Earkart IPO Overview

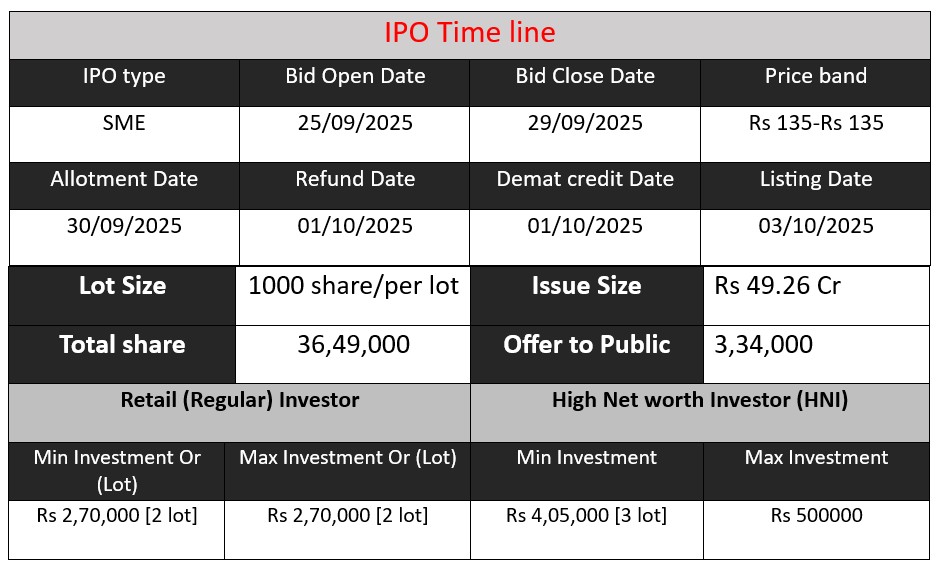

Earkart Limited IPO opens on September 25, 2025 and closes on September 29, 2025. The issue size is 36.49 lakh shares at a fixed price of ₹135 each, including 33.15 lakh fresh issue shares and 3.34 lakh offer for sale. The IPO aims to raise funds for working capital, expanding shop-in-shop clinics, capital expenditure, and general corporate purposes. Investors can bid in lots of 1,000 shares.

Earkart GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 0 | 135 |

| Last Updated: 29 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Earkart Core Business & Overview

Earkart Limited was incorporated on April 14, 2021 as a public company.

Its Corporate Identity Number (CIN) is U74999DL2021PLC399313.

Business Focus / Mission

Earkart is a HealthTech / hearing-solutions company aiming to improve access to hearing care in India.

It distributes hearing aids (its own brand and third-party global brands), hearing aid accessories, mobility aids like foldable walkers, and educational/assistive tools for the physically challenged.

The company also provides remote audiometry / telehealth solutions (its “OMNI” platform) to enable testing & fitting at a distance.

Headquarters & Facilities

Earkart is headquartered in Noida, Uttar Pradesh, India.

Its manufacturing facility is reported to be ~4,500 sq ft in Noida, where it manufactures Behind-The-Ear (BTE) and Receiver-In-Canal (RIC) hearing aids.

Founders / Promoters / Management

Rohit Misra (Promoter & Managing Director) – a healthcare veteran, formerly with Starkey India etc.

Strengths

From the public disclosures, the following stand out as Earkart’s key strengths:

- Diverse Channels & Multi-pronged Business Model

The combination of B2G government contracts, dealer & clinic partner network, online & telehealth presence, and the SIS franchise model gives it flexibility and multiple revenue levers. - Government Ties / Institutional Business

Being a registered supplier on GeM and supplier to ALIMCO gives it access to stable demand from government programs for assistive devices. This can help stabilize revenue and create scale opportunities. - Technology / Product Integration (Remote Audiometry, Telehealth)

Its OMNI remote audiometry and teleconsult capability help it reach underserved, remote, and semi-urban/rural markets more efficiently, reducing dependence on in-person clinics. This can extend its reach and lower cost of customer acquisition. - Improving Financial Metrics & Scale Up

The recent growth in revenue and profit, along with margin improvement, indicates improving operating efficiency and scale benefits. - Quality & Regulatory Compliance

Certifications from BIS, regulatory approval, and manufacturing oversight boost trust in product safety and help in regulatory alignment. - Focused Niche in Hearing & Assistive Devices

Hearing aids and assistive devices are a specialized domain with high technical barriers, medical regulation, and potential stickiness of users (once someone uses a hearing aid, replacement, service, accessories become follow-on business).

Risks

From the IPO prospectus (section titled “Risk Factors”) and analyst commentary, here are material risks:

- Heavy Dependence on Government Contracts / Institutional Sales

In FY25, a large portion of Earkart’s revenue came from government customers. If future government orders decline, are delayed, or contract terms change, it could hurt revenues and cash flows. - Supply Chain / Vendor Concentration Risk

A few key suppliers account for a large share of procurement. Disruption in supply (due to geopolitical tensions, import restrictions, tariffs, or vendor issues) could negatively affect operations. - Limited Operating History / Execution Risk

As a relatively new entrant (founded 2021) in a capital-intensive, regulated medical/devices sector, the company faces risks around scaling operations, product reliability, adoption, regulatory compliance, and building brand/trust. - Regulatory / Medical Device Risk

Hearing aids are medical devices; changes in regulations, compliance costs, certification needs, or regulatory rejection risk may affect the business. - Competition (Domestic & International)

The hearing aid and assistive device market is competitive, with established global players. Earkart must continuously innovate, maintain cost competitiveness, and ensure service quality. - Market Acceptance and Awareness

In many parts of India, awareness of hearing loss, stigma, price sensitivity, and reluctance to adopt hearing aids are challenges. Penetration in rural / semi-urban areas may be slower than anticipated. - Financial / Cash-flow Risk

Scaling operations involves capital expenditure, working capital needs, and the risk of cost overruns or delayed ROI. If margins compress or orders fluctuate, financial stress could ensue.

Financial Performance Overview (₹ in Crore)

| Metric | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 28.92 | 31.75 | 43.11 |

| Profit | 1.31 | 3.06 | 6.88 |

| Assets | 14.73 | 19.25 | 30.29 |

Revenue

- FY 2023: ₹28.92 crore

- FY 2024: ₹31.75 crore

- FY 2025: ₹43.11 crore

Revenue has grown steadily, showing ~10% growth in FY24 and a strong 36% jump in FY25, indicating improved sales traction and expansion of operations.

Profit

- FY 2023: ₹1.31 crore

- FY 2024: ₹3.06 crore

- FY 2025: ₹6.88 crore

Profit has increased more than 5x from FY23 to FY25, with margins improving year after year. This reflects better cost management, operational efficiency, and higher profitability.

Total Assets

- FY 2023: ₹14.73 crore

- FY 2024: ₹19.25 crore

- FY 2025: ₹30.29 crore

Assets have more than doubled over three years, showing continuous capacity building, infrastructure investment, and business expansion.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.