Rachit Prints IPO Overview

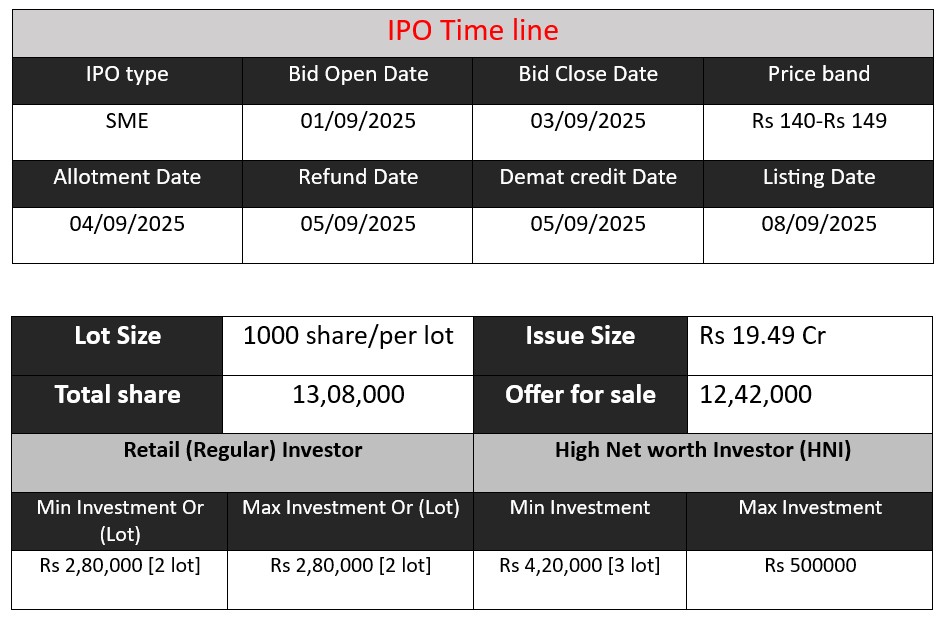

Rachit Prints Ltd IPO opens on 1 September 2025 and closes on 3 September 2025. The SME IPO is a fresh issue of 13.08 lakh equity shares (face value ₹10), aiming to raise approximately ₹19.49 crore at a price band of ₹140–₹149 per share. Proceeds will fund working capital debt repayment and general corporate purposes.

Rachit Prints Subscription and GMP Status

| Category | Subscription (x) |

| QIBs | 1.00 |

| NIIs | 1.33 |

| Retails | 2.52 |

| Total | 1.81 |

| Last Updated: 03 Sep 2025- 5 PM Source: NSE/BSE | |

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 140-149 | |

| Last Updated: 03 Sep 2025- 5 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Date

Core Business & Overview

The company was incorporated on March 31, 2003, and is currently active under the Corporate Identification Number (CIN) U22190UP2003PLC027364. It is categorized as a Public Unlisted Indian Non-Government Company, registered with the RoC in Kanpur. The registered office and manufacturing facility are located at B-9, 10 & 11, Udyog Puram, Delhi Road, Partapur, Meerut (Uttar Pradesh).

Rachit Prints Ltd. is primarily engaged in the manufacturing and trading of printed and dyed fabrics and garments, with integrated capabilities spanning design, printing, dyeing, and finishing services. These products cater to domestic apparel manufacturers and exporters.

Strengths

According to the IPO prospectus and market commentary, Rachit Prints boasts several key strengths:

- Integrated Operations – from design to finishing, allowing tighter quality control and cost efficiency.

- Experienced Promoter Team – deep industry knowledge and leadership.

- Product Portfolio & Market Reach – serves both male and female apparel segments with trend-based designs.

- Geographic Presence – present across 15 states and 1 Union Territory, indicating a decent national footprint.

- Established Distribution Network & Client Relationships – includes both domestic apparel manufacturers and exporters.

- Consistent Financial Performance – demonstrated positive revenues and profits over recent years.

Risks

The company also faces several risks, as outlined in its IPO filings:

- Industry Cyclicality – heavy reliance on the textile sector’s demand cycles may affect revenues.

- High Competition – presence of both organized and unorganized competitors poses pricing pressure.

- Raw Material Price Volatility – fluctuations can squeeze profit margins.

- Geographic Concentration – manufacturing is centralized in Meerut (Uttar Pradesh), exposing the company to regional risk.

- Working Capital Intensity – operations are capital-heavy, which may strain liquidity.

- Dependence on Key Customers and Suppliers – loss of major players could have a material impact.

- Compliance & Documentation Risks – minor delays in statutory filings and potential gaps in traceability of older corporate records may attract regulatory scrutiny.

- Lease-Only Facility – the company does not own its office or factory premises, making operations reliant on lease agreements.

- Historical Safety Incident – a fire in the manufacturing facility in May 2017 highlights risks associated with handling flammable materials.

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Assets |

| FY 2023 | 32.32 | 0.32 | 23.27 |

| FY 2024 | 37.08 | 2.03 | 19.02 |

| FY 2025 | 41.70 | 4.56 | 26.09 |

Revenue:

The company’s revenue has grown steadily from ₹32.32 Cr in FY23 to ₹41.70 Cr in FY25, showing consistent business expansion.

Profit:

Profit has significantly improved from ₹0.32 Cr in FY23 to ₹4.56 Cr in FY25, indicating better cost management and rising efficiency.

Assets:

Assets dipped in FY24 (₹19.02 Cr) but rebounded strongly in FY25 to ₹26.09 Cr, reflecting reinvestments and stronger financial positioning.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.