Sawaliya Foods Products IPO Overview

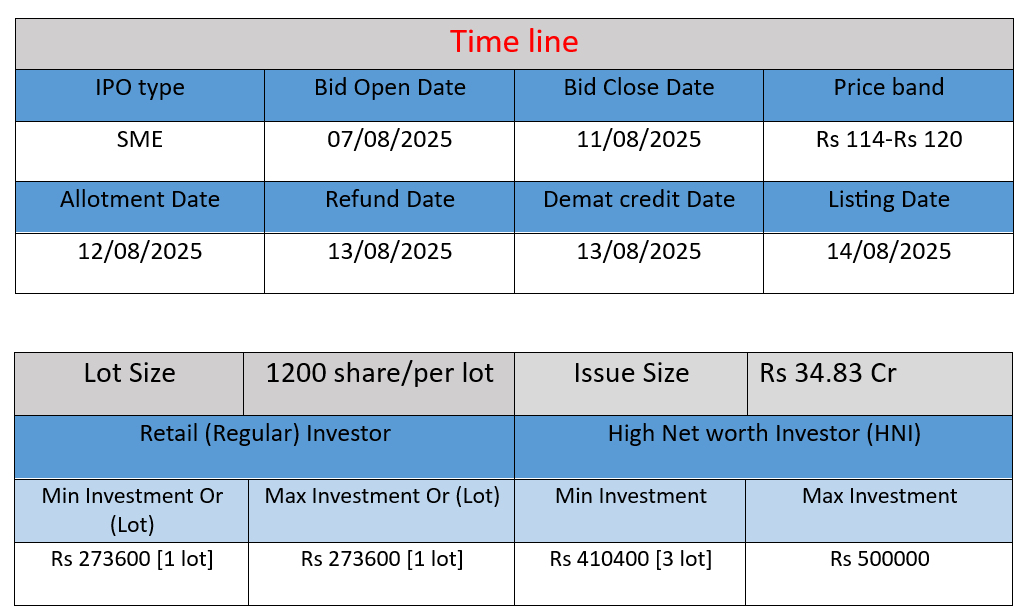

Sawaliya Food Products Ltd IPO opens August 7, 2025 and closes August 11, 2025. The issue size is approximately ₹34.83 crore via 29,02,800 equity shares (₹10 face value), including up to 26,02,800 fresh issues and 3,00,000 offer-for-sale shares. Price band: ₹114–₹120. Proceeds earmarked for capital expenditure (new machinery, solar PV setup), working capital, debt repayment, and general corporate purposes

Sawaliya Foods Products Subscription and GMP Status

| Category | Subscription (x) |

| QIBs | 15.82 |

| NIIs | 20.72 |

| Retails | 8.62 |

| Total | 12.29 |

| Last Updated: 11 Aug 2025 Time: 10 PM (Note: This data is updated every 2 hours) Source: NSE/BSE | |

| GMP (₹) | IPO Price (₹) |

| 4 | 120 |

| Last Updated: 11 Aug 2025 Time: 10 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Date

Core Business & Overview

Sawaliya Food Products Limited (incorporated on 1 July 2014 as a private limited and converted into a public limited on 15 July 2024) operates from Pithampur, Madhya Pradesh. It specializes in the processing and manufacturing of dehydrated vegetables (such as carrots, cabbage, French/field beans), catering to FMCG manufacturers, domestic and international traders, and export markets including the US and Asia.

The company runs two automated manufacturing lines with in‑house cold storage (2,000 MT) and Meyer color-sorter technology, sourcing directly from contract farmers—especially from Madhya Pradesh and Punjab—to streamline supply, reduce costs, and ensure quality control.

Strengths

- Cost‑efficient, vertically integrated model: Farm‑to‑factory sourcing reduces procurement and logistics costs; contract farming ensures raw material stability.

- Strong financial metrics: High margins (EBITDA 36 %, PAT ~20 %) and robust ROCE (49 %) reflect operational efficiency and pricing power.

- Quality and sustainability: US FDA‑approved facility, ISO standards, zero‑waste policy (surplus used for pet‑food), and solar PV adoption underscore its ESG commitment and eligibility for eco‑sensitive export markets.

- Product diversification & innovation: Beyond core vegetables—carrot, cabbage, beans—the company has begun offering dehydrated pumpkin, beetroot, and papaya to capitalize on rising global demand.

Potential Risks

- Agricultural supply risks: Heavy reliance on seasonal crops and climatic conditions could disrupt raw material availability and pricing. Dependency on a few geographies may expose the company to localized agro‑risks.

- Competitive pressures: The dehydrated vegetable and FMCG ingredient market has increasing competition from domestic players and imports, requiring continual innovation and cost management to maintain market share.

- Financial leverage: Although growth and margins are strong, the company’s debt‑to‑equity ratio (1.78×) indicates moderate leverage. Servicing that debt remains a sensitivity, especially in rising interest rate scenarios

Financial Performance Overview (₹ in Crore)

| Financial Year | Revenue | Profit (PAT) | Total Assets |

| FY 2023 | ₹15.09 Cr | ₹0.59 Cr | ₹20.04 Cr |

| FY 2024 | ₹23.40 Cr | ₹3.12 Cr | ₹25.40 Cr |

| FY 2025 | ₹34.18 Cr | ₹6.94 Cr | ₹46.26 Cr |

Revenue

- FY 2023 to FY 2024: Grew from ₹15.09 Cr to ₹23.40 Cr — an increase of 55%, showing strong expansion.

- FY 2024 to FY 2025: Rose further to ₹34.18 Cr — an additional 46% growth, highlighting increased sales, likely due to new products, more contracts, and export demand.

Profit

- Jumped from ₹0.59 Cr in FY 2023 to ₹6.94 Cr in FY 2025 — over 10x increase in just two years.

- Reflects better operational efficiency, higher margin products, and scaling benefits.

Assets

- Increased from ₹20.04 Cr in FY 2023 to ₹46.26 Cr in FY 2025 — over 130% growth.

- Suggests heavy investment in fixed assets like cold storage, solar power units, machinery, and inventory expansion to support growth.

✅ Pros

- Strong revenue and profit growth over three years.

- US FDA-approved facility with sustainable practices.

- Export-oriented with high demand for dehydrated foods.

- High return on capital employed (ROCE ~49%).

- Backward integration through contract farming ensures raw material stability.

❌ Cons

- Dependency on seasonal agriculture and weather risks.

- Moderate debt level (D/E ratio ~1.78) adds financial pressure.

- SME IPO – lower liquidity and higher volatility post-listing.

- Limited brand visibility in the consumer market.

- High competition from domestic and global food processors.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.