Brigade Hotel IPO Overview

Brigade Hotel Ventures Ltd IPO opens July 24 and closes July 28, 2025, via a fresh issue of ₹759.6 Cr at ₹85–90/share. Entire proceeds will fund repayment of debt, purchase of land from parent Brigade Enterprises, and future acquisitions/general corporate needs. With no Offer‑for‑Sale, the issue is fully scalable, aiming for listing around July 31 on BSE/NSE.

Brigade Hotel IPO Subscription Status

| Subscription Rate Source: NSE/BSE | |||

| Category | Shares Offered | Shares Bid For | Subscription (x) |

| QIBs | 2,54,68,941 | 13,81,49,848 | 5.42 |

| NIIs | 1,27,34,470 | 2,43,91,708 | 1.92 |

| Retails | 84,89,647 | 5,43,65,498 | 6.40 |

| Employees | 9,26,341 | 8,68,346 | 0.94 |

| Shareholders | 35,74,588 | 1,17,39,188 | 3.28 |

| Total | 5,11,93,987 | 22,95,14,588 | 4.48 |

| Last Updated: 29 July 2025 Time: 5 PM (Note: This data is updated every 2 hours) Get instant updates on WhatsApp – Join now! | |||

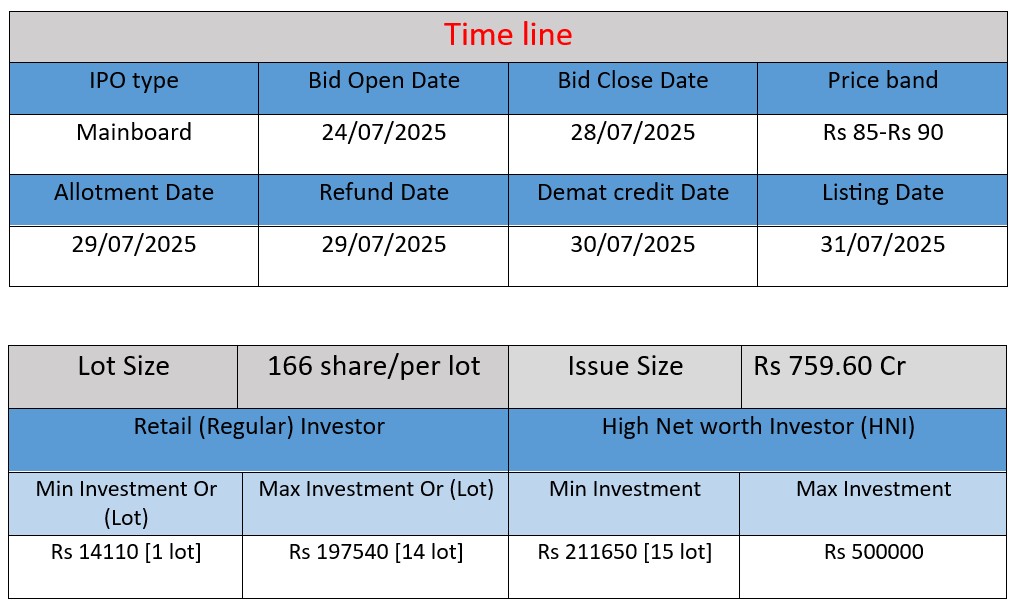

IPO Key Date

Core Business & Overview

- Asset‐owner & developer of branded hotels: BHVL follows an “own‑and‑outsource” model—developing and owning hotel assets while leaving operations to global hospitality brands such as Marriott, Accor, and IHG.

- Strategic presence in South India: Operates nine hotels (1,604 keys) across Bengaluru, Chennai, Kochi, Mysuru, and GIFT City.

- Balanced consumer mix: Targets both MICE/corporate travelers and leisure guests—leveraging clubhouses, banquet spaces, spa/gyms, rooftop bars, etc.—to enrich revenue sources.

Strengths

- Strong parentage – Brigade Group: A wholly owned subsidiary of Brigade Enterprises Ltd (BEL), a leading South Indian real estate developer, giving BHVL access to land, capital, and brand credibility.

- Operational efficiency & profitability: FY 2024 EBITDA margins were ~35%, with RevPAR/occupancy healthy and improving—Q1 FY25 ARR up 3–4% YoY, occupancy ~74%.

- Global operator tie‑ups: Long‑term contracts with internationally branded operators (Marriott, Accor, IHG) support service standards and yield premium positioning.

- Geographically diversified, asset-backed expansion: Pipeline includes five upcoming projects (e.g., Grand Hyatt, InterContinental), planned via IPO proceeds—aiming to scale quickly without diluting asset ownership.

Potential Risks

- High leverage & execution risk: Total debt/EBITDA stood around 5× as of FY2024–25. Ongoing expansion (1,000+ keys) is largely debt-financed and vulnerable to delays.

- Industry cyclicality: Exposure to macroeconomic shifts, discretionary spending, external disruptions (e.g., pandemics, geopolitical events), and seasonal patterns in non-metro markets.

- Operator dependency & concentration: Significant reliance on third-party operators—e.g., two Marriott hotels accounted for ~44% of revenue in FY 2025. Contract lapses or non-renewals could materially impact revenue.

Brigade Hotel Ventures stands out as a strong asset-backed hospitality platform under the Brigade Group umbrella. With a portfolio of strategically-located hotels and partnerships with globally recognized brands, BHVL has shown strong operational performance, with solid margins and growth in demand. However, the company’s ambitious expansion plans—funded largely by debt—and its susceptibility to macroeconomic fluctuations and operator dependence present tangible risks.

Brigade Hotel Ventures Ltd – Financial Overview

| Financial Year | Revenue (₹ Cr) | Profit (₹ Cr) | Total Assets (₹ Cr) |

| FY 2022 | 146.48 | -82.72 | 869.09 |

| FY 2023 | 350.22 | -3.09 | 840.67 |

| FY 2024 | 401.70 | 31.14 | 886.78 |

Revenue

- FY 2022: ₹146.48 Cr – COVID impact still visible; travel & hospitality were under recovery.

- FY 2023: ₹350.22 Cr – Strong rebound (139% growth); industry recovery and rising occupancy helped.

- FY 2024: ₹401.70 Cr – Continued growth (15% YoY), driven by higher Average Room Rates (ARRs) and consistent demand.

Profit

- FY 2022: Loss of ₹82.72 Cr – Heavy fixed costs and low revenue due to pandemic pressure.

- FY 2023: Narrowed loss to ₹3.09 Cr – Near breakeven due to better operating efficiency.

- FY 2024: Profit of ₹31.14 Cr – First full year of profitability; reflects operating leverage and turnaround.

Total Assets

- FY 2022: ₹869.09 Cr – Assets include hotel properties and ongoing projects.

- FY 2023: ₹840.67 Cr – Slight dip, possibly due to depreciation or debt adjustment.

- FY 2024: ₹886.78 Cr – Capital investments and project additions increased asset base.

Outcome:

Brigade Hotel Ventures Ltd has shown a strong financial turnaround—from a ₹82.72 Cr loss in FY22 to a ₹31.14 Cr profit in FY24—reflecting the revival of the hospitality sector and improved operational efficiency. With growing revenue and asset stability, the company is now aiming to expand further through its ₹759.6 Cr IPO. The proceeds will help reduce debt and fund new hotel projects, positioning the company for long-term sustainable growth in India’s premium hospitality market.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.