Mehul Colours IPO Overview

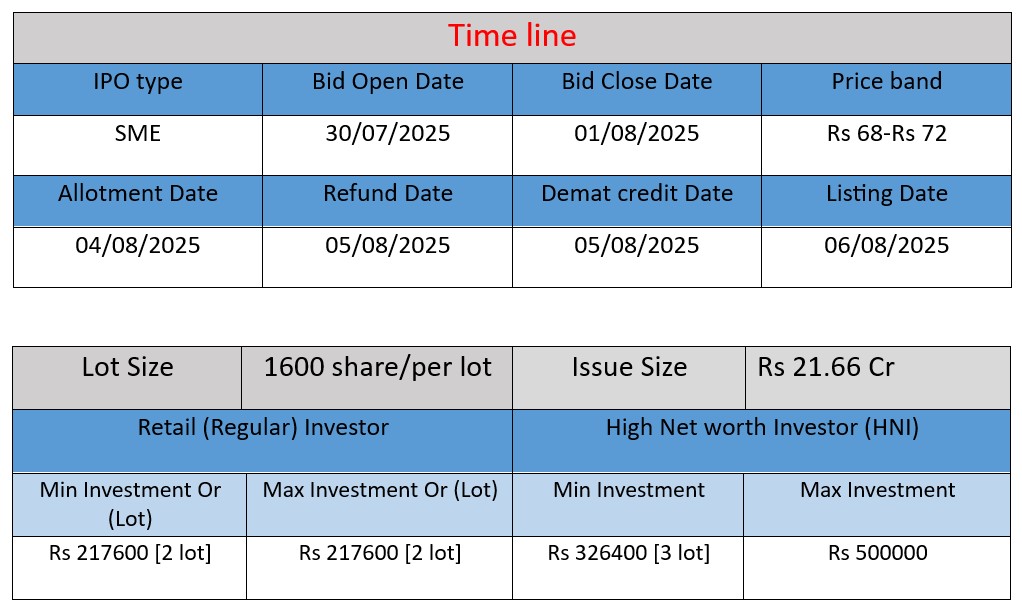

Mehul Colours Limited IPO opens on July 30 and closes on August 1, 2025. The issue comprises up to 3,008,000 equity shares (face value ₹10) priced between ₹68–₹72, aggregating ₹21.66 crore. Proceeds will fund capital expenditure for a new manufacturing facility, working capital requirements, and general corporate purposes. Listed on BSE SME—subscription opens July 30 and closes August 1, 2025

Mehul Colours Subscription and GMP Status

| Category | Subscription (x) |

| QIBs | 13.54 |

| NIIs | 11.27 |

| Retails | 3.48 |

| Total | 5.34 |

| Last Updated: 1 Aug 2025 Time: 5 PM (Note: This data is updated every 2 hours) Source: NSE/BSE | |

| GMP (₹) | IPO Price (₹) |

| 5 | 72 |

| Last Updated: 1 Aug 2025 Time: 5 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Date

Core Business & Overview

Incorporated in December 1995 and headquartered in Mumbai, Mehul Colours Limited specializes in manufacturing colour masterbatches, additive masterbatches, special-effect masterbatches, filler masterbatches, and pigments for the plastics industry. These are used to enhance the aesthetics and functional properties of plastic products across packaging, automotive, consumer goods, agriculture, wiring, and more.

The company has two manufacturing units in Vasai (Mumbai) and an R&D/testing facility to ensure quality and innovation in products. Its annual production capacity is approximately 1.28 million kg

Financial Performance Overview (₹ in Crore)

| Financial Year | Revenue | Profit (PAT) | Total Assets |

| FY 2023 | ₹21.18 | ₹2.94 crore | ₹10.82 crore |

| FY 2024 | ₹21.94 | ₹3.22 crore | ₹13.87 crore |

| FY 2025 | ₹22.82 | ₹5.50 crore | ₹18.95 crore |

Revenue

- FY23: ₹21.18 crore

- FY24: ₹21.94 crore (↑ ₹0.76 crore, ~3.6%)

- FY25: ₹22.82 crore (↑ ₹0.88 crore, ~4%)

Revenue has shown consistent but moderate growth year over year.

Profit

- FY23: ₹2.94 crore

- FY24: ₹3.22 crore (↑ ₹0.28 crore, ~9.5%)

- FY25: ₹5.50 crore (↑ ₹2.28 crore, ~70.8%)

Profit has grown significantly in FY25, indicating better cost efficiency or margin improvements.

Total Assets

- FY23: ₹10.82 crore

- FY24: ₹13.87 crore (↑ ₹3.05 crore, ~28%)

- FY25: ₹18.95 crore (↑ ₹5.08 crore, ~36.6%)

Steady rise in assets, possibly due to investment in capacity, equipment, or infrastructure.

✅ Pros

- Consistent revenue growth with a sharp rise in FY25 profit.

- Diversified product portfolio in the growing masterbatch industry.

- IPO funds aimed at capacity expansion and operational strengthening.

- Experienced promoters and in-house R&D capabilities.

❌ Cons

- SME IPO listing may face low liquidity and higher price volatility.

- Moderate revenue growth despite increasing assets.

- No long-term contracts with key clients—customer concentration risk.

- Dependency on a single product category (masterbatches).

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.