Takyon Networks IPO Overview

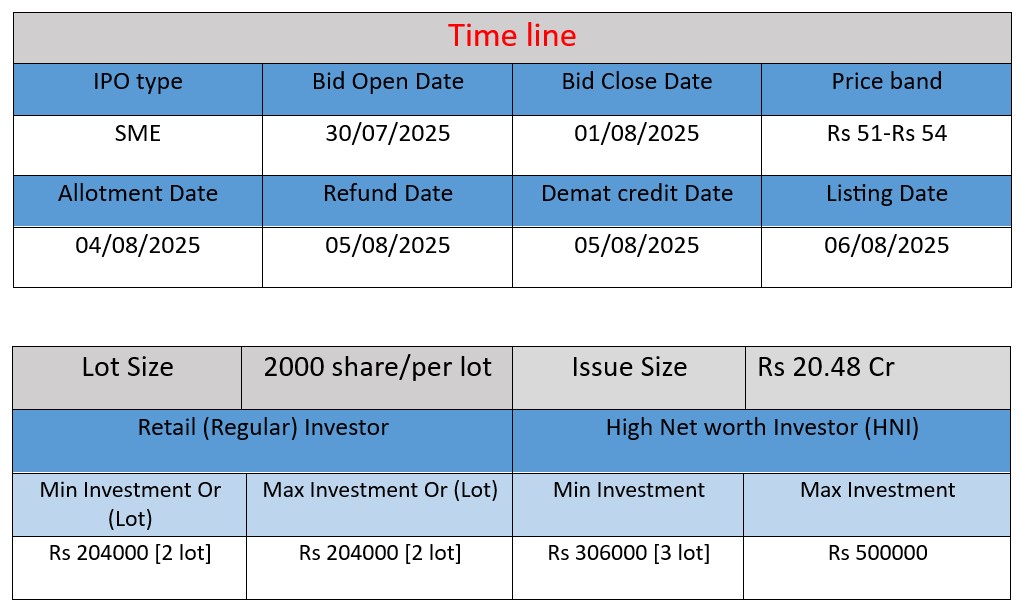

Takyon Networks Limited’s SME IPO opens 30 July 2025 and closes 1 August 2025, offering 3,792,000 equity shares at a price band of ₹51–₹54 (face value ₹10), raising ₹20.48 crore. Proceeds will fund working capital requirements, repayment of borrowings, and general corporate purposes. The issue is set to list on the BSE‑SME platform on 6 August 2025

Takyon Networks Subscription and GMP Status

| Category | Subscription (x) |

| QIBs | 13.29 |

| NIIs | 37.31 |

| Retails | 19.74 |

| Total | 14.50 |

| Last Updated: 1 Aug 2025 Time: 5 PM (Note: This data is updated every 2 hours) Source: NSE/BSE | |

| GMP (₹) | IPO Price (₹) |

| 54 | |

| Last Updated: 1 Aug 2025 Time: 5 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Date

Core Business & Overview

Takyon Networks Limited—formerly Takyon Networks Private Limited—is a Lucknow‑based public company incorporated in May 2015 and converted to a public company in August 2024. Founded in 2009, it operates in the IT infrastructure, system integration, cloud, cybersecurity, and managed services domains.

Core offerings include:

- Enterprise networking: LAN/WAN, Wi‑Fi, fiber optics, SDN

- Network and data centre services: Design, consulting, deployment, virtualization

- Security & surveillance: Firewalls, endpoint security, CCTV, access control

- Cloud & managed services: IaaS, PaaS, SaaS, remote monitoring, AMC/maintenance.

Its clientele comes from government, telecom, education, defence, energy, railways, and corporate sectors. It is empanelled with agencies like UPDESCO, UPELC, ITI, UPRNN, and is an authorized BSNL system integrator for the UP circle. Takyon also holds certified partnerships with OEMs such as Ruckus, Juniper, Sophos, Hitachi, Nokia, HP, and Dell

Financial Performance Overview (₹ in Crore)

| Financial Year | Revenue | Profit (PAT) | Total Assets |

| FY 2023 | ₹63.24 | ₹2.81 | ₹69.67 |

| FY 2024 | ₹107.50 | ₹5.22 | ₹72.83 |

| FY 2025 | ₹103.12 | ₹6.96 | ₹85.70 |

1. Revenue

- FY 2023: ₹63.24 Cr

- FY 2024: ₹107.50 Cr (Huge growth of ~70% YoY)

- FY 2025: ₹103.12 Cr (Slight decline of ~4% from FY 2024)

The revenue nearly doubled in FY 2024, indicating strong project wins or contract execution. However, a small dip in FY 2025 could mean some large projects were completed in FY 2024 or there was slight delay in new order execution.

2. Profit

- FY 2023: ₹2.81 Cr

- FY 2024: ₹5.22 Cr (Growth of ~85%)

- FY 2025: ₹6.96 Cr (Growth of ~33%)

Profit has consistently increased over the three years. Even in FY 2025, despite a small drop in revenue, profit rose—indicating improved margins, cost control, or higher-value projects.

3. Total Assets

- FY 2023: ₹69.67 Cr

- FY 2024: ₹72.83 Cr

- FY 2025: ₹85.70 Cr

Assets have grown steadily, showing expansion in the company’s scale—likely due to investment in infrastructure, receivables from larger contracts, or new capabilities like cloud and managed services.

✅ Pros (Advantages)

- Offers end-to-end IT infrastructure and managed services across multiple sectors.

- Strong growth in profit with healthy return ratios (RoE & RoCE).

- Certified partnerships with top OEMs and government empanelments.

- Experienced promoters with a proven execution record.

- Robust order book ensures near-term revenue visibility.

⚠️ Cons (Risks)

- Heavy dependence on government tenders and contracts.

- Limited vendor base without long-term supply agreements.

- Customer concentration risk with a few clients driving revenue.

- Vulnerable to hardware supply chain disruptions.

- SME listing may result in low post-IPO liquidity and higher volatility.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.