (GE’s power electronics business in India) the company expanded into DC power systems and telecom-power hardware.

Headquarters / footprint

Its registered / operational presence is in Bengaluru (Karnataka, India).

The company claims a pan-India footprint, plus international presence (Africa, Myanmar, Bangladesh, Sri Lanka) in delivering telecom, energy, and infrastructure services.

Business / lines of activity

Pace Digitek positions itself as a solutions integrator in the telecom infrastructure and energy domains. Key verticals include:

- Telecom / Power Management Systems: Designing, manufacturing, and supplying systems such as DC power systems, hybrid DC systems, SMPS, charge control units, inverters, etc., targeted mostly for telecom tower infrastructure.

- Optic Fiber / Telecom Infrastructure / EPC / Turnkey Projects: Laying optical fibre, deploying telecom infrastructure (towers, etc.), and offering EPC / turnkey models.

- Renewable Energy & Energy Storage / BESS (Battery Energy Storage Systems): More recently, it has been pushing into solar, battery storage, hybrid solar + BESS systems, and integrating energy solutions, in response to growth in renewables.

- Operation & Maintenance (O&M), lifecycle services: Beyond supply, it offers after-sales services, maintenance, lifecycle management, and AMC / warranty support.

Strengths

From the available literature, some of the key strengths or differentiators of Pace Digitek are:

- End-to-end integrated capabilities / vertical integration

Because Pace Digitek is involved in both product manufacturing (via Lineage) and project execution, plus O&M and lifecycle services, it has more control over the supply-to-install-to-maintain chain.

This reduces dependence on external vendors or contractors and may help ensure consistency in quality, timelines, and margins. - Strong order book and diversified business verticals

The claimed order backlog (~ ₹7,634 crore) provides revenue visibility and buffer.

Also, the business is not purely dependent on telecom — increasing exposure to energy / BESS provides diversification (though in practice telecom still dominates). - Technological / domain experience, acquisitions

The acquisition of GE’s Lineage Power enabled the company to absorb expertise in DC / power electronics, which was a value-accretive move.

Its R&D focus, process maturity (ISO / certifications claimed) and in-house product design are also cited as strengths (e.g. ability to innovate in product systems) in some IPO-/review notes. - Geographic reach & scale

The presence across several Indian states and some international presence helps them bid across regions. Also, two manufacturing facilities (with large production area) enhance capacity. - Financial growth / margin improvement

Over recent years, it has reported strong growth in revenue and improving margins (e.g. EBITDA margin increasing to ~19.8% in FY25) in the IPO note.

Risks & Challenges

While the company has promising dimensions, a number of risks are clearly flagged in its IPO / analysis documents. Key ones include:

- Customer / revenue concentration risk

A large portion of revenue comes from a small set of major customers. For example, in FY25, about 93–96% of revenue is reported as coming from its top ~ 10 customers.

Any weakening, loss, or non-renewal from those clients could significantly impact revenue. - High working capital intensity / receivables cycle

The business is capital / working capital intensive. In the IPO note, the working capital cycle is noted as ~ 145 days, and debtor days ~ 218 days.

If collections delay, or if clients default, cash flow can be stressed. - Dependence on government / public sector / tendering

Much of its revenue comes via government / PSU / state contracts (i.e. via bids). If it fails to win bids, or if policies / tendering terms change, the business may suffer. - Supply chain / vendor risk

Disruption in supply of raw materials, critical components, imported parts, or vendor failures could hamper operations or increase costs. - Sectoral / technology risk

Since telecom continues to contribute a large share of revenue, downturns in telecom capex cycles, regulatory changes, or disruptive technology shifts could negatively affect demand.

The newer energy / BESS segment also has inherent execution, technology, and competitive risk (battery technology, cost fluctuations, regulatory / subsidy changes). - Execution risk in new verticals

Moving deeper into BESS / energy storage is promising but challenging: success depends on cost control, technology, scalability, regulatory support, and competition.

Financial Performance Overview (₹ in Crore)

| Fiscal Year | Revenue | Profit | Assets |

| FY 2023 | 503.2 | 16.53 | 840.15 |

| FY 2024 | 2434.49 | 229.87 | 2253.87 |

| FY 2025 | 2438.78 | 279.10 | 2648.96 |

Revenue

- FY 2023: ₹503.2 crore

- FY 2024: ₹2434.49 crore (massive jump of ~384% YoY)

- FY 2025: ₹2438.78 crore (flat, almost no growth vs FY 2024)

The company scaled up sharply in FY 2024, likely due to large order execution and expansion into new verticals (energy/BESS). However, FY 2025 shows stagnation in revenue growth, signaling either order execution delay, saturation, or a pause after rapid scale-up.

Profit

- FY 2023: ₹16.53 crore

- FY 2024: ₹229.87 crore (strong jump, PAT margin ~9.4%)

- FY 2025: ₹279.1 crore (further rise, PAT margin ~11.4%)

Profitability has improved significantly with scale. Margins are expanding — showing better cost control, efficiency, or favorable mix (higher-margin segments like energy solutions). This is a positive indicator of financial health.

Assets

- FY 2023: ₹840.15 crore

- FY 2024: ₹2253.87 crore (168% growth)

- FY 2025: ₹2648.96 crore (17.5% growth)

Asset base expanded rapidly in FY 2024, supporting reven

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.