Jinkushal Industries IPO Overview

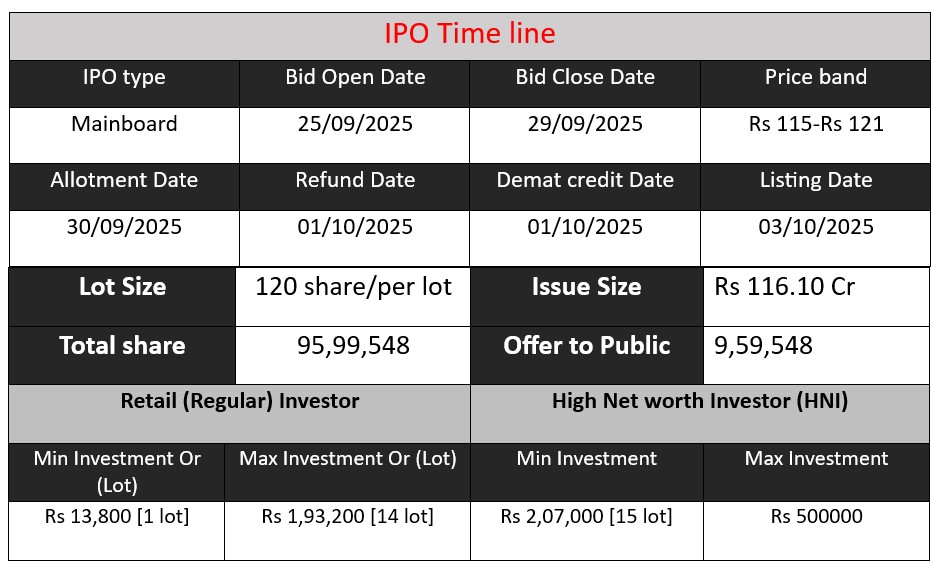

Jinkushal Industries Limited IPO opens on 25th September 2025 and closes on 29th September 2025. The company aims to raise ₹116 crore by issuing equity shares between ₹115-121 each. Funds will be used for business expansion, working capital, and general corporate purposes. JKIPL, a leading exporter of construction machinery, offers investors an opportunity to participate in its growth and global market expansion.

Jinkushal Industries GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 20 | 115-121 |

| Last Updated: 30 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Jinkushal Industries Core Business & Overview

Jinkushal Industries Limited (JKIPL), founded in 2007 and headquartered in Raipur, Chhattisgarh, is a prominent Indian exporter of construction machinery. The company specializes in trading new/customized and used/refurbished heavy equipment, including excavators, backhoe loaders, bulldozers, and motor graders. With a presence in over 30 countries, JKIPL is recognized as a Three-Star Export House by the Directorate General of Foreign Trade (DGFT), Government of India.

Business

- Export Trading: JKIPL exports a diverse range of construction machinery, including both new and refurbished units, to international markets.

- Brand Development: The company has launched its own brand, ‘HexL’, focusing on backhoe loaders to cater to global markets.

- Logistics & Warehousing: To support its operations, JKIPL has developed a robust logistics and warehousing network, facilitating efficient distribution of machinery worldwide.

Strengths

- Market Leadership: JKIPL holds a 6.9% market share in the non-OEM construction equipment export sector, making it the largest exporter in this category.

- Global Reach: The company has successfully exported machinery to over 30 countries, including the UAE, Mexico, Netherlands, Belgium, South Africa, Australia, and the UK.

- Sustainability Initiatives: JKIPL is committed to environmental responsibility through the refurbishment and reuse of construction machinery, contributing to the circular economy.

Risks

- Market Dependency: The company’s revenue is heavily reliant on international markets, making it susceptible to global economic fluctuations and trade policies.

- Customer Concentration: JKIPL’s customer base may be limited, posing risks if key clients reduce orders or switch to competitors.

- Capital Requirements: The nature of the business requires significant working capital for inventory management, refurbishment processes, and logistics, which could impact liquidity

Financial Performance Overview (₹ in Crore)

| Financial Metric | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 233.45 | 238.59 | 380.56 |

| Profit | 10.12 | 18.64 | 19.14 |

| Assets | 49.39 | 109.44 | 179.35 |

Revenue

- From FY 2023 to FY 2024, revenue increased marginally from ₹233.45 crore to ₹238.59 crore, a growth of 2.2%, indicating steady but slow expansion.

- From FY 2024 to FY 2025, revenue jumped significantly to ₹380.56 crore, an increase of 59.5%, suggesting strong business scaling, likely due to higher exports or increased sales of machinery.

Profit

- Profit increased from ₹10.12 crore in FY 2023 to ₹18.64 crore in FY 2024, a growth of 84%, which is substantial compared to revenue growth, indicating improved operational efficiency or better margins.

- Profit further increased to ₹19.14 crore in FY 2025, a growth of 2.7%, despite the large revenue jump, which may indicate rising costs or investments affecting net profitability.

Asset

- Assets nearly doubled from ₹49.39 crore in FY 2023 to ₹109.44 crore in FY 2024 and further increased to ₹179.35 crore in FY 2025, showing aggressive investment in machinery, inventory, or infrastructure to support growth.

- The strong asset growth reflects capacity expansion to support higher revenue potential.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.