Justo Realfintech IPO Overview

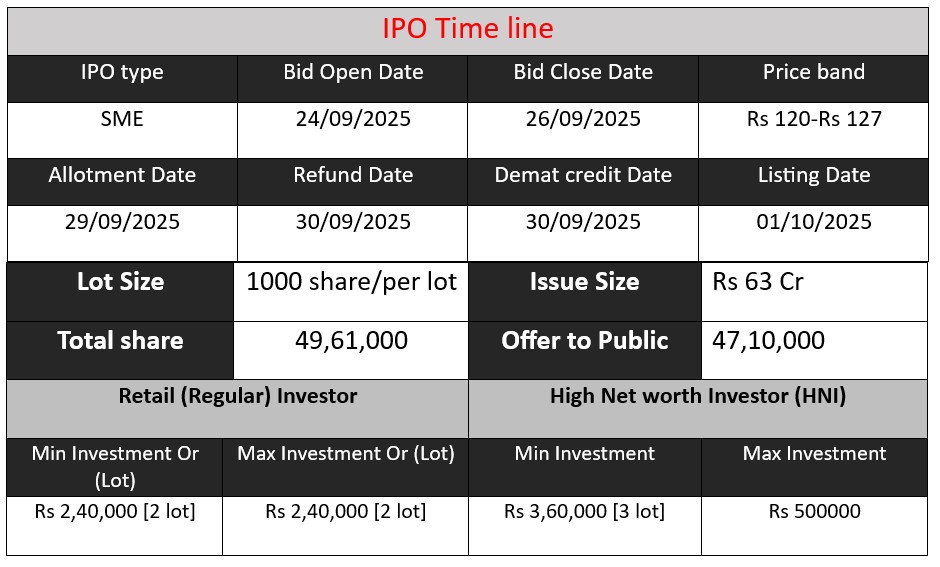

Justo Realfintech Limited IPO opens on September 24, 2025, and closes on September 26, 2025, aiming to raise ₹63 crore through a fresh issue of 4,961,000 equity shares priced between ₹120 and ₹127 each. The IPO proceeds will fund working capital, IT infrastructure, debt repayment, and general corporate purposes. Shares are expected to list on the BSE SME platform on October 1, 2025.

Justo Realfintech GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 4 | 120-127 |

| Last Updated: 26 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Justo Realfintech Core Business & Overview

Justo Realfintech Limited is a Mumbai-based real estate services company founded in 2019. It specializes in providing end-to-end solutions for real estate developers, covering aspects from project strategy and marketing to sales execution and customer relationship management. The company operates across multiple cities, including Pune, Mumbai, Nashik, and has plans to expand into Hyderabad, Bengaluru, select South Indian cities, and Dubai over the next two years.

Services

Justo Realfintech offers a comprehensive suite of services tailored to the needs of real estate developers:

- Project Strategy & Marketing: Assisting in pricing, unit sizing, and go-to-market strategies.

- Sales Execution: Managing the sales process from lead generation to closure.

- Customer Relationship Management (CRM): Enhancing customer engagement and retention.

- Digital Platforms: Utilizing proprietary tools like JustoVerse and JustoWorks to streamline operations and improve sales efficiency.

Strengths

- Tech-Enabled Operations: The company leverages digital tools to enhance visibility and conversion rates for developers.

- Strong Market Presence: With over 8,500 apartments sold across 80 projects, Justo has established a significant footprint in the real estate market.

- Strategic Partnerships: In 2024, Arbour Investments injected ₹58.1 crore into Justo, comprising ₹41.5 crore in equity and ₹16.6 crore in debt, to drive growth and innovation.

Risks

- Revenue Volatility: The company’s project-based revenue model can lead to fluctuations in income.

- Client Concentration: A significant portion of business comes from repeat clients, which may pose risks if client relationships change.

- Regulatory Compliance: Navigating the complexities of real estate regulations, including RERA compliance, can be challenging

Financial Performance Overview (₹ in Crore)

| Financials | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 70.44 | 59.38 | 81.35 |

| Profit | 15.3 | 6.69 | 15.21 |

| Assets | 32.62 | 41.77 | 76.28 |

Revenue

- Revenue dipped from ₹70.44 Cr in FY 2023 to ₹59.38 Cr in FY 2024, a decline of 15.7%, indicating a slowdown in business activity or project completion delays.

- FY 2025 shows a strong recovery to ₹81.35 Cr, a growth of 37% compared to FY 2024, reflecting new project wins, expansion, or improved sales execution.

Profit

- Profit followed a similar pattern, dropping sharply from ₹15.3 Cr (FY 2023) to ₹6.69 Cr (FY 2024), a decrease of 56%, indicating either higher costs or lower margins during FY 2024.

- In FY 2025, profit recovered to ₹15.21 Cr, almost back to FY 2023 levels, signaling improved efficiency and cost control.

Asset

- Assets increased steadily: ₹32.62 Cr → ₹41.77 Cr → ₹76.28 Cr, showing a strong investment in infrastructure, digital platforms, or working capital to support growth.

- FY 2025 asset growth is particularly sharp (82.5%), suggesting major expansion or capital infusion.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.