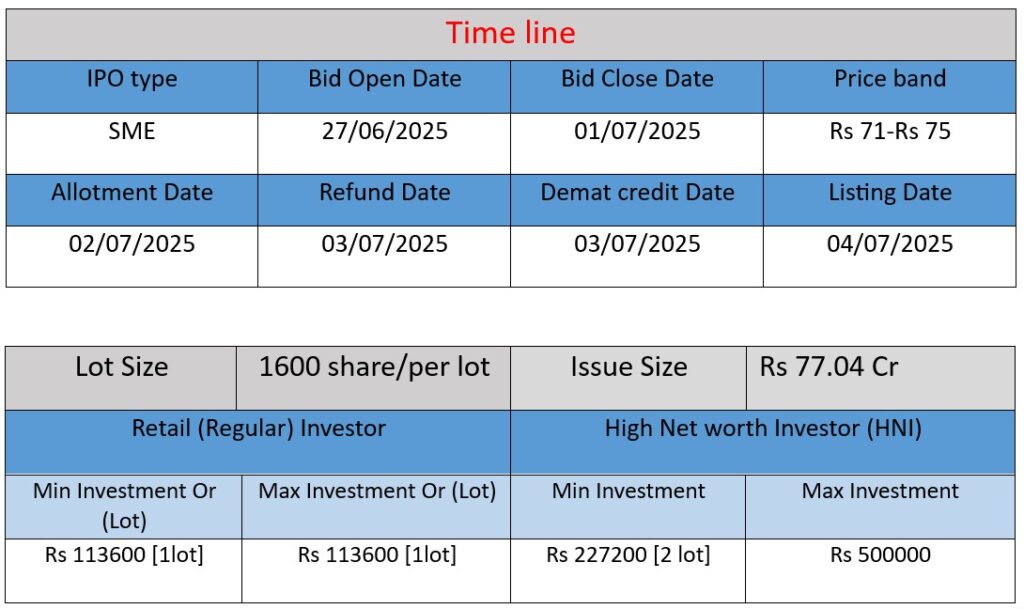

Neetu Yoshi’s ₹77 Cr IPO (1.02 Cr shares at ₹71–75) opened June 27, 2025, targeting listing on BSE SME around July 4. Proceeds will fund a second manufacturing facility (~₹50.78 Cr) and corporate needs.

Company Core Work

- Metallurgical engineering: Specializes in manufacturing customized ferrous metallurgical components—including brake beams, coupling parts, axle boxes, suspension castings—ranging from 0.2 kg to 500 kg.

- Railways specialization: An RDSO‑certified, Class‑A vendor supplying over 25 critical safety spares to Indian Railways, handling braking, propulsion, structural support, couplers, etc..

- Integrated facility: Owns a ~7,173 m² foundry/CNC machining facility in Uttarakhand with ~8,087 MTPA capacity, equipped for melting, machining, heat-treatment, and in‑house testing.

Strengths

- Specialized certifications & quality controls

- RDSO-approved and ISO‑9001, 14001, 45001 certified.

- Strategic location & infrastructure

- Facilities in Uttarakhand offer cost advantages (electricity, raw material access) and integrated manufacturing.

- Rapid financial growth

- FY 2023–24 revenue of ₹47.45 Cr with PAT ₹12.58 Cr (~26.5% PAT margin) and robust nine-month FY 2024–25 figures.

- Niche market and client base

- Strong foothold in the railway spares segment—a critical, regulated niche with consistent government demand.

Risks

- Single-location dependency

- Entire operations centered in one Uttarakhand facility—exposing the firm to disruption risks.

- Raw material procurement vulnerability

- Reliance on suppliers without long‑term contracts adds cost and supply instability.

- Government-policy risk

- Business hinges on railway modernization and policy; any budgetary or policy delays could impact performance.

- IP & operational risks

- Pending trademark registrations and leased office dependency pose legal/certification risks.

- Working capital & cash flow pressure

- Historical negative cash flows could strain future capex and growth.

Conclusion

Neetu Yoshi Limited has rapidly scaled since 2020 into a quality-focused, niche railway components manufacturer supported by strong certifications, integrated infrastructure, and impressive profitability. The current IPO aims to fuel capacity expansion and deepen its market position. However, the company’s dependence on a single location and supplier chain, along with railway‑sector policy exposure, warrant caution. Prospective investors should balance its financial momentum and clear growth strategies against operational and policy vulnerabilities.

Here is a brief financial performance analysis across FY2022 to FY2024:

Revenue

- FY2022: ₹4.59 Cr

- FY2023: ₹16.23 Cr

- FY2024: ₹47.33 Cr

Analysis:

Revenue has shown exponential growth over three years — nearly 10x increase from FY22 to FY24. This suggests rapid scale-up in operations and strong demand, likely due to increased orders from Indian Railways and improved production capacity.

Profit

- FY2022: ₹0.07 Cr

- FY2023: ₹0.42 Cr

- FY2024: ₹12.58 Cr

Analysis:

Profit surged dramatically, especially in FY24, showing efficient cost control and better utilization of capacity. The Profit Margin jumped from ~0.4% in FY22 to over 26.5% in FY24, reflecting operational efficiency and high-margin product demand.

Total Assets

- FY2022: ₹3.08 Cr

- FY2023: ₹14.63 Cr

- FY2024: ₹38.49 Cr

Analysis:

Assets increased over 12x in two years. This is consistent with capital investments in their foundry and CNC facility, indicating infrastructure buildup to support high growth.

📌 Summary

- Neetu Yoshi Limited is experiencing hyper growth across all metrics: revenue, profit, and assets.

- FY2024 marks a turning point with sharp profitability and high asset base, signaling readiness for further scale.

- Strong financial momentum supports their IPO plans and future expansion into a second facility.