हिंदी में पढ़ने के लिए मेनू बार से हिंदी भाषा चयन करें।

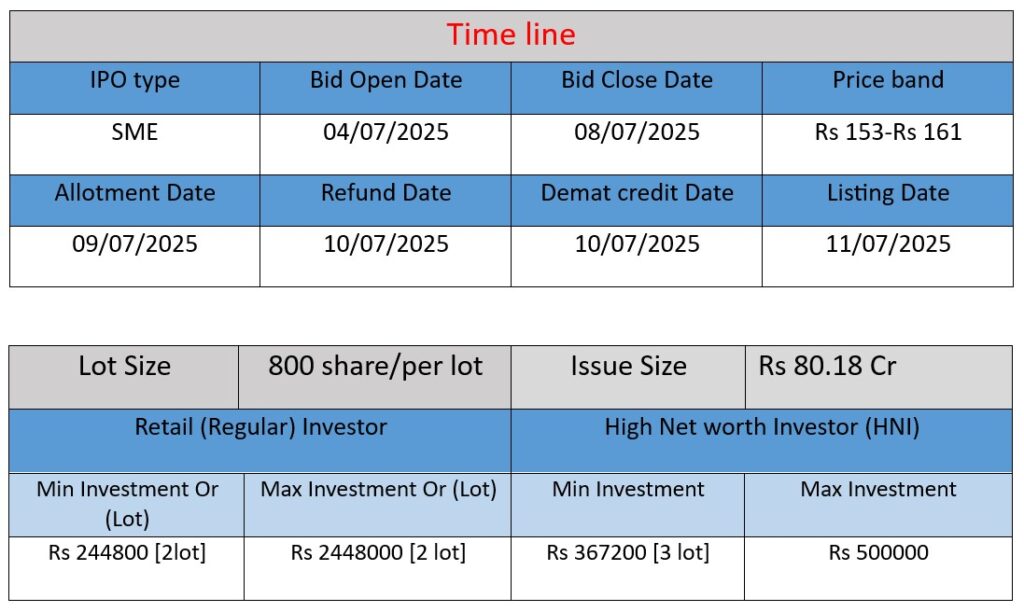

Meta Infotech Limited IPO opens on July 4, 2025, and closes on July 8, 2025, with a total issue size of ₹80.18 crore. The IPO is a fresh issue aimed at funding capital expenditure, establishing an experience center, repaying borrowings, and meeting general corporate purposes.

Company Profile & Core Work

- Founded in 1998 in Mumbai, Meta Infotech pivoted to cybersecurity around 2010.

- Offers end-to-end enterprise cybersecurity solutions, including SASE, endpoint detection & response, cloud, email, network, application, and database security.

- Operations span consulting, implementation, managed services, AMC, training, and they serve sectors like banking, insurance, IT/ITES, manufacturing, pharmaceuticals, etc..

- Presence in Mumbai, Hyderabad, with ~260–300 employees.

Strengths

- Deep specialization in enterprise cybersecurity – client-focused solutions and high retention rates, claiming 100% in some areas

- Trusted brand with long-term presence (25+ years) and marquee clients like ICICI Lombard, Mahindra Finance, Tech Mahindra .

- Comprehensive delivery framework, from consulting to training, plus 24/7 support and a “money-back guarantee” on support services .

Risks

- Competitive cybersecurity market: Faces large global vendors (Palo Alto, CrowdStrike, Check Point) and other specialist firms .

- Execution risk in IPO fund usage—planning capex, experience centre, debt repayment. Overshoots could impact ROI.

- Dependence on key clients and sectors; client churn or slowdown in industries like banking/insurance could heavily affect business.

- Evolving threat landscape brings technical risks; must continuously upgrade tools, talent, and partnerships to stay relevant.

Conclusion

Meta Infotech is a focused and mature cybersecurity firm with strong credentials—demonstrated by its long client relationships, comprehensive services, and solid financial performance. The IPO support and low debt position it well for measured growth. However, it operates in a highly competitive and fast-changing field, and its post-IPO success largely depends on disciplined capital deployment and ongoing technical innovation.