BMW Ventures IPO Overview

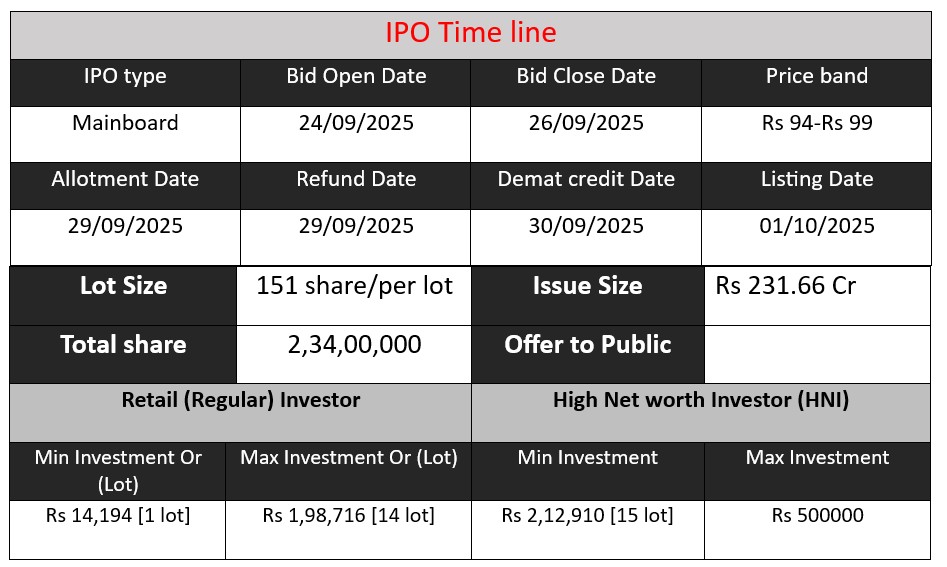

BMW Ventures Limited’s Initial Public Offering (IPO) opens on September 24, 2025, and closes on September 26, 2025. The company aims to raise ₹231.66 crore by issuing 2.34 crore equity shares with a face value of ₹10 each. The price band is set between ₹94 and ₹99 per share. The net proceeds will be utilized for repayment/pre-payment of certain outstanding borrowings and general corporate purposes. The listing is scheduled on October 1, 2025, on both BSE and NSE.

BMW Ventures GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 2 | 94-99 |

| Last Updated: 26 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

BMW Ventures Core Business & Overview

BMW Ventures Limited is a diversified industrial company based in Patna, Bihar, India. Established in 1994, it operates in multiple sectors, including steel distribution, manufacturing of PVC pipes and roll-formed products, and fabrication of pre-engineered buildings (PEBs) and steel girders. The company is particularly dominant in the steel distribution market in Bihar, where it serves over 1,299 dealers across 29 of the state’s 38 districts.

Core Operations

- Steel Distribution: BMW Ventures holds an exclusive distributorship agreement with its primary supplier in Bihar, making it a dominant regional distributor. This segment contributes significantly to the company’s revenue.

- Manufacturing: The company produces PVC pipes and roll-formed products, catering to various industrial needs.

- Fabrication: BMW Ventures fabricates pre-engineered buildings and steel girders, with RDSO approval, enabling it to supply girders for railway projects.

Strengths

- Dominant Regional Presence: With a vast dealer network and exclusive distributorships, BMW Ventures commands a significant market share in Bihar’s steel distribution sector.

- Consistent Financial Performance: The company has shown steady revenue growth, with a 6% increase from ₹1,938 crores in March 2024 to ₹2,062 crores in March 2025. Its profit after tax (PAT) rose by 10% during the same period.

- Diversified Product Portfolio: Engaging in multiple sectors reduces dependency on a single market, providing a buffer against sector-specific downturns.

Risks

- Supplier Concentration Risk: The company depends heavily on a single principal supplier for its long and flat steel products, with about 96% of its purchases coming from this supplier in recent years. Any disruption in the supplier’s operations could severely impact BMW Ventures’ business.

- Geographical Revenue Concentration: A significant portion of the company’s revenue is concentrated in Bihar, making it vulnerable to regional economic fluctuations and policy changes.

- Exposure to Raw Material Price Volatility: Fluctuations in the prices of raw materials can affect profit margins, especially since the company operates in the manufacturing and distribution sectors

Financial Performance Overview (₹ in Crore)

| Financial Metric | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 2,015 | 1,938.2 | 2,062.04 |

| Profit | 32.66 | 29.94 | 32.82 |

| Total Assets | 481.79 | 646.15 | 676.09 |

Revenue:

- Revenue declined slightly in FY 2024 (₹1,938.2 crore) compared to FY 2023 (₹2,015 crore), indicating a temporary slowdown, possibly due to market fluctuations or supply chain constraints.

- FY 2025 saw a recovery, with revenue increasing to ₹2,062.04 crore, showing resilience and growth beyond pre-slowdown levels.

Profit:

- Profit after tax dropped from ₹32.66 crore in FY 2023 to ₹29.94 crore in FY 2024, reflecting the dip in revenue and possibly higher costs or margin pressure.

- FY 2025 shows a rebound in profit to ₹32.82 crore, slightly higher than FY 2023, indicating improved operational efficiency or cost control.

Total Assets:

- Assets grew significantly from ₹481.79 crore in FY 2023 to ₹646.15 crore in FY 2024, and further to ₹676.09 crore in FY 2025.

- This increase indicates investment in expansion, inventory, or property, plant, and equipment, which supports long-term growth.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.