True Colors IPO Overview

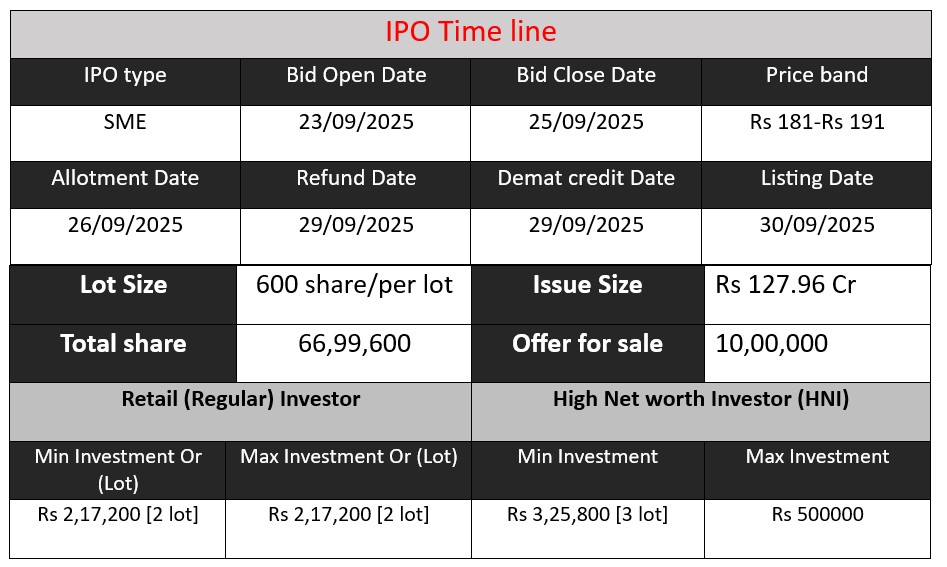

True Colors Ltd is launching a ₹127.96 crore SME IPO, offering approx 67 lakh shares at a price band of ₹181–191 per share. The issue consists of a fresh issue of approx 57 lakh shares plus an Offer for Sale of 10 lakh shares. The IPO opens on 23 September 2025 and closes on 25 September 2025. Proceeds will be used for working capital, repayment of debt and general corporate purposes. Listing to be on the BSE-SME platform.

True Colors GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 30 | 181-191 |

| Last Updated: 25 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

True colors Core Business & Overview

True Colors Limited was incorporated in October 2021 in India (initially as a private company) and later converted to a public limited entity in March 2025.

Headquarters: Surat, Gujarat — a major textile hub in India.

Business Model & Verticals: The company operates in a vertically integrated digital textile printing business. Its core verticals include:

- Digital Textile Printing Machinery & Ink Supply — importing, selling, installing, and servicing machines plus inks.

- Sublimation Paper Manufacturing — producing the consumables required for sublimation printing.

- Digital Textile Printing Services / Fabric Printing — printing on fabrics using various printing technologies and supplying printed fabric.

Mission & Vision: It aims to be a leader in India for digital textile solutions and sublimation, with emphasis on innovation, customer reliability, and sustainability.

Recent Move: The company has announced an IPO (Initial Public Offering) to raise fresh funds for growth, debt repayment, working capital, and general corporate purposes.

Scale & Infrastructure: As of the latest disclosures, the company has a large workforce (600+ employees in some sources), a substantial physical infrastructure (~2 lakh square feet), and a wide after-sales service network across textile hubs in India.

Strengths

From available materials, these appear to be some of True Colors’ key strengths:

- Vertical Integration: They cover multiple parts of the value chain — from machinery (import, setup, service), to consumables (inks, sublimation paper), to fabric printing services. This helps with margins, control over quality, and customer stickiness.

- Rapid Revenue Growth: Their financials show strong growth over recent financial years, both in revenue and profit.

- Strategic Positioning in Textile Hub: Being based in Surat (and having presence in other textile regions) gives them locational advantage — proximity to raw materials, clients, labor, etc.

- Sustainability Orientation: The company is emphasising green or sustainable practices (e.g., lower water use, less waste) in marketing, which may gain advantages as buyers and regulators increasingly demand environmental compliance.

- After-Sales Service Network: Good service support and spare parts + maintenance are crucial in machinery/industrial business. True Colors claims a large network across India. That reduces downtime risk for customers and increases customer trust.

Risks

Any business has risks; for True Colors, some of the main ones (from IPO filings, analysis, media) include:

- Dependence on Imports: Machinery and some inputs are imported. That exposes them to foreign exchange risk, supply chain disruptions, shipping delays, changes in import duties or regulatory policies.

- Raw Material & Input Price Volatility: Inks, papers, fabrics etc., may have prices that fluctuate. If costs go up, they may not be able to pass on the increase to customers fully, squeezing margins.

- Concentration Risk (Geographic & Customer): A large portion of revenue comes from a few states (Gujarat, Punjab, Maharashtra) which means regional adverse events could affect operations significantly. Also, if a few customers are large, dependency could be risky.

- Technology / Competitive Risk: Digital printing is technology-driven. There is continuous innovation, potential for obsolescence, competition from local or lower cost players; must keep investing in R&D and upgradation.

- Operational & Working Capital Challenges: Printing and machinery businesses are capital intensive, have longer working capital cycles (machinery, paper, inks, servicing). If not managed well, cash flow constraints can hurt.

- Limited Operating History in Public Form: Though the business has been around in some form for longer, as a public limited entity since 2025 — that’s relatively recent. That may increase uncertainty for investors.

Financial Performance Overview (₹ in Crore)

| Particulars | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 80.66 | 160.08 | 233.66 |

| Profit | 3.92 | 8.24 | 24.69 |

| Assets | 45.53 | 105.91 | 154.97 |

Revenue

- FY 2023: ₹80.66 crore

- FY 2024: ₹160.08 crore

- FY 2025: ₹233.66 crore

Revenue almost doubled in FY 2024 (+98.5%) and then grew by 45.9% in FY 2025. This shows strong business expansion and rising demand for its products and services.

Profit

- FY 2023: ₹3.92 crore

- FY 2024: ₹8.24 crore

- FY 2025: ₹24.69 crore

Profit more than doubled in FY 2024 and then tripled in FY 2025. Net margin improved significantly, showing better cost efficiency, scale benefits, and higher profitability.

Assets

- FY 2023: ₹45.53 crore

- FY 2024: ₹105.91 crore

- FY 2025: ₹154.97 crore

Assets grew steadily, more than tripling in three years. This indicates expansion in infrastructure, machinery, and working capital to support higher scale of operations.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.