BLT Logistics IPO Overview

BLT Logistics Limited IPO opens 04 August 2025 and closes 06 August 2025. It comprises a fresh issue of 12,96,000 equity shares (face value ₹10), aggregating to ₹9.72 crore at a price band of ₹71–₹75 per share. Proceeds will fund trucks and equipment acquisition, meet working‑capital needs, and support general corporate purposes. Listing expected on BSE SME on 11 August 2025.

BLT Logistics Subscription and GMP Status

| Category | Subscription (x) |

| QIBs | 1.04 |

| NIIs | 29.35 |

| Retails | 34.69 |

| Total | 15.59 |

| Last Updated: 6 Aug 2025 Time: 11 AM (Note: This data is updated every 2 hours) Source: NSE/BSE | |

| GMP (₹) | IPO Price (₹) |

| 45 | 75 |

| Last Updated: 6 Aug 2025 Time: 11 AM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

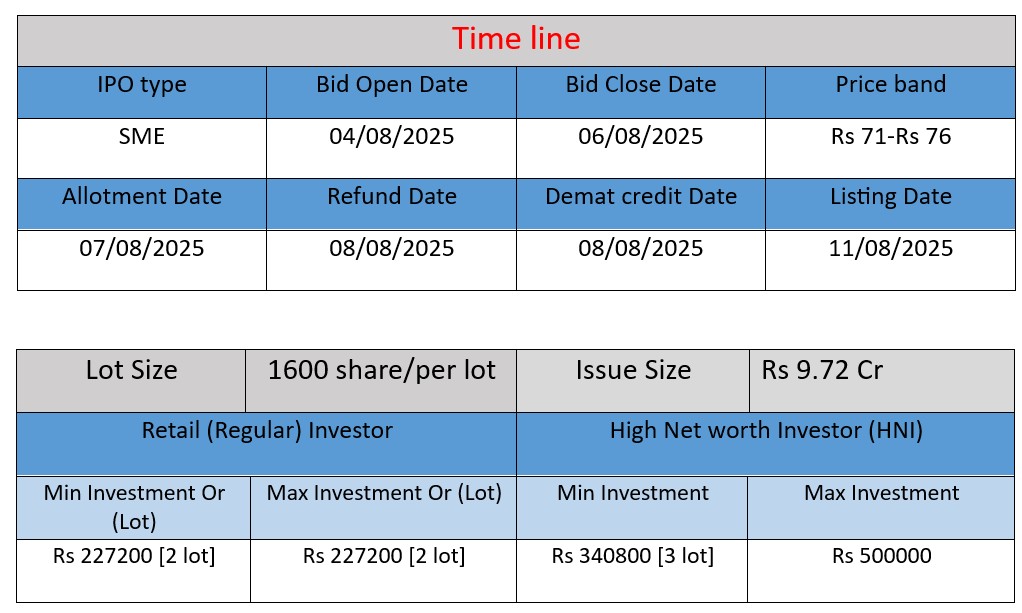

IPO Key Date

Core Business & Overview

- Incorporated: 6 September 2011, Delhi, India (CIN U63000DL2011PLC224622)

- Nature of business: Support services to organizations—logistics, trucking, warehouse, project cargo, packers & movers

- Fleet & network: Over 100 vehicles (around 88 containerized, plus 15%+ third‑party), serving clients across India

- Service mix: Offers full truckload (FTL) and less-than-truckload (LTL), project cargo, warehouse, packers & movers, transportation for electronics, FMCG, retail sectors

- Technology & safety infrastructure: Telematics and GPS-enabled tracking, 24×7 control room, driver background checks and defensive training programs, in‑house workshops for preventive maintenance. Risk route‑mapping for men, material, machines ensures operational safety

Strengths

- High customer retention: Maintains a ~98% client retention over 13+ years—a testament to service quality and reliability

- Technology‑driven operations: GPS and telematics, real‑time tracking, MIS reporting, and proactive fleet maintenance help manage cost, efficiency, and security

- Scalable & diversified service portfolio: Mix of owned and leased fleet, varied truck sizes, pan‑India reach and multi‑sector clientele enable adaptability to different logistics needs

Potential Risks

- Financial leverage: Carried open charges totalling ₹15.88 crore over several lenders (HDFC, Axis Bank, Yes Bank, etc.) as of late 2024—indicating borrowing dependency

- Limited scale & capitalization: Small paid-up capital (~₹3.5 Cr) and only 13 employees reported; may constrain ability to scale or take on large institutional contracts

Competitive market & client concentration risk: Operating in a highly competitive logistics sector in India; risk amplified if servicing a narrow client base or sector concentration (exact client mix not publicly detailed).

Financial Performance Overview (₹ in Crore)

| Financial Year | Revenue | Profit (PAT) | Total Assets |

| FY 2022 | ₹20.94 | ₹0.14 | ₹10.33 |

| FY 2023 | ₹31.03 | ₹1.35 | ₹12.76 |

| FY 2024 | ₹40.34 | ₹3.13 | ₹21.32 |

Revenue

- The company’s revenue grew 48.2% from FY22 to FY23 (₹20.94 Cr → ₹31.03 Cr), and 30% from FY23 to FY24 (₹31.03 Cr → ₹40.34 Cr).

- This indicates strong business expansion and higher demand for its logistics services.

Profit

- Profit surged from just ₹0.14 Cr in FY22 to ₹1.35 Cr in FY23—almost 9.6x growth.

- In FY24, profit further increased to ₹3.13 Cr, showing strong cost control and improved margins.

Asset

- Total assets rose steadily from ₹10.33 Cr in FY22 to ₹21.32 Cr in FY24—more than double in 2 years.

- This reflects investments in trucks, warehousing, or expansion-related infrastructure.

✅ Pros:

- Strong revenue and profit growth over the last three years.

- High customer retention (~98%) shows service reliability.

- Tech-enabled logistics operations with GPS and MIS reporting.

- Proceeds to be used for asset expansion and working capital.

❌ Cons:

- Small-scale company compared to major logistics players.

- High dependency on borrowed capital; financial leverage risk.

- Operates in a highly competitive and price-sensitive market.

- Limited public information about client concentration or contracts.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.