Patel Chem Specialities IPO Overview

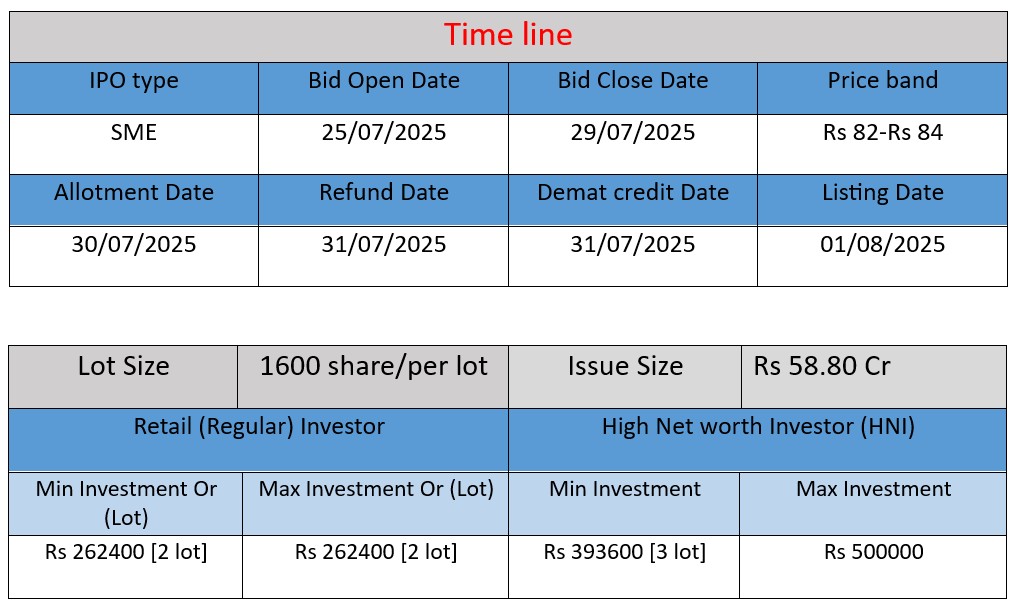

Patel Chem Specialities Limited is launching a ₹58.80 crore SME IPO (fresh issue of 70 lakh equity shares @ ₹82–84/share) on 25 July 2025, closing on 29 July 2025. Proceeds will fund a new manufacturing plant at Indrad, Mehsana for CCS, SSG, and Calcium CMC, along with general corporate purposes. Listing is scheduled on BSE–SME on 1 August 2025.

Patel Chem Specialities IPO Subscription Status

| Category | Subscription (x) |

| QIBs | 93.81 |

| NIIs | 235.68 |

| Retails | 166.53 |

| Total | 106.89 |

| Last Updated: 29 July 2025 Time: 5 PM (Note: This data is updated every 2 hours) Source: NSE/BSE | |

| GMP (₹) | IPO Price (₹) |

| 35 | 84 |

| Last Updated: 29 July 2025 Time: 5 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Date

Core Business & Overview

- Founded in 2008 and headquartered in Ahmedabad, Gujarat, PCSL is an Indian FDA‑approved, ISO 9001:2015, GMP, Halal & Kosher certified manufacturer and exporter of pharmaceutical excipients and specialty chemicals.

- It produces cellulose- and starch-based excipients including Sodium CMC (Rheollose), Croscarmellose Sodium (Disolwell), Sodium Starch Glycolate (BlowTab), Calcium CMC (Swellcal), Microcrystalline Cellulose (Hindcel), Magnesium Stearate (PharLub), Pregelatinized Starch (AmyloTab) and Sodium Monochloroacetate (SMCA).

- Its products serve as binders, disintegrants, thickeners, stabilizers, and gelling agents across pharmaceutical, food & beverage, cosmetics, and industrial applications.

Strengths

a) Quality & Certifications

- Adheres to US‑DMF, FDA, GMP, ISO and other international standards (EP, BP, USP‑NF), ensuring compliance for global markets.

- Equipped with stringent quality control systems and a full-fledged R&D facility for tailored innovation and batch consistency.

b) Manufacturing Capacity & Global Reach

- Operates two manufacturing units in Ahmedabad (Vatva) and Talod (Himmatnagar) spanning ~7,000 sqm with over 7,200 MT annual capacity.

- Supplies to 15+ countries, including major markets such as the USA, Germany, Japan, UK, South Korea, and regions in East Asia, Europe, Middle East, and Southeast Asia.

c) Strategic Expansion Plans

Recently filed an IPO of ₹58.80 cr (fresh issue), aimed at funding a new manufacturing facility in Indrad (Gujarat) to produce CCS, SSG, Calcium CMC, and scaling other operations.

Potential Risks

a) Reliance on Exports & Regulatory Standards

Heavy exposure to global regulatory environments; non-compliance or quality issues could impact export markets. Maintaining certifications across jurisdictions (FDA, EP, BP, USP‑NF) requires ongoing investment and vigilance.

b) Customer Concentration & Market Dependency

Pharma comprises roughly 67% of FY25 revenue, with the top 10 customers accounting for ~30% of sales—concentration risk if major clients reduce orders.

c) Competitive & Commodity Pressures

The specialty chemicals sector is expanding rapidly in India, with rising competition and volatility in raw material costs potentially impacting margins and pricing power.

d) Execution Risk from Expansion

The planned manufacturing facility requires timely execution; delays or budget overruns could strain financials or hurt future growth expectations.

Financial Performance Table

| Financial Year | Revenue | Profit After Tax (PAT) | Total Assets |

| FY 2023 | ₹69.40 | ₹2.89 | ₹37.08 |

| FY 2024 | ₹82.36 | ₹7.66 | ₹46.96 |

| FY 2025 | ₹105.09 | ₹10.56 | ₹65.31 |

Revenue :

- Revenue increased from ₹69.4 crore in FY2023 to ₹105.09 crore in FY2025.

- This is a growth of ~51% over two years, reflecting strong business expansion and demand across domestic and international markets.

Profit :

- Profit after tax grew from ₹2.89 crore in FY2023 to ₹10.56 crore in FY2025.

- That’s a remarkable 266% growth, indicating operational efficiency and improved profit margins.

Total Assets :

- Total assets rose from ₹37.08 crore to ₹65.31 crore.

- A 76% increase, showing the company is actively investing in infrastructure, manufacturing capacity, and long-term assets to support its growth plans.

| ✅ Pros of Patel Chem Specialities IPO |

| The company has shown strong growth in revenue and profit. Products are exported to over 15 countries globally. It has a diversified product portfolio in pharma and chemicals. Holds international certifications like ISO, GMP, Halal, and Kosher. Low debt and strong return ratios (ROE and ROCE). IPO funds will be used for expansion of a new manufacturing plant. |

| ⚠️ Cons of Patel Chem Specialities IPO |

| High dependency on a few major customers. Vulnerable to raw material price fluctuations. Heavy reliance on the pharma industry for revenue. Listing on the SME platform may limit liquidity. Risk of delays or cost overruns in new plant construction. |

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.