B D Industries IPO Overview

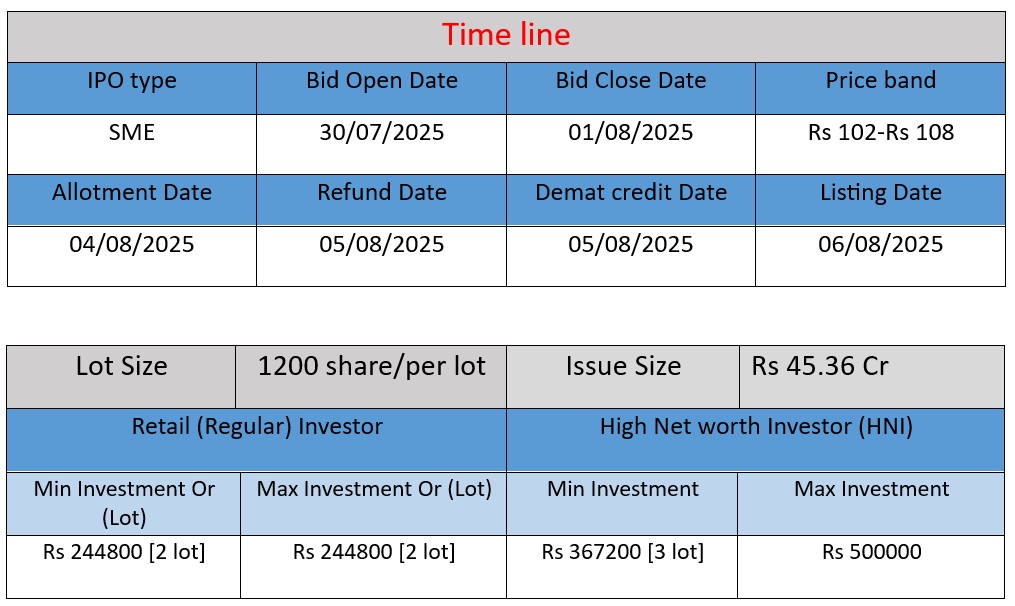

B. D. Industries (Pune) Ltd IPO opens on 30 Jul 2025 and closes on 1 Aug 2025. It’s a fresh issue of 42 lakh equity shares (face value ₹10), raising ₹45.36 crore at a price band of ₹102–₹108 per share. The offering aims to finance repayment/pre‑payment of borrowings, working capital needs, machinery purchase, and general corporate purposes. Listing is proposed on BSE SME.

B D Industries Subscription and GMP Status

| Category | Subscription (x) |

| QIBs | 1.27 |

| NIIs | 4.02 |

| Retails | 1.31 |

| Total | 1.25 |

| Last Updated: 1 Aug 2025 Time: 5 PM (Note: This data is updated every 2 hours) Source: NSE/BSE | |

| GMP (₹) | IPO Price (₹) |

| 108 | |

| Last Updated: 1 Aug 2025 Time: 5 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Date

Core Business & Overview

Incorporation & Products

B.D. Industries Limited, incorporated in 1984 (and its Pune entity established in 2010), specializes in the manufacturing of rotationally molded plastic products for diverse sectors such as agriculture, pharmaceuticals, textiles, automotive, road safety, and material handling—producing items like fuel tanks, battery boxes, pallets, road barriers, and safety cones.

Operation Footprint

The BDI Group operates across five plants in western, northern, and southern India, with over 35 years of experience, ISO 9001/ISO 14001/ISO 45001 and IATF 16949 certifications, and a portfolio exceeding 500–600 product variants

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Total Assets |

| FY 2023 | ₹54.61 | ₹1.49 | ₹27.18 |

| FY 2024 | ₹54.25 | ₹3.18 | ₹31.96 |

| FY 2025 | ₹82.38 | ₹8.15 | ₹68.90 |

Revenue

- FY 2023 → FY 2024: Slight dip from ₹54.61 to ₹54.25 crore. Revenue remained nearly flat.

- FY 2024 → FY 2025: Significant growth of 51.8%, reaching ₹82.38 crore, indicating strong business expansion and higher order volumes.

Profit

- FY 2023 → FY 2024: Profit more than doubled from ₹1.49 to ₹3.18 crore, showing improved operational efficiency.

- FY 2024 → FY 2025: Further sharp rise of 156%, reaching ₹8.15 crore, reflecting stronger margins and better cost control.

Total Assets

- FY 2023 → FY 2024: Assets increased from ₹27.18 to ₹31.96 crore, showing moderate asset investment.

- FY 2024 → FY 2025: Assets grew by over 2x to ₹68.90 crore, indicating major investment in infrastructure, machinery, or capacity expansion.

✅ Pros (Advantages)

- Strong growth in revenue and profit in FY 2025.

- Presence across diverse industries reduces risk.

- Holds multiple quality and safety certifications.

- Led by experienced and technically skilled promoters.

- IPO funds to support growth and debt reduction.

- Rapid increase in total assets indicates expansion.

- Moderate SME IPO size may attract retail investors.

⚠️ Cons (Risks)

- Operates in a highly competitive and fragmented market.

- High dependency on imported raw materials.

- SME listing carries liquidity and volatility risks.

- Revenue was flat in FY23–FY24, raising growth concerns.

- Business requires heavy working capital.

- Operations are regionally concentrated.

- Valuation may seem high for current business scale.