M&B Engineering IPO Overview

M&B Engineering Limited’s IPO (₹650 crore book-built issue) opens July 30, 2025 and closes August 1, 2025. Total Issue size is 16.88 million shares, including a fresh issue of ~7.14 million shares (₹275 cr) and an Offer for Sale of ~9.74 million shares (₹375 cr). The proceeds are earmarked for capital expenditure, IT upgrades, debt repayment, and general corporate purposes. Price band: ₹366 – ₹385 per share.

M&B Engineering Subscription and GMP Status

| Subscription Rate Source: NSE/BSE | |||

| Category | Shares Offered | Shares Bid For | Subscription (x) |

| QIBs | 53,11,475 | 19,50,38,078 | 36.72 |

| NIIs | 26,55,737 | 10,15,62,106 | 38.24 |

| Retails | 17,70,491 | 5,76,25,784 | 32.55 |

| Employees | 60,606 | 4,92,936 | 8.13 |

| Shareholders | |||

| Total | 97,98,309 | 35,47,18,904 | 36.20 |

| Last Updated: 1 Aug 2025 Time: 5 PM (Note: This data is updated every 2 hours) Get instant updates on WhatsApp – Join now! | |||

| GMP (₹) | IPO Price (₹) |

| 51 | 385 |

| Last Updated: 1 Aug 2025 Time: 5 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

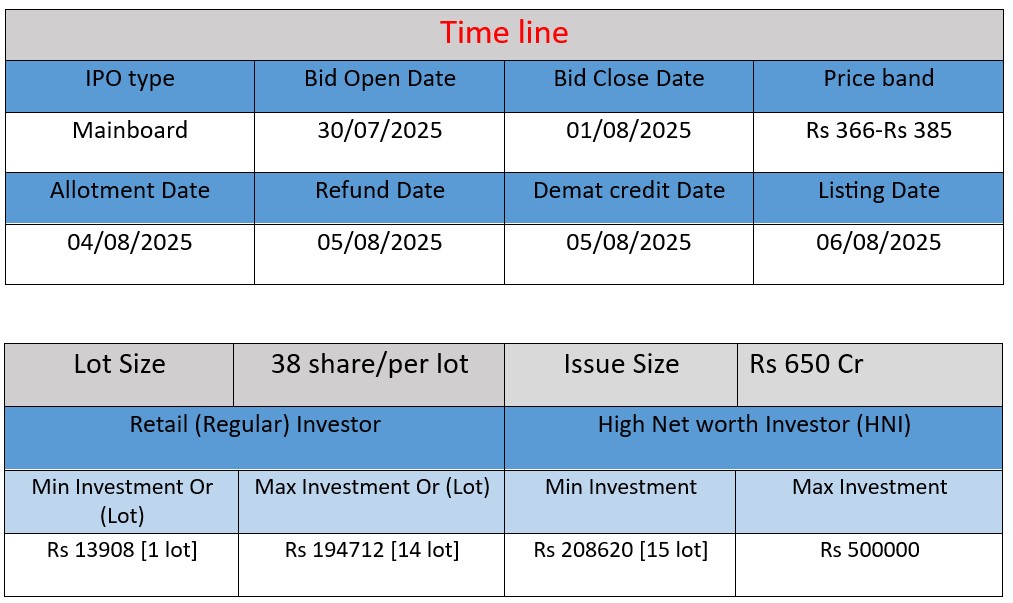

IPO Key Date

Core Business & Overview

- M&B Engineering Limited (established in 1981) is one of India’s leading providers of design‑led engineering solutions focused on Pre‑Engineered Buildings (PEBs) and Self‑Supported Steel Roofing systems. It operates through two principal divisions: Phenix (PEB and structural steel) and Proflex (mobile on‑site roofing manufacturing).

- It has two state‑of‑the‑art plants in Sanand, Gujarat and Cheyyar, Tamil Nadu, with a combined PEB capacity of ~103,800 MTPA and roofing capacity of ~1.8 million sqm per annum as of March 31 2025.

Core Business Activities

Pre‑Engineered Buildings & Structural Steel

Phenix handles end‑to‑end PEB solutions: design, engineering, fabrication, and on‑site erection of industrial and infrastructure buildings including complex steel components (bridges, power structures etc.) .

Self‑Supported Steel Roofing

Under Proflex, the company deploys 14 mobile units to manufacture and install self‑supported steel roofing across industrial and infrastructural projects. They command ~75 % market share in this segment FY24 per CRISIL

Turnkey & Consultancy Services

They also provide project management, mechanical/electrical/instrumentation engineering, civil works, quality control, and documentation services—delivered by competent personnel with focus on reliability and scheduling.

Financial Performance Overview (₹ in Crore)

| Financial Year | Revenue | Profit | Total Assets |

| FY 2023 | ₹880.47 | ₹32.89 | ₹558.79 |

| FY 2024 | ₹795.06 | ₹45.63 | ₹633.11 |

| FY 2025 | ₹988.56 | ₹77.05 | ₹849.21 |

Revenue:

- FY 2023 to FY 2024: Revenue declined from ₹880.47 Cr to ₹795.06 Cr (approx. 9.7% drop), possibly due to delayed projects or weaker demand.

- FY 2024 to FY 2025: Revenue jumped to ₹988.56 Cr (approx. 24.4% growth), indicating a strong recovery and higher project execution.

Profit:

- FY 2023: ₹32.89 Cr

- FY 2024: ₹45.63 Cr (↑ ~38.8%)

- FY 2025: ₹77.05 Cr (↑ ~68.9%)

This sharp rise shows improved cost management and better operating margins year-on-year.

Total Assets:

- FY 2023: ₹558.79 Cr

- FY 2024: ₹633.11 Cr (↑ ~13.3%)

- FY 2025: ₹849.21 Cr (↑ ~34%)

This indicates the company is expanding and investing in infrastructure or assets to support future growth.

✅ Pros (Advantages)

- Market Leadership – M&B Engineering is the largest player in India’s self-supported steel roofing segment, holding about 75% market share.

- Strong Profit Growth – The company’s net profit rose to ₹77.05 crore in FY25, a ~69% increase from the previous year.

- Reputed Client Base – Long-standing relationships with top clients like Adani, Tata, and Intas, with a high rate of repeat orders.

- End-to-End Services – The company offers complete in-house solutions, from design and engineering to installation, ensuring better control over quality and timelines.

- Strong Financials – Healthy return ratios such as ROE (~25%) and ROCE (~24.8%) show efficient management and good return on capital.

- Rising Total Assets – The company’s assets have grown steadily from FY23 to FY25, indicating expansion and long-term growth.

- Government Infra Push – National infrastructure programs (like Gati Shakti, logistics parks) support higher demand for steel structures.

- On-Site Mobile Units – Their mobile units enable fast and cost-effective roofing installations directly at the project site.

⚠️ Cons (Risks)

- Decline in Revenue (FY24) – Revenue fell from ₹880 crore in FY23 to ₹795 crore in FY24, despite industry growth.

- Under-utilization of Cheyyar Plant – One of their main facilities is not being used at full capacity, which may impact profitability.

- Client Concentration Risk – A significant share of revenue comes from a few major clients, which could be risky if any reduce orders.

- Execution Risk – Reliance on third-party contractors for on-site work may lead to delays or quality issues.

- Unregistered Trademarks – Some of the company’s trademarks are not officially registered, posing brand and legal risks.

- High Competition – Competes with strong players like Pennar, Everest, and Interarch in the pre-engineered building and roofing space.

- Sector Dependency – Business performance is tied to the construction and infrastructure sectors, which are cyclical.

- Valuation Concerns – Some investors may find the IPO price a bit high compared to recent profit levels.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.