Vashishtha Luxury Fashion IPO Overview

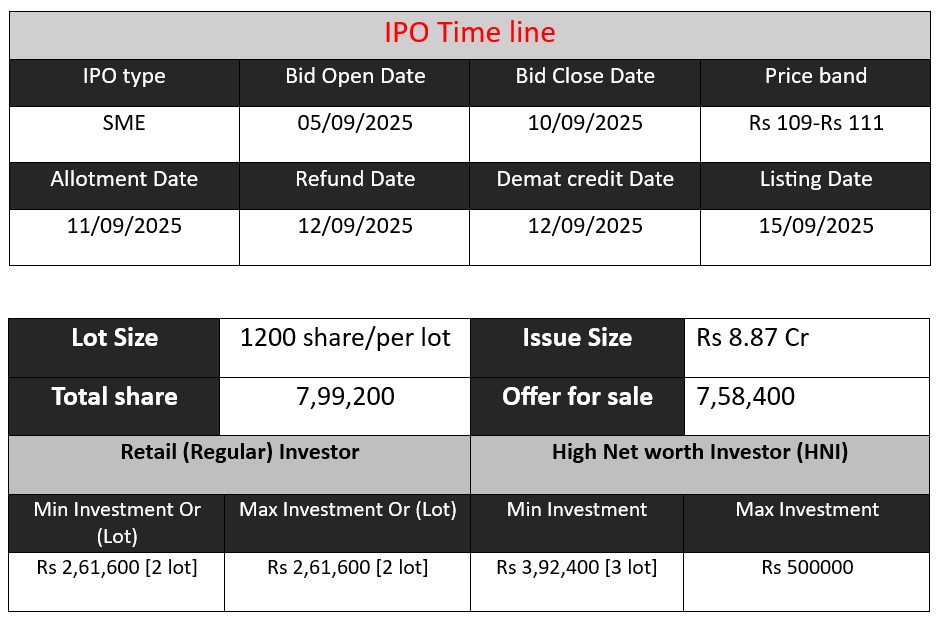

Vashishtha Luxury Fashion Ltd’s SME IPO opens on September 5, 2025 and closes on September 10, 2025. It offers a fresh issue of 7,99,200 equity shares at a price band of ₹109–111, raising ₹8.87 crore. The IPO will be listed on BSE SME on September 15, 2025. Proceeds are earmarked for expanding via embroidery machine capex, repayment of certain borrowings, and general corporate purposes.

Vashishtha Luxury Fashion Subscription and GMP Status

| Category | Subscription (x) |

| QIBs | 0.00 |

| NIIs | 0.16 |

| Retails | 0.32 |

| Total | 0.22 |

| Last Updated: 08 Sep 2025- 6 PM Source: NSE/BSE | |

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 7 | 109-111 |

| Last Updated: 10 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Date

Vashishtha luxury Fashion Core Business & Overview

Vashishtha Luxury Fashion Ltd specializes in high-fashion hand embroidery, embellishments, and accessories. The firm emphasizes both machine and hand-done embroidery, and extends services into printing (digital and hand-painted), crochet, macramé, jewelry crafting, molding, and accessory creation.

Incorporation & Legal Status

Incorporated on September 6, 2022, it’s a public unlisted company based in Mumbai, with its registered address at Sun Industrial Estate, Lower Parel (West). It carries a CIN of U17100MH2022PLC389963, with an authorized share capital of ₹5.00 crore and paid-up capital of approximately ₹1.56 crore.

Export Orientation

Operating as a 100% export house, Vashishtha serves couture and prêt-à-porter brands across international markets like Europe, the UK, the USA, Australia, and Turkey. The company was originally founded in 2010 as Vashishtha Exports and restructured into its current form in 2022.

Strengths

According to its IPO-related disclosures, key strengths include:

- Consistent Quality & Skilled Craftsmanship

A reputation for standardized processes and craftsmanship ensures reliability in delivery and product consistency. - Experienced Management & Skilled Workforce

Backed by over a decade of industry experience along with a dedicated team of skilled artisans. - Customer-Centric & Customization-Focused

Tailored designs and cultivating long-term client relationships are central to their business ethos. - Efficient Integrated Production Setup

Operations benefit from a streamlined, vertically integrated production model ensuring workflow efficiency. - Scalability

Adequate capacity to ramp up production aligns well with growing international demand.

Risk

The IPO prospectus also outlines several key vulnerabilities:

- Seasonality

Fluctuating demand, especially around festive periods, may negatively impact revenue streams. - Client Concentration

Heavy reliance on a limited number of clients heightens vulnerability in case of client loss. - Geographic Revenue Concentration

Dependence on revenue from specific countries could destabilize it amid geopolitical or economic shifts. - Unsecured Borrowings

Outstanding loans of approximately ₹27.99 lakh (as of March 2025) may be recalled unexpectedly, affecting cash flow. - Currency Fluctuations

Being fully export-oriented, the company is particularly susceptible to exchange rate volatility

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Assets |

| FY 2023 | 6.12 | 1.04 | 7.40 |

| FY 2024 | 7.14 | 0.32 | 7.89 |

| FY 2025 | 10.64 | 1.53 | 8.39 |

Revenue

- FY 2023: ₹6.12 crore

- FY 2024: ₹7.14 crore

- FY 2025: ₹10.64 crore

Revenue has shown strong growth, rising steadily from FY 2023 to FY 2025. The jump from ₹7.14 crore to ₹10.64 crore (around 49% growth) in FY 2025 highlights expansion and better order inflows.

Profit

- FY 2023: ₹1.04 crore

- FY 2024: ₹0.32 crore

- FY 2025: ₹1.53 crore

Profit dipped sharply in FY 2024 despite revenue growth, likely due to higher expenses or borrowing costs. However, FY 2025 saw a strong recovery, with profits reaching highest in three years, indicating improved operational efficiency.

Total Assets

- FY 2023: ₹7.40 crore

- FY 2024: ₹7.89 crore

- FY 2025: ₹8.39 crore

Assets have grown gradually each year, showing consistent investment in infrastructure and capacity. The asset growth supports the revenue expansion trend.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.