ARC Insulation IPO Overview

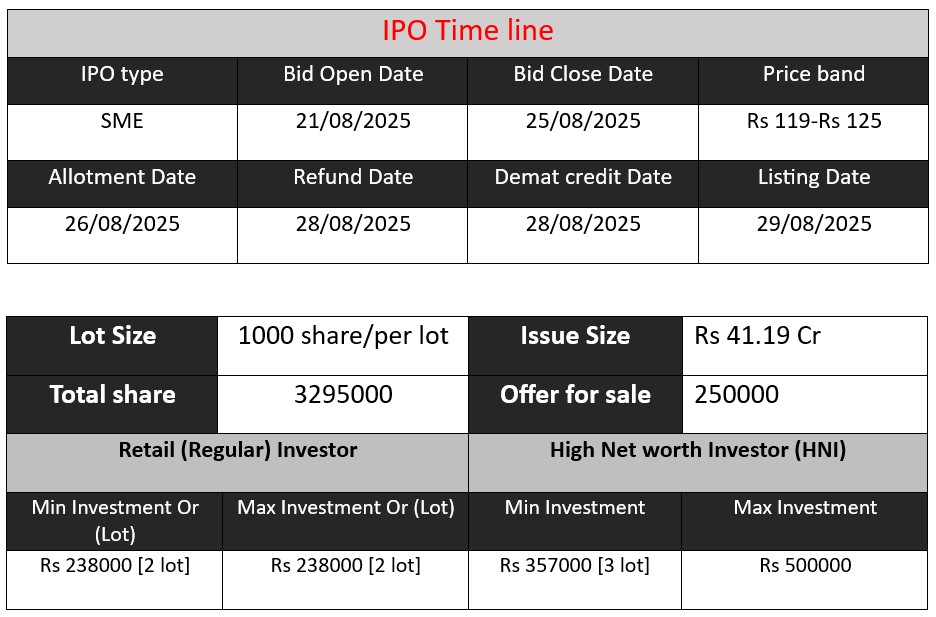

ARC Insulation & Insulators Ltd IPO — a public cum offer-for-sale SME issue of ₹41.19 cr, comprising ~32.95 lakh equity shares (fresh issue of ₹38.06 cr plus offer-for-sale of ₹3.13 cr), opens 21 August 2025, closes 25 August 2025; proceeds earmarked for capital expenditure (new plant), office expansion, debt prepayment, working capital needs, and general corporate purposes. Listing on NSE SME slated 29 August 2025.

ARC Insulation Subscription and GMP Status

| Category | Subscription (x) |

| QIBs | 11.62 |

| NIIs | 20.54 |

| Retails | 14.32 |

| Total | 13.83 |

| Last Updated: 25 Aug 2025- 8 PM Source: NSE/BSE | |

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 5 | 119-125 |

| Last Updated: 25 Aug 2025- 8 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Date

Core Business & Overview

Incorporated: September 10, 2008, in Bishnupur, West Bengal

Arc Insulation & Insulators Limited specializes in manufacturing Glass Fiber Reinforced Polymer (GFRP) and Fiber Reinforced Polymer (FRP) composite products. These materials include rebars, tubes, sheets, grating walkways, fencing, pipes, and other industrial-grade FRP solutions.

These high-performance, corrosion-resistant alternatives to steel rebars serve sectors such as infrastructure, energy, power, chemical, and marine industries.

Strengths

- Strong Growth Trajectory: Exceptional year-over-year increases in both revenue (108.86%) and profitability (210.23%) in FY 2023, highlighting operational momentum.

- High-Quality Product Portfolio: Offering corrosion-resistant, high-strength GFRP/FRP products suitable for demanding infrastructure and industrial applications.

- Firm Financial Position: Healthy EBITDA margin (~29%), and robust net worth growth (~18%), indicative of improving operational efficiency and asset utilization.

Risks

- Significant Borrowing / Open Charges:

- Substantial open charges (~₹18.29 crore) could impact liquidity or credit standing.

- Major lender: State Bank of India; the debt exposure is material relative to capital base.

- Market Concentration & Client Base Uncertainty:

- Lack of clarity around its client concentration or diversification.

- Dependence on GFRP/FRP niche markets could expose the company to sector-specific cyclical risks.

- Unlisted Status & Limited Disclosure:

The company remains unlisted, which may limit its access to capital markets and reduce transparency for investors or creditors

Financial Performance Overview (₹ in Crore)

| Fiscal Year | Revenue | Profit | Assets |

| FY 2023 | 23.98 | 2.64 | 18.27 |

| FY 2024 | 28.45 | 6.10 | 22.42 |

| FY 2025 | 32.72 | 8.56 | 39.29 |

Revenue

- FY 2023: ₹23.98 Cr → FY 2025: ₹32.72 Cr

Growth shows strong demand and expanding business operations.

Profit

- FY 2023: ₹2.64 Cr → FY 2025: ₹8.56 Cr

Profit has tripled in 3 years, showing better efficiency and cost management.

Assets

- FY 2023: ₹18.27 Cr → FY 2025: ₹39.29 Cr

Assets more than doubled, meaning the company is investing heavily in expansion and strengthening its base.

✅ Pros

- Strong revenue and profit growth over the last 3 years.

- Expanding assets, indicating business scale-up.

- Specialized product portfolio (FRP/GFRP) with growing demand.

- Healthy EBITDA margins (~29%) reflect operational efficiency.

- IPO proceeds to reduce debt and fund expansion.

❌ Cons

- High debt exposure with open charges of ~₹18 Cr.

- Limited disclosure as an unlisted SME company.

- Market niche concentration may limit diversification.

- Dependency on infrastructure and industrial cycles.

- Smaller scale compared to listed industry peers.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.