Epack Prefab Technologies IPO Overview

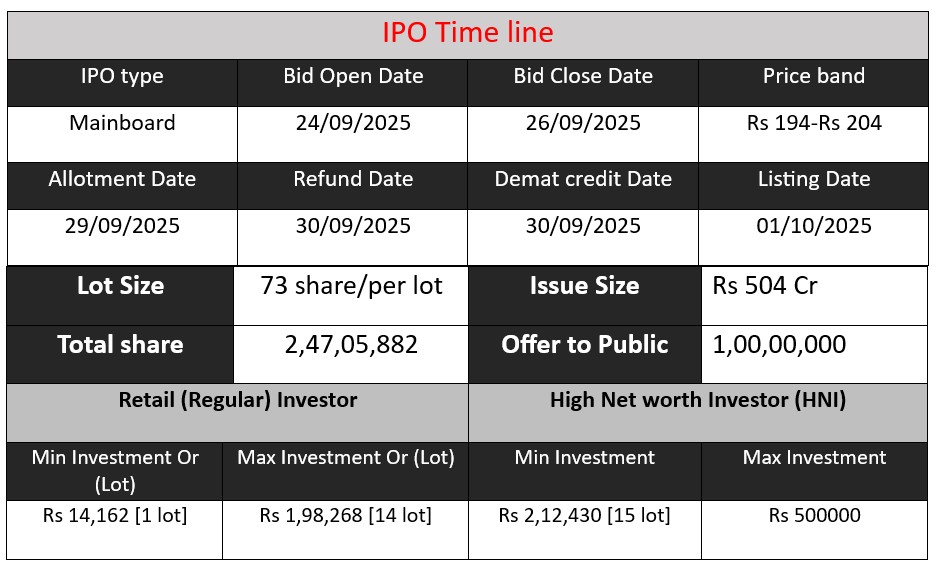

Epack Prefab Technologies is launching a ₹504 crore IPO comprising a fresh issue of ₹300 crore and an offer-for-sale of ₹204 crore, with 2,47,05,882 shares on offer. The issue opens on 24 September 2025 and closes on 26 September 2025. Proceeds will fund a new manufacturing facility, expand an existing unit, repay debt, and support general corporate purposes.

Epack Prefab Technologies GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 2 | 194-204 |

| Last Updated: 26 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Epack Prefab Technologies Core Business & Overview

Epack Prefab Technologies was incorporated in 1999. It operates primarily in two business verticals:

Pre-Fab Business: This includes designing, manufacturing, installation, and erection of pre-engineered steel buildings, prefabricated structures, sandwich insulated panels, etc.

EPS Packaging Business: Manufacturing expanded polystyrene (EPS) products (sheets, blocks, molded shapes) for use in packaging, construction, consumer goods, etc.

Facilities & Locations:

Three manufacturing plants in India: Greater Noida (Uttar Pradesh), Ghiloth (Rajasthan), and Mambattu (Andhra Pradesh).

Three design centres located in Noida, Hyderabad, and Visakhapatnam.

Recent Developments:

The company filed its Draft Red Herring Prospectus (DRHP) as part of its IPO process.

The IPO is for ₹504 crore total, with ₹300 crore being a fresh issue and the rest via offer-for-sale.

They recently set up a new sandwich panel manufacturing facility in Mambattu, Andhra Pradesh.

Strengths

Based on filings and independent analysis, strengths of Epack Prefab Technologies include:

- Strong Growth & Financial Trajectory

- High revenue growth: FY2023 → FY2024 saw a 38% increase in revenue.

- Profit growth: profit rose from ₹24 crore to ₹43 crore in same period.

- Healthy order books, indicating demand visibility.

- Diversified Product Portfolio & Turnkey Capabilities

- They cover multiple segments: PEBs, sandwich panels, prefabricated structures, EPS packaging, etc.

- Ability to execute turnkey projects adds value (reduces coordination risk for clients).

- Strategically Located Manufacturing & Design Facilities

- Locations in UP, Rajasthan, Andhra Pradesh provide geographic spread, potentially reducing logistics and delivery time.

- In-house design / engineering centres help in better control, faster turnaround.

- Repeat Business & Client Relationships

- Substantial portion of business from repeat customers reportedly.

- Serving across industries enhances stability.

- Regulatory Certifications, Quality & Environment

- Holds ISO 9001:2015 and ISO 14001:2015 certifications, which show attention to quality systems and environmental compliance.

Risks

Some of the key risks and potential weak points:

- High Dependency on the Pre-Fab Business Segment

- Over 80%+ of revenue comes from the Pre-Fab business. If that demand falls (because of economic slowdown, delays in industrial / infrastructure projects, etc.), it could hit revenue severely.

- Raw Material Price & Supply Volatility

- Steel (for prefab business) and EPS beads etc (for packaging business) are key inputs. Any sharp price fluctuation, supply disruption, or dependency on limited suppliers could squeeze margins.

- Regulatory / Environmental / Legal Issues

- The company has a case filed by the Uttar Pradesh Pollution Control Board under the Air Act for allegedly non-compliance.

- More broadly, environmental norms, regulatory approvals, labor / workplace safety compliance can impose costs or delays.

- Competition & Industry Risk

- Competition from traditional construction (RCC & others) which are more familiar to many customers; prefabricated solutions sometimes are seen as more expensive upfront.

- Unorganised sector players may undercut on price, quality trade-offs may hurt margin.

- Operational / Execution Risks

- Dependence on third-party erectors for erection / installation at site; delays or quality issues here can hurt reputation and profitability.

- Working capital demands, especially with growth, inventory, receivables etc can pressure cash flows.

Financial Performance Overview (₹ in Crore)

| Metric | FY 2023 | FY 2024 | FY 2025 |

| Revenue | ₹656.76 | ₹904.90 | ₹1133.92 |

| Profit | ₹23.97 | ₹42.96 | ₹59.32 |

| Assets | ₹432.05 | ₹613.72 | ₹931.02 |

Revenue

The revenue shows consistent and strong growth:

- FY23 → FY24: 37.7% growth

- FY24 → FY25: 25.4% growth

This indicates expanding market demand and effective business execution. The growth rate is high but slightly slowing, which is natural as the base revenue increases.

Profit

Profits are growing faster than revenue:

- FY23 → FY24: 79.2% growth

- FY24 → FY25: 38.1% growth

This shows improving operational efficiency and margins, meaning the company is controlling costs and scaling well.

Assets

Assets are rising rapidly:

- FY23 → FY24: 42% increase

- FY24 → FY25: 51.7% increase

This suggests significant investment in capacity, facilities, or expansion. A strong asset base gives long-term stability, but it may also increase capital intensity and dependence on returns from these investments.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.