Flysbs Aviation IPO Overview

FlySBS Aviation Limited IPO opens on 1 August 2025 and closes on 5 August 2025. The offer comprises a fresh issue of 45,57,000 equity shares (₹10 face value), aggregating up to ₹102.53 crore. Shares are priced in a band of ₹210–₹225 each. Net proceeds will fund long‑term dry‑lease acquisition of six aircraft, repayment of borrowings, and general corporate purposes.

Flysbs Aviation Subscription and GMP Status

| Category | Subscription (x) |

| QIBs | 166.38 |

| NIIs | 527.15 |

| Retails | 251.75 |

| Total | 266.01 |

| Last Updated: 5 Aug 2025 Time: 4 PM (Note: This data is updated every 2 hours) Source: NSE/BSE | |

| GMP (₹) | IPO Price (₹) |

| 215 | 225 |

| Last Updated: 5 Aug 2025 Time: 4 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

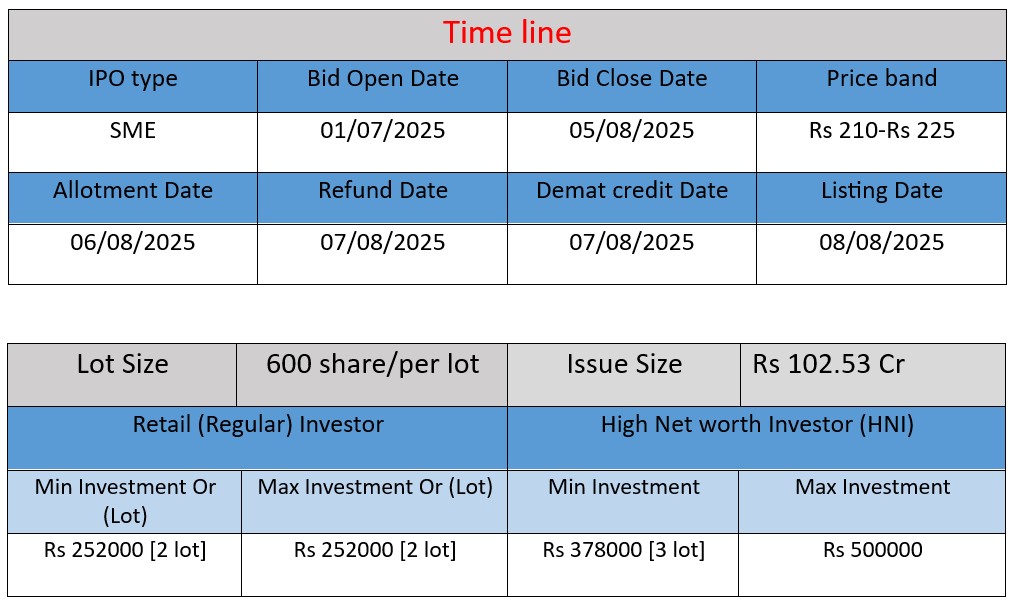

IPO Key Date

Core Business & Overview

- Established on August 7, 2020, FlySBS Aviation Limited is headquartered in Chennai, Tamil Nadu, and operates as a DGCA-approved Non-Scheduled Operator (NSOP) offering private air charter services across domestic and international routes .

- It serves elite clients—entrepreneurs, corporate executives, celebrities, diplomats, and politicians—providing tailored air-travel solutions and access to exclusive destinations including Japan, the Middle East, Europe, North America, New Zealand, Africa, and more .

- Revenue models include:

- On-demand private jet charters

- Subscription-based programs (e.g. “Je’time”)

- Membership and Flexjet programs

- Air-time share / dry-lease arrangements

- Medical evacuation (medevac) and high security/diplomatic missions .

Strengths

- Seasoned leadership with deep aviation expertise

Founders include Capt. Deepak Parasuraman (30+ years), Kannan Ramakrishnan, and CEO Amba Shankar—all bringing decades of cross-functional industry experience . - Favourable business model: asset-light and scalable

Operates primarily on a dry lease asset-light model, flying a 13‑seater Embraer Legacy 600 with outsourced maintenance. This structure minimizes capital expenditure and enables scalable growth . - Premium, high-margin international clientele

Over 94% of FY24–25 revenue came from B2B and high-end corporate charter contracts, and more than 70% of flying hours were from international missions, which command higher yields . - Synergies with Afcom Holdings Limited

Association with group firm Afcom (cargo airline) enables cost efficiencies in fuel procurement, maintenance, and operations .

Potential Risks

- Regulatory compliance challenges

The aviation sector is highly regulated, and past lapses in regulatory filings have posed legal or reputational risks for the company. - Highly niche and demand-sensitive clientele

Heavy reliance on HNIs, corporates, and VIPs makes the revenue model sensitive to changes in elite-travel demand and economic cycles . - Capital intensity and growth execution risk

Though using an asset-light model, scale-up depends on leasing more aircraft (~6 new aircraft via IPO proceeds), managing ATF costs, crew, routing, and infrastructure expansions—especially as international operations grow . - Market infrastructure and operational bottlenecks

India only has ~30 business jet–capable airports, limiting flexibility and potentially causing scheduling or regulatory hurdles . - Volatility in aviation input costs

Fuel prices, airport handling fees, crew salaries, and lease rentals are volatile and can compress margins if not managed carefully

Financial Performance Overview (₹ in Crore)

| Financial Year | Revenue | Profit After Tax (PAT) | Total Assets |

| FY 2023 | ₹31.11 | ₹3.44 | ₹20.11 |

| FY 2024 | ₹106.49 | ₹11.25 | ₹77.15 |

| FY 2025 | ₹193.89 | ₹28.41 | ₹191.83 |

Revenue

- FY 2023 to FY 2024: Revenue increased by 242.4% (₹31.11 Cr → ₹106.49 Cr)

- FY 2024 to FY 2025: Revenue increased by 82.1% (₹106.49 Cr → ₹193.89 Cr)

This sharp rise reflects increasing demand for premium charter services, international expansion, and fleet utilization.

Profit

- FY 2023 to FY 2024: PAT grew by 227%

- FY 2024 to FY 2025: PAT grew by 152%

Profitability is scaling alongside revenue, indicating strong operational efficiency and cost control.

Total Assets

- FY 2023 to FY 2024: Assets grew nearly 284%

- FY 2024 to FY 2025: Assets grew 148.6%

Rise in assets is driven by new aircraft leases, infrastructure investments, and scale-up for international operations.

✅ Pros

- Strong revenue and profit growth over the last 3 years

- Asset-light, scalable business model with high-margin charter services

- Experienced promoters and strong international presence

- IPO proceeds aimed at expanding fleet and operations

❌ Cons

- Operates in a highly regulated and capital-intensive sector

- Heavy dependence on elite clientele and economic cycles

- Limited airport infrastructure for private jets in India

- No long-term operational history; risk in execution and expansion

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.