NIS Management IPO Overview

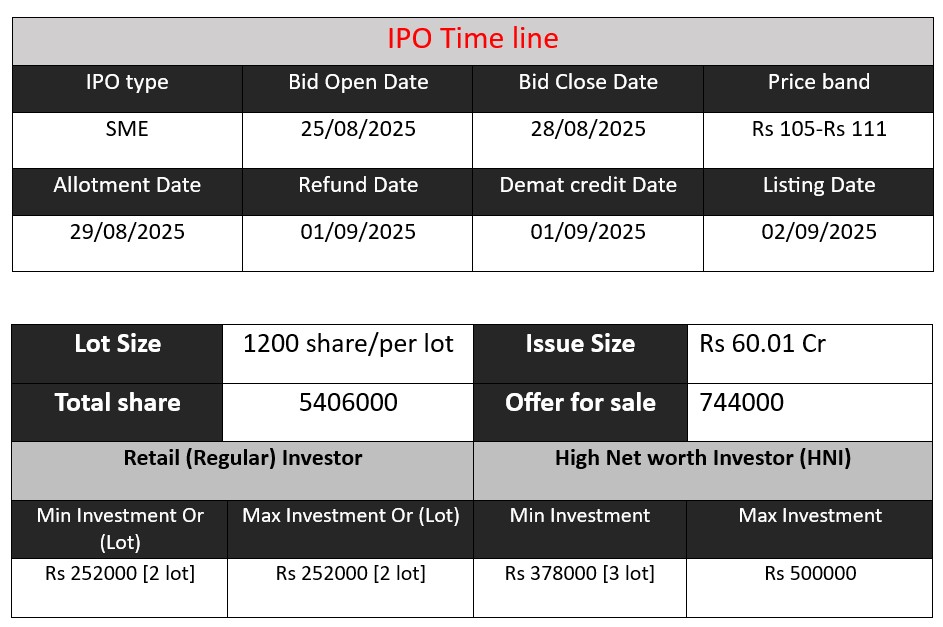

NIS Management Ltd is launching a ₹60.01 crore SME (Book-building) IPO offering a total of 5,406,000 equity shares (face value ₹10), comprising a fresh issue (43.32 lakh shares) and offer-for-sale (7.44 lakh shares). The IPO opens on 25 Aug 2025 and closes on 28 Aug 2025. Proceeds will fund working capital and general corporate purposes. Listing is scheduled on BSE SME on 2 Sep 2025.

NIS Management Subscription and GMP Status

| Category | Subscription (x) |

| QIBs | 1.94 |

| NIIs | 6.61 |

| Retails | 1.01 |

| Total | 2.05 |

| Last Updated: 28 Aug 2025 7 PM Source: NSE/BSE | |

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 105-111 | |

| Last Updated: 28 Aug 2025 7 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Date

Core Business & Overview

NIS Management Limited specializes in integrated security and facility management services. Their offerings include security guard deployment, electronic security solutions, housekeeping, payroll accounting, and more, serving sectors such as government institutions, PSUs, airports, retail, and hospitality.

History & Presence:

Founded in 1985 in Kolkata, the company initially commenced as a small security service provider with just five guards. Today, it employs over 16,000 personnel, operating across 14 Indian states and serving nearly 600 clients.

Training & Quality Assurance:

NIS runs Keertika Academy, a group-affiliated training center that provides structured training for its workforce. This helps ensure staff readiness and operational excellence.

The company also holds several ISO certifications, including:

ISO 9001:2015 (Quality Management)

ISO 14001:2015 (Environmental Management)

ISO 45001:2018 (Occupational Health and Safety)

ISO 30409:2016 (Human Resources Management)

ISO 27001:2022 (Information Security)

ISO 18788:2015 (Security Operations Management)

Strengths

- Strong Regional Footprint & Client Base

A long-standing presence in key regions such as West Bengal, Bihar, and Jharkhand, along with a diverse portfolio of clients—including government, PSUs, and private sectors—underscores its solid market positioning. - Efficient Workforce Management

The company touts an optimized core-to-associate staff ratio of approximately 129:1, significantly improving from 50:1 in 2019, enabling enhanced managerial efficiency with a lean support team of ~131 back-office staff. - Technology-Enabled Monitoring

Use of QR code-based systems to track employee adherence and service quality enables better monitoring, accountability, and operational oversight. - Structured Training & ISO Compliance

The Keertika Academy and multiple ISO certifications show NIS’s emphasis on quality control, employee safety, data security, and operational excellence—key enablers of reliability and trust.

Risks

- Geographic Revenue Concentration

A significant portion of revenue is concentrated in West Bengal, which may expose NIS to regional economic or regulatory fluctuations. - High Working Capital Requirements

The business model is working-capital intensive, with large receivables cycles that may strain cash flow and financial flexibility. - Competitive Market Pressure

The security and facility management sector is highly competitive, posing risks to contract renewals and margin stability. - Margin Pressures from Wage Costs

Rising labor costs can squeeze margins—given the workforce-heavy nature of operations, wage fluctuations can materially impact profitability. - Delay in Receivable Collections

Delayed payments from clients can exacerbate liquidity challenges and undermine operational fluidity.

Financial Performance Overview (₹ in Crore)

| Year (₹ Cr) | Revenue | Profit | Assets |

| FY 2023 | 340.64 | 16.14 | 225.72 |

| FY 2024 | 377.99 | 18.38 | 247.44 |

| FY 2025 | 402.17 | 18.67 | 255.11 |

Revenue

- FY 2023: ₹340.64 Cr → FY 2024: ₹377.99 Cr (+11%)

- FY 2024: ₹377.99 Cr → FY 2025: ₹402.17 Cr (+6%)

Consistent revenue growth, but growth slowed in FY25 compared to FY24.

Profit

- FY 2023: ₹16.14 Cr → FY 2024: ₹18.38 Cr (+13.9%)

- FY 2024: ₹18.38 Cr → FY 2025: ₹18.67 Cr (+1.6%)

Profit growth has almost stalled in FY25, despite higher revenue → margin pressure.

Total Assets

- FY 2023: ₹225.72 Cr → FY 2024: ₹247.44 Cr (+9.6%)

- FY 2024: ₹247.44 Cr → FY 2025: ₹255.11 Cr (+3.1%)

Assets are rising, but growth slowed in FY25, showing limited expansion.

✅ Pros

- Consistent revenue growth with established presence in 14 states.

- Diverse client base including govt., PSU, and private sector.

- Strong workforce of 16,000+ supported by in-house training (Keertika Academy).

- Multiple ISO certifications ensure quality & compliance.

- Use of tech (QR monitoring) improves efficiency & accountability.

❌ Cons

- Heavy revenue dependence on West Bengal region.

- Profit growth slowing despite revenue increase.

- Working capital intensive with high receivables risk.

- Highly competitive, low-margin security industry.

- Rising wage costs may pressure profitability further.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.