Trualt Bioenergy IPO Overview

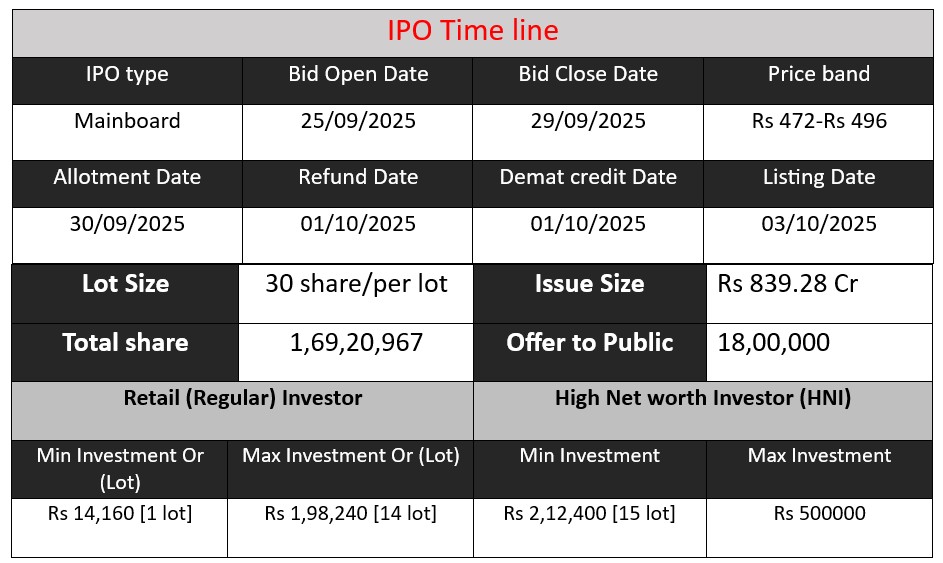

TruAlt Bioenergy IPO opens on 25th September 2025 and closes on 29th September 2025, offering shares to raise ₹839 crore. The IPO comprises [insert total shares] shares at a price band of ₹472–₹496 per share. Proceeds will fund ethanol & CBG plant expansion, retail fuel outlets, and general corporate purposes. Listed on NSE & BSE, this IPO marks a key opportunity in India’s renewable energy sector.

Trualt Bioenergy GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 110 | 472-496 |

| Last Updated: 29 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Trualt Bioenergy Core Business & Overview

TruAlt Bioenergy Limited is one of India’s largest biofuel producers, primarily engaged in the production of first-generation (1G) ethanol and compressed biogas (CBG). Incorporated in 2021 and headquartered in Bengaluru, the company operates several large-scale facilities, including a 2,000 KLPD (kilolitres per day) ethanol plant and a 10.2 TPD CBG plant in Karnataka.

Operations

- Ethanol Production: TruAlt produces 1G ethanol from sugarcane juice, molasses, sugar beet, and starch-based feedstocks like corn and damaged grains.

- Compressed Biogas (CBG): Through its subsidiary Leafinity, the company operates a 10.2 TPD CBG plant, contributing to India’s renewable energy goals.

- Retail Fuel Marketing: In June 2025, TruAlt received authorization from the Ministry of Petroleum and Natural Gas to operate as an Oil Marketing Company (OMC), enabling it to retail petrol and high-speed diesel. The company plans to establish 100 retail outlets, with operations expected to commence at eight outlets shortly.

Strengths

- Market Leadership: TruAlt is India’s largest ethanol producer by installed capacity, with 1,800 KLPD operational as of March 2025. The company produced 1.82 lakh kilolitres of ethanol in FY25, up from 1.41 lakh kilolitres in FY24.

- Secure Feedstock Supply: The company benefits from assured access to raw materials through its promoter group, which has a cane crushing capacity of 79,000 tonnes per day. In FY25, TruAlt consumed 3.75 lakh MT of sugar syrup or juice and 3.61 lakh MT of molasses for its ethanol operations.

- Strategic Partnerships: In July 2024, TruAlt secured a ₹390 crore order to supply nearly 6 crore litres of 1G bioethanol over three months from August to October 2024. This order was from leading Oil Marketing Companies (OMCs) including Hindustan Petroleum Corporation Limited, Bharat Petroleum Corporation Limited, Indian Oil Corporation Limited, and Mangalore Refineries and Ports Limited.

Risks

- Feedstock Dependency: The company’s reliance on sugarcane and molasses makes it vulnerable to fluctuations in agricultural output due to factors like monsoon variability, crop diseases, and supply chain disruptions.

- Underutilization of Capacity: Despite significant capital expenditure, TruAlt’s ethanol production capacity utilization was just 45% in FY25, indicating potential inefficiencies and execution risks in balancing demand and supply.

- Debt and Financial Pressure: While the company has been deleveraging, its debt burden remains a concern. In FY24, high interest costs impacted profitability, and sustained financial pressure could continue to affect margins

Financial Performance Overview (₹ in Crore)

| Financials | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 762.38 | 1,223.4 | 1,907.72 |

| Profit | 35.46 | 31.81 | 146.64 |

| Assets | 1,855.98 | 2,419.08 | 3,029.73 |

Revenue

- Revenue increased from ₹762.38 crore in FY23 to ₹1,907.72 crore in FY25.

- FY23–FY24 growth: ₹1,223.4 – ₹762.38 = ₹461.02 crore → 60.5% growth

- FY24–FY25 growth: ₹1,907.72 – ₹1,223.4 = ₹684.32 crore → 55.9% growth

The company shows strong top-line growth, indicating increasing demand for ethanol, CBG, and related energy products.

Profit

- Profit declined slightly from ₹35.46 crore in FY23 to ₹31.81 crore in FY24, despite higher revenue. This could indicate higher operating costs or initial scaling costs.

- In FY25, profit jumped sharply to ₹146.64 crore → a 361% increase from FY24, showing improved operational efficiency, better cost management, and higher margin contracts/orders.

Asset

- Assets grew steadily from ₹1,855.98 crore in FY23 to ₹3,029.73 crore in FY25.

- The increase aligns with the company expanding its production facilities and retail fuel operations. A larger asset base provides capacity for further growth but also implies higher capital deployment.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.