हिंदी में पढ़ने के लिए मेनू बार से हिंदी भाषा चयन करें।

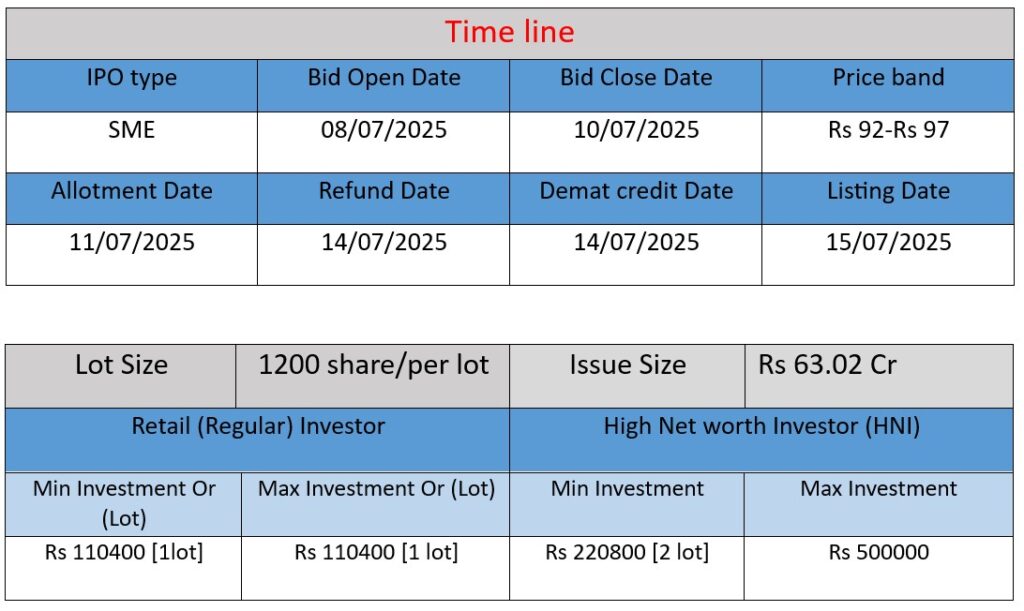

Glen Industries Ltd’s SME IPO (₹63.02 Cr fresh issue) opens July 8, 2025 and closes July 10, 2025. Price band is ₹92–97/share for 1,200‑share lots (min investment ~₹1.16 L). Proceeds (₹47.73 Cr) will fund a new manufacturing facility in Purba Bardhaman, West Bengal; remaining for corporate purposes and IPO costs. Shares to list on BSE SME (~July 15, 2025).

Company Overview & Core Business

- Established history & evolution

Founded in 2007 (originally Glen Stationery Pvt Ltd), diversified into thin‑wall food containers in 2011, and launched Glen Industries Ltd in 2019 for eco-friendly straws manufacturing.

- Primary operations

Manufactures thin‑wall food containers and compostable straws—both PLA and paper-based—targeting HoReCa (hotels, restaurants, catering), beverages, QSRs, and dairy sectors.

- Facilities & capacity

Operates a 90,000 sq ft plant in Dhulagarh, West Bengal, with advanced, automated, zero-human-contact machinery. Capacity stands at 665 MT/month for containers, 160 MT PLA straws, 95 MT paper straws; addedU‑shaped straw lines in 2022.

Strengths

- Experienced leadership & dedicated team

Promoters include Lalit and Nikhil Agrawal and Niyati Seksaria, with over a decade of experience in food-packaging and eco-products.

- Robust manufacturing & quality systems

Microprocessor-controlled machinery, high hygiene standards, certifications (ISO 9001, FSSC 22000, HACCP), and capacity for customization (digital printing, shrink-sleeving).

- Diverse market focus & export footprint

Serving 25+ global clients; exports to Europe, USA, Australia, Middle East, and Africa, catering to regional preferences.

- Eco-conscious product portfolio

Early adoption of PLA and paper straws; diversified with U-shaped variants since 2022, aligning with sustainability trends.

Risks & Challenges

- Raw-material & supply vulnerabilities

Heavily reliant on external suppliers; exposed to fluctuations in raw material prices and logistics reliability.

- High leverage

Borrowings at ₹132.8 Cr vs net worth of ₹40.2 Cr (D/E ≈2.3×), increasing financial risk.

- Intra-group competition & governance concerns

A sister unit (Ostern Pvt Ltd) operates in similar space without a formal non-compete, raising channel conflict and preferential-treatment risks.

- Execution & environmental compliance

Expansion delays or cost overruns could hurt performance; subject to stringent environmental, quality, and labor regulations .

- Export-related uncertainties

Overseas revenue exposure could lead to currency and trade-policy risks .

Glen Industries Ltd is a compelling case in India’s sustainable packaging sector. Backed by a capable management team, modern capacity, and strong financial momentum, the company is well-positioned to ride global eco-packaging trends. It’s particularly attractive for its consistent revenue growth, profitability, and export diversity.

However, investors and stakeholders should monitor key risks: raw‑material price volatility, high leverage, governance issues related to intra-group competition, and execution compliance. If the company manages these effectively, it could emerge as a resilient player in a growing, eco-conscious packaging market.

Glen Industries Ltd – Financial Performance (₹ in Crores)

| Financial Year | Revenue | Profit (PAT) | Total Assets |

| FY2023 | 118.85 | 1.48 | 137.06 |

| FY2024 | 144.50 | 8.58 | 160.31 |

| FY2025 | 170.66 | 18.26 | 214.36 |

Revenue

Glen Industries has shown consistent revenue growth over the last 3 years. Revenue increased by 21.6% YoY in FY24 and by 18.1% YoY in FY25, reflecting strong demand, expanded production capacity, and a broader customer base including exports.

Profit (PAT)

Profit has grown over 11x in 2 years, indicating improved operational efficiency and cost management. Net profit margins improved significantly, showing that the company’s core business has become more profitable with scale.

Total Assets

Asset base expansion by ~56% in two years shows heavy investments in infrastructure and manufacturing facilities. It signals future capacity buildup but also needs careful monitoring of return on assets.

Summary

- Glen Industries is experiencing strong financial momentum with double-digit growth in revenue and exceptional growth in profitability.

- Asset expansion aligns with their IPO objectives of scaling operations.

- The company has moved from a low-margin to a high-margin player, which is a positive signal for long-term sustainability.

How Can I Apply for an IPO?

1. Open a Demat Account

To apply for an IPO, having a Demat account is mandatory. You can open one through trading platforms like Zerodha, Groww, Angel One, or Upstox. For example, if you download the Groww app and complete your KYC, your Demat account usually gets activated within 24–48 hours.

2. Ensure You Have a UPI ID or Net Banking Access

While applying, you need either a valid UPI ID (like from Google Pay or PhonePe) or access to Net Banking with ASBA support from your bank. For instance, if you have an account in SBI, you can log in to your Net Banking portal and apply IPO through the IPO section.

3. Apply via App or Bank Portal

There are two ways to apply:

(1) Through trading apps like Zerodha or Groww – go to the IPO section, select Company enter the lot size and your UPI ID, then approve the request in your UPI app.

(2) Through your bank’s Net Banking – go to the ASBA or IPO section, select company, fill in the required details, and submit.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.