Karbonsteel Engineering IPO Overview

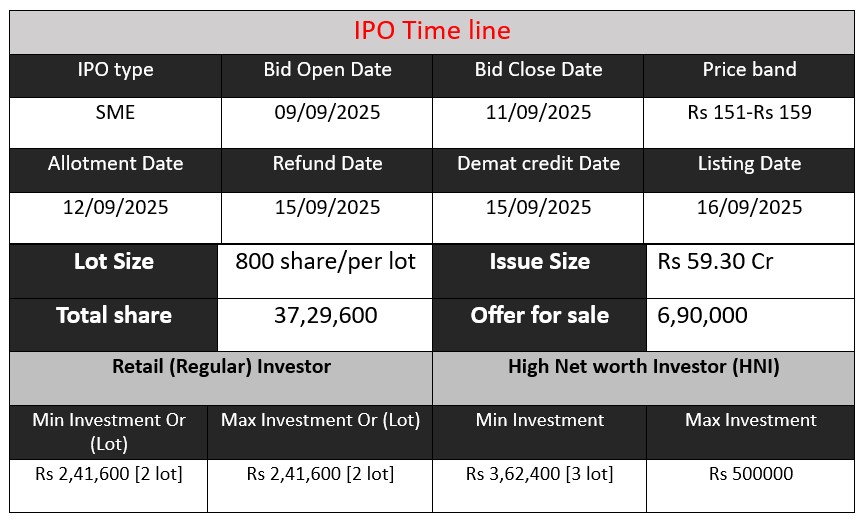

Karbonsteel Engineering Ltd’s SME IPO offers up to ₹59.30 crore through a public and promoter-sale of 37.296 lakh equity shares at a ₹151–₹159 per share band, opening on 9 September 2025 and closing on 11 September 2025, with listings on BSE-SME. Proceeds will fund expansion at the Umbergaon facility, repay debt, support working capital, and serve general corporate needs

Karbonsteel Engineering GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 21 | 151-159 |

| Last Updated: 11 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Karbonsteel Engineering Core Business & Overview

Karbonsteel Engineering Limited is a structural engineering and steel fabrication company established in 2011. It specializes in designing, fabricating, and assembling heavy and precision steel structures across various industrial and infrastructure sectors. Key verticals of the company include:

- Heavy steel fabricated structures: Components like columns, beams, pipe racks, platforms, staircases, and walkways.

- Precision fabricated/technological structures: Such as furnace support systems and accumulator towers requiring tight dimensional tolerances.

- Steel bridge structures: Open web girders, built-up sections, and plate girders, notably for high-speed rail projects.

- Pre-engineered buildings (PEBs): Factory-fabricated components like columns, rafters, crane beams, and cladding systems for rapid on-site assembly.

They operate two manufacturing plants:

- Umbergaon (Gujarat) – larger facility: about 7.60 lakh sq ft, ~3,000 MT/month capacity, advanced equipment (CNC cutting, robotic welding, etc.)

- Khopoli (Maharashtra) – smaller: around 56,084 sq ft, ~500 MT/month capacity, similarly equipped for structural fabrication

They have contributed significantly to high-profile projects, including fabrication of approximately 10,000 MT of steel bridge structures for the Mumbai–Ahmedabad High-Speed Rail corridor, affirming their engineering capabilities.

Strengths

Here are several core strengths enhancing Karbonsteel Engineering’s position:

- Robust project track record – Involvement in critical infrastructure and industrial projects across sectors like steel plants, refineries, chemical units, high-rises, and high-speed rail.

- Strong manufacturing capabilities – Two well-equipped facilities enabling a combined production capacity of ~36,000 MT/year, with modern cutting, welding, and quality testing systems.

- Recognized certifications and clientele – ISO 9001:2015 (quality) and ISO 14001:2015 (environment) certifications, plus reputed clients including ArcelorMittal Nippon Steel India, Tata Projects, and JSW Severfield.

Potential Risks

While the firm exhibits solid fundamentals, several risks are present:

- Client concentration risk – The top 10 clients contributed a staggering ~99.3% of revenue in FY25. Losing even a few could significantly impact financials.

- Regional concentration – Nearly all revenue (~98%) in FY25 stemmed from Gujarat, making the company vulnerable to regional economic fluctuations or systemic disruptions.

- Supply chain dependency – Top 10 suppliers accounted for over 66% of procurement costs in FY25; disruptions could adversely affect operations.

- High employee attrition – Attrition rates at facilities were alarmingly high (Umbergaon: ~95.96% in FY23, ~60% in FY24, and ~54.6% in FY25; Khopoli: over 100% in FY25). This undermines workforce stability, ramps up training and recruitment costs, and can undermine productivity.

- Legal and debt exposure – The company faces ongoing legal proceedings (criminal and tax-related). Additionally, financial indebtedness stood at ₹62.76 cr as of FY25, and failure to service debt could strain operations.

- Facility disruption risk – Operations rely heavily on two sites; disruptions in either location can gravely affect manufacturing and delivery schedules.

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit (PAT) | Total Assets |

| FY 2023 | 155.58 | 5.11 | 143.76 |

| FY 2024 | 218.34 | 9.42 | 176.14 |

| FY 2025 | 273.05 | 14.16 | 232.75 |

Revenue

- FY 2023: ₹155.58 cr → FY 2024: ₹218.34 cr → FY 2025: ₹273.05 cr.

- Strong CAGR of ~32% over three years, showing steady growth in business volume and successful execution of projects.

Profit

- Profit nearly tripled from ₹5.11 cr (FY 2023) to ₹14.16 cr (FY 2025).

- Profit margin improved (3.3% in FY 2023 → 4.3% in FY 2025), reflecting better cost management, higher operational efficiency, and stronger order execution.

Total Assets

- Assets increased from ₹143.76 cr in FY 2023 to ₹232.75 cr in FY 2025, a growth of ~62%.

- Suggests capacity expansion, investment in facilities, and stronger asset base to support rising demand.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.