Gujarat Peanut IPO Overview

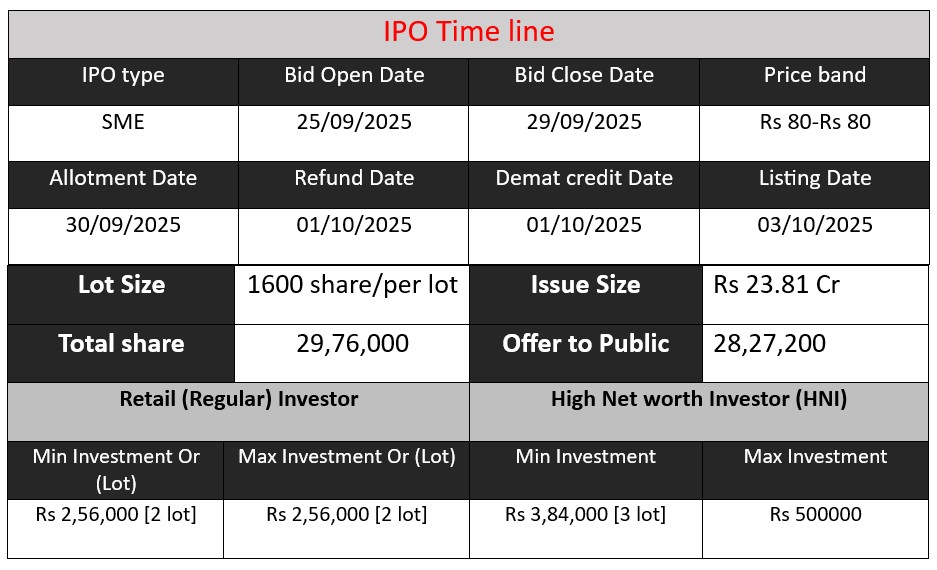

Gujarat Peanut & Agri Products Ltd IPO opens on 25th Sep 2025 and closes on 29th Sep 2025. The issue size is ₹23.81 crore, offering 29.76 lakh equity shares at a fixed price of ₹80 per share. The minimum lot size is 1,600 shares, requiring a minimum investment of ₹1.28 lakh. Proceeds will fund capital expenditure, working capital, and general corporate purposes. Listing is scheduled on BSE SME on 3rd Oct 2025.”

Gujarat Peanut GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 6 | 80 |

| Last Updated: 29 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Gujarat Peanut and Agri Core Business & Overview

Gujarat Peanut & Agri Products Limited (GPAPL), established in 2005 and based in Rajkot, Gujarat, is a family-owned enterprise specializing in the processing and export of peanuts and other agricultural commodities. The company is registered under the Corporate Identification Number (CIN) U15490GJ2005PLC046918 and was formerly known as Gujarat Peanut Products Private Limited.

Business Activities

GPAPL is engaged in the cleaning, grading, processing, sorting, trading, and marketing of various agricultural products. Its product portfolio includes peanuts, sesame seeds, spices, grains, pulses, and raw cotton. The company caters to both domestic and international markets, exporting to over 10 countries, including the UAE, China, Thailand, Indonesia, Iraq, Iran, Poland, Kosovo, and Lebanon.

Strengths

- Established Market Presence: With nearly two decades in the industry, GPAPL has built a strong reputation for quality and reliability in the agricultural sector.

- Diverse Product Range: The company’s wide array of products allows it to cater to various market segments, enhancing its competitiveness.

- International Export Network: Exporting to multiple countries diversifies revenue streams and reduces dependency on the domestic market.

Risks

- Commodity Price Volatility: Fluctuations in the prices of agricultural products can impact profit margins.

- Operational Risks: Challenges in procurement, processing, and distribution can affect the company’s efficiency and profitability.

- Regulatory Changes: Changes in export-import policies or agricultural regulations can impact business operations.

- Financial Risks: The company’s financial performance may be influenced by factors such as debt levels and working capital management.

Financial Performance Overview (₹ in Crore)

| Financial Metric | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 147.98 | 296.79 | 363.04 |

| Profit | 0.82 | 3.95 | 6.49 |

| Assets | 31.33 | 72.75 | 126.92 |

Revenue:

- Revenue has shown a strong upward trend over three years.

- FY 2024 revenue (296.79) almost doubled from FY 2023 (147.98), a growth of 100.5%.

- FY 2025 revenue (363.04) grew by 22.3% compared to FY 2024.

- This indicates consistent demand for the company’s products and successful expansion.

Profit:

- Profit margin has improved significantly. FY 2023 profit was very low at 0.82 crore.

- FY 2024 profit jumped to 3.95 crore (381% growth from previous year).

- FY 2025 profit increased to 6.49 crore (64.3% growth).

- Profit growth is slower than revenue growth in FY 2025, which may indicate higher costs or investment in expansion.

Assets:

- Total assets have increased sharply from 31.33 crore in FY 2023 to 126.92 crore in FY 2025, indicating strong asset accumulation and business scaling.

- This growth in assets supports the company’s expanding operations and export business.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.