हिंदी में पढ़ने के लिए मेनू बार से हिंदी भाषा चयन करें।

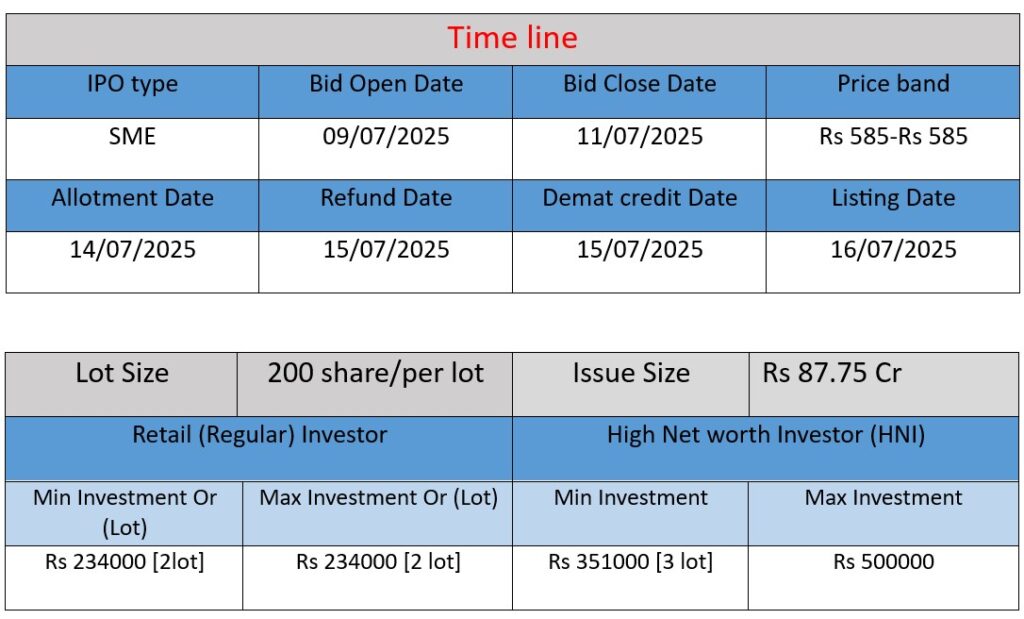

CFF Fluid Control’s Rs 87.75 Cr fixed‑price FPO (15 lakh shares at ₹585 each) opens on July 9, 2025 and closes July 11, 2025. Proceeds will primarily (₹72.6 Cr) fund working capital and ₹8.33 Cr is earmarked for general corporate purposes. The follow‑on offer aims to support the company’s defence‑focused expansion, including its new Chakan facility and strengthened submarine systems manufacturing.

Core Business & Overview

- What they do

Incorporated in 2012 and headquartered in Mumbai (with a major manufacturing site in Khopoli, Maharashtra), CFF designs, manufactures, overhauls, repairs, and maintains shipboard machinery, combat systems, pneumatic & hydraulic systems, test facilities, and critical component systems for Indian Navy submarines and surface ships. - Sector focus

Primarily serves India’s defence sector (notably submarine equipment for the Scorpene programme) along with the energy sector, including nuclear and clean-energy systems. - In-house capabilities

Boasts end-to-end capabilities: design, precision fabrication (including exotic materials like titanium and Inconel), rapid prototyping, testing, integration, and lifecycle support. - Strategic partnerships

Collaborates via TOT agreements with European OEMs—such as Coyard SAS (France), Naval Group, Atlas Elektronik—particularly for submarine systems and sonar technologies under India’s “Make in India” vision.

Strengths

- High-barrier defence niche

Sits in a specialized, high-entry-barrier domain with few equivalents in domestic submarine-grade engineering. - Long-standing client relationships

Trusted by Indian defence PSU yards like Mazagon Dock, Naval Dockyards (Mumbai, Vizag, Karwar), and upcoming registrations with others—reflecting deep client confidence. - Order book & financial traction

Indian new-analysis highlights a strong ₹514 Cr order book (90% from defence PSU yards). Fiscal 2025 revenues rose ~36% to ₹145–146 Cr, PAT up ~39–40% to ₹23–24 Cr, EBITDA ~40 Cr at ~28% margin . - Promoters & technical excellence

Experienced leadership with access to advanced defence technology and manufacturing certifications; authorized equipment manufacturer for Scorpene subs, and engaged in sonar developments.

Risks

- Revenue dependency

Over 90% of revenues stem from contracts with Indian defence PSU shipyards; any decline in their budgets or orders could significantly impact revenue. - Geographic concentration

Manufacturing is currently centralized in Khopoli (and upcoming Chakan), leaving operations exposed to regional disruptions. - Regulatory & licensing vulnerabilities

Reliance on continued certification and regulatory approvals across defence platforms; any delays may hamper execution. - Promoter-related conflicts

Promoter group engages in similar business lines, possibly leading to conflicts of interest. - Legal proceedings

The company, its group, and directors are party to certain legal proceedings which might adversely affect financials or operations if outcomes are negative.

CFF Fluid Control emerges as a niche defence-focused engineering firm with strong design-to-deployment prowess, strategic global tie-ups, robust financial growth, and high barriers to entry—all under the Make‑in‑India umbrella. However, its client concentration, dependence on government defence budgets, regional concentration, and regulatory and legal overhangs pose material risks.

For stakeholders and investors, this presents a classic high-reward, high-risk scenario: if India’s naval capital expenditure and programmes sustain or grow, the company stands to significantly benefit; conversely, budget cuts, project delays, or licensing/legal hurdles could impact outcomes.

Financial Performance Analysis (in ₹ Crore)

| Financial Year | Revenue | Profit (PAT) | Total Assets |

| FY 2023 | ₹70.67 Cr | ₹10.14 Cr | ₹88.68 Cr |

| FY 2024 | ₹106.86 Cr | ₹17.09 Cr | ₹161.16 Cr |

| FY 2025 | ₹145.56 Cr | ₹23.85 Cr | ₹199.03 Cr |

Revenue

- FY-2023 to FY-2024: Grew from ₹70.67 Cr to ₹106.86 Cr → Growth: ₹36.19 Cr (≈ 51.2%)

- FY-2024 to FY-2025: Increased to ₹145.56 Cr → Growth: ₹38.7 Cr (≈ 36.2%)

Analysis: Strong and consistent revenue growth indicates rising demand for their defence-related systems and possibly new order wins or execution from key defence projects.

Profit

- FY-2023 to FY-2024: Rose from ₹10.14 Cr to ₹17.09 Cr → Growth: ₹6.95 Cr (≈ 68.5%)

- FY-2024 to FY-2025: Jumped to ₹23.85 Cr → Growth: ₹6.76 Cr (≈ 39.5%)

Analysis: Profit has grown faster than revenue in both years, implying improving margins and cost efficiency. Likely supported by better utilization of manufacturing capabilities and high-margin defence contracts.

Total Assets

- FY-2023 to FY-2024: Increased from ₹88.68 Cr to ₹161.16 Cr → Growth: ₹72.48 Cr (≈ 81.7%)

- FY-2024 to FY-2025: Grew to ₹199.03 Cr → Growth: ₹37.87 Cr (≈ 23.5%)

Analysis: Significant asset buildup in FY-2024 suggests expansion (likely tied to Chakan facility or procurement of new machinery for defence contracts). Slower growth in FY-2025 indicates stabilization post-investment.

Summary

- Consistent growth in all key financial metrics demonstrates strong execution and rising demand in the defence sector.

- Profitability is increasing faster than revenue, pointing to operational efficiency and possible pricing power.

- Asset expansion reflects future-ready capacity building, aligned with upcoming large-scale defence projects.

How Can I Apply for an IPO?

1. Open a Demat Account

To apply for an IPO, having a Demat account is mandatory. You can open one through trading platforms like Zerodha, Groww, Angel One, or Upstox. For example, if you download the Groww app and complete your KYC, your Demat account usually gets activated within 24–48 hours.

2. Ensure You Have a UPI ID or Net Banking Access

While applying, you need either a valid UPI ID (like from Google Pay or PhonePe) or access to Net Banking with ASBA support from your bank. For instance, if you have an account in SBI, you can log in to your Net Banking portal and apply IPO through the IPO section.

3. Apply via App or Bank Portal

There are two ways to apply:

(1) Through trading apps like Zerodha or Groww – go to the IPO section, select Company enter the lot size and your UPI ID, then approve the request in your UPI app.

(2) Through your bank’s Net Banking – go to the ASBA or IPO section, select company, fill in the required details, and submit.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.