NSB BPO IPO Overview

NSB BPO Solutions Limited IPO opens on September 23, 2025, and closes on Oct 7, 2025, with a price band of ₹121–₹140 per share. The issue size is ₹77.91 crore, comprising 53 lakh shares. Funds raised will be used for business expansion, technology upgrades, and working capital. The IPO will be listed on BSE SME. Investors can explore this opportunity to participate in a growing BPO company with diversified services across sectors.

NSB BPO GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 0 | 121-140 |

| Last Updated: 6 Oct 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

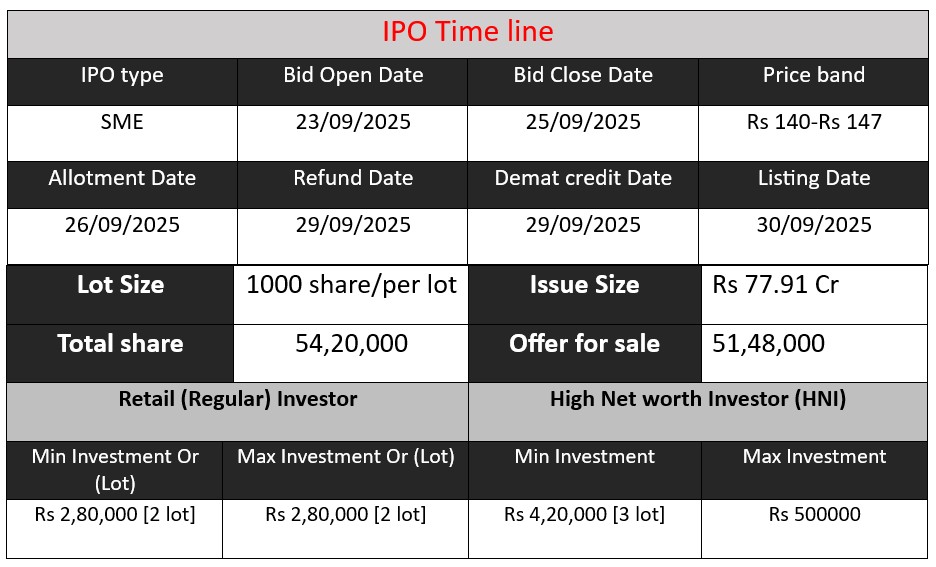

IPO Key Detail

NSB BPO Core Business & Overview

NSB BPO Solutions Limited is a prominent Indian Business Process Outsourcing (BPO) company, established in 2005 and headquartered in Bhopal, Madhya Pradesh. The company specializes in providing comprehensive support services to a diverse clientele across various industries.

Services:

- Customer Care & Call Center Operations: Providing helpline support and customer service solutions.

- Tele-Sales & Tele-Collections: Managing sales calls and debt recovery processes.

- Document Digitization & KYC Processing: Digitizing physical documents and handling Know Your Customer (KYC) formalities.

- Payroll Management: Administering employee compensation and benefits.

- Warehousing & Archival Services: Storing and managing business records and inventories.

The company caters to sectors such as Telecom, BFSI (Banking, Financial Services, and Insurance), E-Retail, Insurance, Food Delivery, Hotels, Government Organizations, Healthcare, and Education.

Strengths

- Diverse Clientele: Serving a wide range of industries, which mitigates sector-specific risks.

- Technological Integration: Utilizing advanced technologies like Artificial Intelligence, Speech Analytics, and Data Analytics to enhance service quality.

- Experienced Workforce: Employing a skilled team trained in industry best practices.

Risks

- Competitive Market: Operating in a highly competitive BPO industry, which may pressure margins.

- Technological Dependence: Reliance on technology infrastructure, which requires continuous investment and maintenance.

- Regulatory Compliance: Need to adhere to evolving data protection and labor laws, especially in sectors like BFSI and healthcare.

Financial Performance Overview (₹ in Crore)

| Financial Metric | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 284.89 | 128.03 | 138.12 |

| Profit | 2.21 | 4.78 | 8.53 |

| Assets | 210.7 | 147.85 | 175.12 |

Revenue:

- Revenue dropped significantly from ₹284.89 crore in FY 2023 to ₹128.03 crore in FY 2024, a decline of around 55%.

- FY 2025 shows a slight recovery to ₹138.12 crore, indicating a stabilization but still below FY 2023 levels.

- The dip in revenue could be due to client loss, reduction in large contracts, or macroeconomic factors affecting the BPO industry.

Profit:

- Despite the revenue decline in FY 2024, profit increased from ₹2.21 crore to ₹4.78 crore, and further to ₹8.53 crore in FY 2025.

- This indicates strong cost management and operational efficiency, as the company managed to grow profit even when revenue decreased.

- The profit growth shows that NSB BPO is improving margins and controlling expenses effectively.

Assets:

- Total assets decreased from ₹210.7 crore in FY 2023 to ₹147.85 crore in FY 2024, reflecting either asset sales, write-offs, or lower capital investment.

- FY 2025 shows an increase to ₹175.12 crore, suggesting the company has started rebuilding its asset base, possibly in line with revenue recovery.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.