TSC India IPO Overview

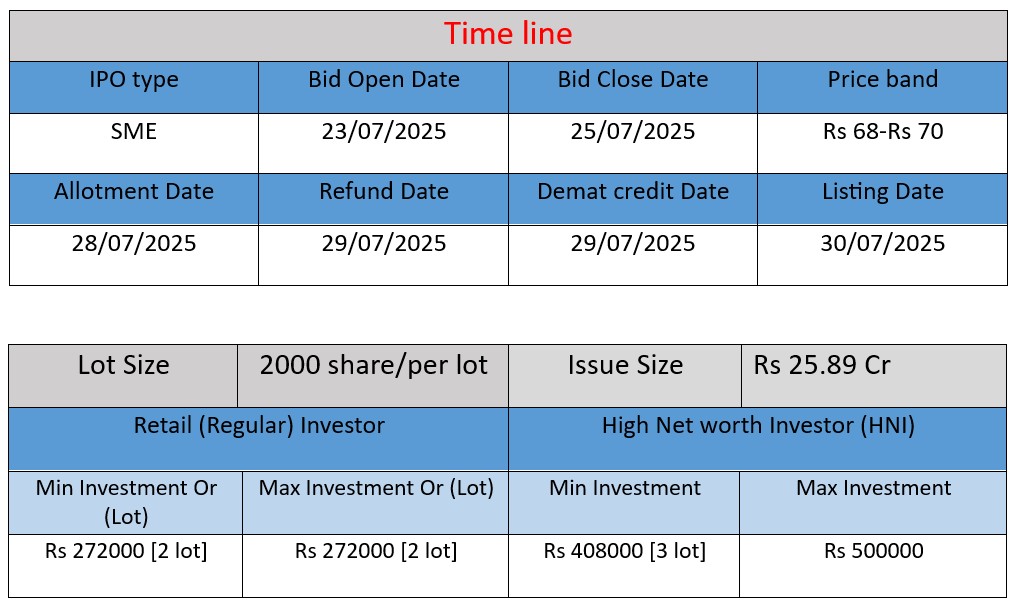

TSC India Ltd IPO opens on July 23, 2025 and closes on July 25, 2025, offering 36.98 lakh equity shares in a 100% fresh, book‑built public issue totaling ₹25.89 crore. Priced at ₹68–70 per share (face value ₹10), it’s listed on NSE‑SME. The issue aims to support working capital requirements, general corporate purposes, and IPO expenses. Listing is expected on July 30, 2025.

TSC India IPO Subscription Status

| Category | Subscription (x) |

| QIBs | 26.15x |

| NIIs | 89.98x |

| Retails | 40.91x |

| Total | 43.87x |

| Last Updated: 25 July 2025 Time: 5 PM (Note: This data is updated every 2 hours) Get instant updates on WhatsApp – Join now! | |

IPO Key Date

Core Business & Overview

- Travel management services

Incorporated in 2003, originally as TSC Travel Services Private Limited, TSC India operates as a B2B and corporate travel management company. Its primary service is air-ticketing—across both domestic and international routes—coupled with itinerary planning, consulting, and negotiation services for business clients. - Operational footprint & volume

The company has offices (including virtual ones) in key Indian cities: Jalandhar, Chandigarh, Lucknow, Ahmedabad, Jaipur, New Delhi, and Pune. Over FY 2023–25, it grew ticket volumes from about 70k to over 160k per year. - Supporting platforms

TSC provides real-time flight updates, automated accounting, sub-agent management tools, 24×7 support, and guaranteed booking confirmations via Global Distribution System (GDS) integration.

Strengths

- Automated accounting & real‑time updates

Its platform automates invoicing and payment tracking, ensuring timely information—an advantage for corporate clients. - Comprehensive end‑to‑end booking support

From enquiry to confirmation, the company supports clients through dedicated teams and integrated tools. - Instant booking with guaranteed confirmation

Reduces the risk of reservation loss and enhances client reliability. - Diverse inventory through GDS integration

Access to flights, hotels, cars, and more via GDS allows competitive pricing and broader service offering.

Potential Risks

- Industry cyclical exposure

Heavy reliance on global and corporate travel makes TSC vulnerable to disruptions like pandemics, geopolitical instability, or economic downturns. - Working‑capital & liquidity pressure

The sharp increase in scale has driven working capital and borrowings; FY25 net operating cash was deeply negative (~₹13.46 cr) - Commission structure dependency

Revenue is tied to airline commissions, bonuses, and GDS rebates—any reduction directly impacts margins. - Payment framework risk

Dependence on timely inflow or outflow; delays could hurt operations or cash flow. - Geographical expansion hazards

Investigating new markets introduces regulatory, infrastructural, and competition challenges.

Outcome

TSC India Limited has steadily carved a niche in B2B travel management, leveraging technology, GDS partnerships, and strong execution to grow from ₹9 cr to ₹26 cr in revenue over two years. Its platform strengths—automation, real-time updates, and comprehensive booking—cater well to corporate clients seeking reliability and efficiency.

However, the business remains vulnerable to macro travel trends, working capital dynamics, and airline commission policies. These factors need close monitoring as the company scales.

Overall, TSC India’s momentum is impressive, supported by robust technology and financials. Sustaining growth will require prudent financial management, diversification strategies, and adaptability to the cyclical nature of travel.

Financial Performance Analysis (in ₹ Crore)

| Financial Year | Revenue | Profit (PAT) | Total Assets |

| FY 2023 | ₹4.51 | ₹0.29 | ₹14.55 |

| FY 2024 | ₹9.30 | ₹1.19 | ₹26.16 |

| FY 2025 | ₹19.35 | ₹4.69 | ₹54.03 |

Revenue

- FY 2023: ₹4.51 crore

- FY 2024: ₹9.30 crore (↑ 106%)

- FY 2025: ₹19.35 crore (↑ 108%)

Analysis:

TSC India has demonstrated consistent and exponential revenue growth, more than doubling its income year-over-year. This reflects strong expansion in its B2B travel operations and increasing customer base.

Profit (PAT)

- FY 2023: ₹0.29 crore

- FY 2024: ₹1.19 crore (↑ 310%)

- FY 2025: ₹4.69 crore (↑ 294%)

Analysis:

Net profit surged sharply in both FY24 and FY25, indicating improved operational efficiency and margin expansion. The company has scaled profit faster than revenue, showcasing effective cost management.

Total Assets

- FY 2023: ₹14.55 crore

- FY 2024: ₹26.16 crore (↑ 80%)

- FY 2025: ₹54.03 crore (↑ 106%)

Analysis:

Total assets have steadily grown, doubling from FY24 to FY25. This suggests increased investment in infrastructure, systems, and working capital, possibly due to rising operational scale and customer demand.

Summary

TSC India Ltd has displayed robust financial growth across all key metrics—Revenue, Profit, and Assets—over three consecutive years. This trend points to a strong business model, successful market positioning in the B2B travel segment, and a well-managed expansion strategy. If the company sustains this momentum and controls debt and working capital efficiently, it holds strong future potential.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.