Seshaasai Technologies IPO Overview

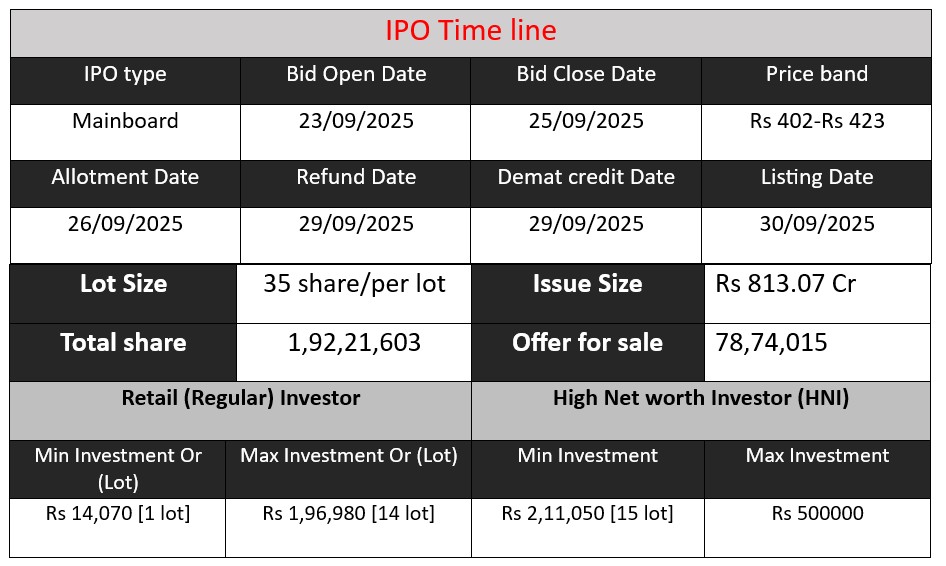

Seshaasai Technologies Limited is launching its Initial Public Offering (IPO) with a price band of ₹402–₹423 per share. The issue aims to raise approximately ₹813.07 crore, comprising a fresh issue of ₹480 crore and an offer for sale of ₹333.07 crore. The IPO opens on September 23, 2025, and closes on September 25, 2025. The listing is scheduled for September 30, 2025, on both BSE and NSE. Retail investors can apply for a minimum of 35 shares.

Seshaasai Technologies GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 56 | 402-423 |

| Last Updated: 25 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Seshaasai technologies Core Business & Overview

Seshaasai Technologies Limited, founded in 1993 and headquartered in Mumbai, is a prominent Indian technology solutions provider specializing in secure and scalable offerings for payments, communication, and fulfillment services. The company operates across multiple sectors, including Banking, Financial Services, and Insurance (BFSI), retail, manufacturing, supply chain, government, and renewable energy.

Core Offerings

Seshaasai Technologies delivers a comprehensive suite of solutions:

- Payment Solutions: Manufacturing of payment instruments such as debit/credit cards, prepaid cards, cheques, and mass transit cards.

- Communication & Fulfillment: Providing secure, omni-channel communication services, including policy documents and utility bills, ensuring efficient delivery and quick turnaround.

- IoT Solutions: Manufacturing RFID tags and labels, offering IoT services like RFID automation and middleware for industries such as retail, logistics, and BFSI.

Strengths

- Market Leadership: Among India’s top two payment card manufacturers, holding a 31.9% market share in FY25.

- Proprietary Technology: Utilizes in-house developed platforms like RUBIC, eTaTrak, and IOMS, offering customized and scalable solutions.

- Extensive Manufacturing Network: Operates 24 manufacturing units across seven locations in India, certified for producing various types of cards and RFID tags.

- Strong Financial Performance: Reported a Profit After Tax (PAT) of ₹222.32 crore in FY25, marking a 31% year-over-year increase.

Risks

- Customer Concentration: A significant portion of revenue is derived from a limited number of clients. For instance, the top 10 customers contributed 65.84% of revenue for the three months ending June 30, 2024.

- Regulatory Dependency: The company’s operations are heavily influenced by government policies and regulations, particularly in the BFSI sector.

- Supply Chain Vulnerabilities: Dependence on imported raw materials and machinery exposes the company to risks associated with global supply chain disruptions and price fluctuation

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Assets |

| FY 2023 | 1,146.3 | 108.1 | 782.54 |

| FY 2024 | 1,558.26 | 169.28 | 958.41 |

| FY 2025 | 1,463.15 | 222.32 | 1,160.39 |

Revenue:

- Revenue increased significantly from ₹1,146.3 crore in FY 2023 to ₹1,558.26 crore in FY 2024, a growth of 36%, reflecting strong business expansion and higher demand for payment solutions.

- In FY 2025, revenue slightly declined to ₹1,463.15 crore, a drop of 6% compared to FY 2024. This could be due to market fluctuations, competitive pressures, or delays in client projects.

Profit:

- Profit after tax (PAT) shows a strong upward trend: ₹108.1 crore (FY 2023) → ₹169.28 crore (FY 2024) → ₹222.32 crore (FY 2025).

- Despite a slight decline in revenue in FY 2025, PAT grew by 31%, indicating improved cost management, higher operational efficiency, or better margins.

Asset:

- Total assets increased steadily from ₹782.54 crore (FY 2023) → ₹958.41 crore (FY 2024) → ₹1,160.39 crore (FY 2025).

- The growth in assets indicates continued investment in technology, manufacturing capacity, and infrastructure to support long-term expansion.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.