Anand Rathi Share IPO Overview

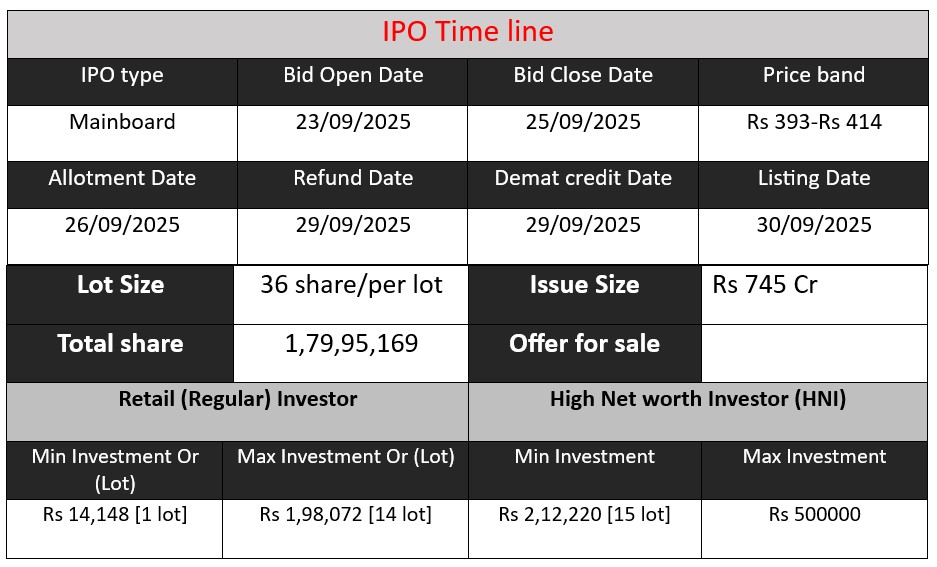

Anand Rathi Share & Stock Brokers Ltd. is launching its IPO from September 23 to September 25, 2025, aiming to raise ₹745 crore through a fresh issue of 1.79 crore shares priced between ₹393 and ₹414 each. The funds will primarily support working capital needs. The IPO will be listed on BSE and NSE, with shares credited to demat accounts by September 29 and listing on September 30.

Anand Rathi Share GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 39 | 393-414 |

| Last Updated: 25 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Anand Rathi share Core Business & Overview

Anand Rathi Share and Stock Brokers Limited (ARSSBL) is a prominent full-service brokerage firm in India, established in 1991. It operates as a wholly owned subsidiary of Anand Rathi Financial Services Limited and is part of the larger Anand Rathi Group, which offers a comprehensive range of financial services including wealth management, investment banking, corporate finance, and insurance.

ARSSBL provides a wide array of services encompassing:

- Broking Services: Equity, derivatives, commodities, and currency trading.

- Margin Trading Facility (MTF): Enables clients to trade by borrowing funds, enhancing revenue per client.

- Financial Product Distribution: Offers mutual funds, portfolio management services, corporate fixed deposits, non-convertible debentures, and bonds.

The company serves a diverse clientele, including retail investors, high-net-worth individuals (HNIs), ultra-HNIs, and institutional clients. As of September 30, 2024, approximately 85% of its active clients were above 30 years of age.

Strengths

- Robust Financial Performance: The company reported a Return on Equity (ROE) of approximately 23%, an EBITDA margin of around 37%, and a Profit After Tax (PAT) margin exceeding 12% as of March 31, 2025.

- Technological Integration: ARSSBL offers proprietary digital platforms such as Trade Mobi, AR Invest, and Trade Xpress, which combine digital convenience with advisory services.

- Strong Brand Reputation: The company’s association with Anand Rathi Wealth, which has delivered nearly 1,000% returns since its listing in December 2021, has bolstered investor confidence in the ARSSBL brand.

Risks

- Credit and Liquidity Risks: The firm’s margin trading facility exposes it to potential defaults by clients, which could impact liquidity and profitability.

- Market Dependency: The company’s performance is closely tied to market cycles; downturns can adversely affect revenues and client activity.

- Competitive Landscape: The rise of discount brokers and digital platforms presents challenges in maintaining market share and profitability

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Assets |

| FY 2023 | 92.96 | 50.8 | 1,340.58 |

| FY 2024 | 131.2 | 37.74 | 1,628.78 |

| FY 2025 | 215.08 | 77.29 | 2,585.1 |

Revenue

- Revenue has grown consistently over the three years.

- From FY 2023 to FY 2024, revenue increased from ₹92.96 crore to ₹131.2 crore, a growth of 41%.

- From FY 2024 to FY 2025, revenue surged to ₹215.08 crore, a jump of 64%, indicating strong business expansion and higher client inflow.

Profit

- Profit shows volatility. FY 2024 profit decreased to ₹37.74 crore from ₹50.8 crore in FY 2023 (26% decline) despite revenue growth, which may indicate increased expenses or operational investments.

- FY 2025 profit rebounded sharply to ₹77.29 crore (105% increase), aligning with the strong revenue growth and possibly better operational efficiency.

Assets

- Total assets grew steadily from ₹1,340.58 crore in FY 2023 to ₹2,585.1 crore in FY 2025, showing a 93% increase over two years.

- This reflects expansion in the company’s investment portfolio, client base, and overall operational scale.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.