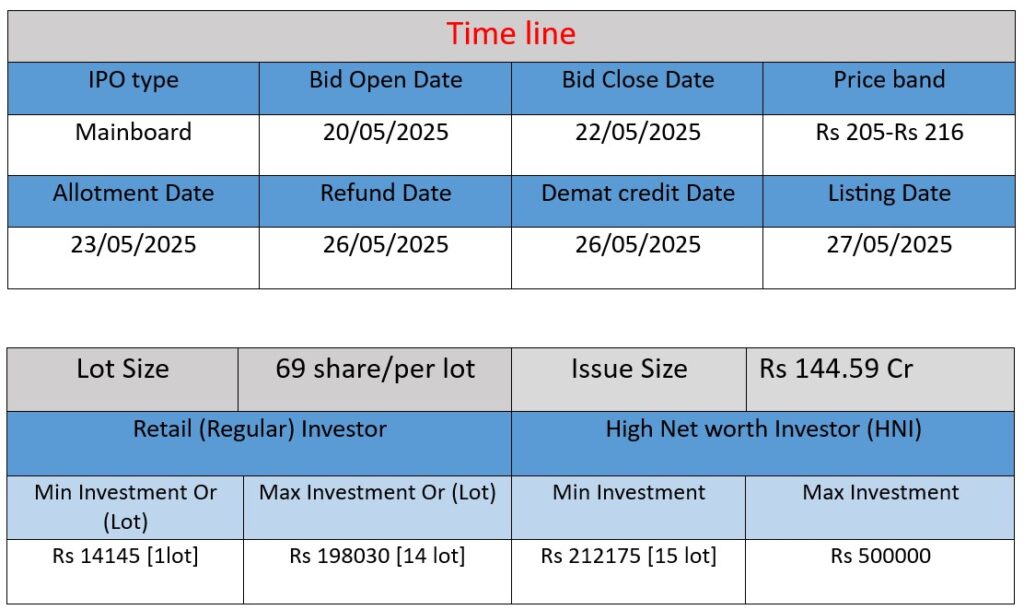

Borana Weaves Limited, a Surat-based textile manufacturer, has launched its ₹144.89 crore IPO on May 20, 2025, comprising a fresh issue of 67.08 lakh equity shares. The proceeds aim to fund a new grey fabric manufacturing unit in Surat (₹71.3 crore), meet incremental working capital needs (₹26.5 crore), and cover general corporate purposes. The IPO closes on May 22, 2025, with shares proposed for listing on BSE and NSE.

Core Business Focus

Borana Weaves Limited, established in 2020 and headquartered in Surat, Gujarat, is a rapidly expanding textile manufacturing company specializing in unbleached synthetic grey fabrics and polyester textured yarns. The company has demonstrated significant growth and innovation since its inception. Below is an analysis of its operations, strengths, and potential risks, based on information from its official website, financial reports, and industry news.

Core Business Activities

Borana Weaves Limited focuses on the production of unbleached synthetic grey fabrics, which serve as foundational materials for various applications, including fashion, home décor, technical textiles, and interior design. The company also manufactures polyester textured yarn (PTY), derived from heating polyester-oriented yarn (POY), which is utilized in their fabric production process.

Manufacturing Infrastructure

The company operates three manufacturing units in Surat, equipped with advanced machinery:

- 700 high-speed water jet looms

- 15 texturizing machines

- 6 warping machines

- 10 folding machines

This infrastructure enables Borana Weaves to produce approximately 220 million metres of fabric annually.

Technological Advancements

Borana Weaves has consistently invested in technological upgrades to enhance production efficiency and product quality. Notably, between 2020 and 2023, the company integrated 700 high-tech water jet looms across its units and introduced advanced sizing, warping, and high-speed texturizing machines. In 2024, they expanded into high-speed air jet weaving for cotton and viscose fabrics.

Strengths: Competitive Advantages

Rapid Growth and Financial Performance

Since its incorporation, Borana Weaves has exhibited robust financial growth:

- Revenue: ₹199 crore in FY24, up from ₹135.4 crore in FY23.

- Net Profit: ₹23.6 crore in FY24, compared to ₹16.3 crore in FY23. The company also reported a 219.94% increase in revenue and a 796.23% rise in profit in FY23.

Vertical Integration

Borana Weaves’ operations encompass the entire production process, from POY to greige fabric, including texturizing, warping, sizing, and weaving. This vertical integration ensures quality control, cost efficiency, and timely delivery.

Customer Retention

The company boasts a high customer retention rate, with 98% of orders being repeat business, indicating strong customer satisfaction and loyalty.

Strategic Location

Situated in Surat, a major textile hub in India, Borana Weaves benefits from a well-established supply chain, skilled workforce, and proximity to key markets.

Risks: Potential Challenges

Financial Liabilities

As of the latest reports, Borana Weaves has active open charges totaling ₹96.90 crore, indicating significant financial liabilities.

Market Concentration

A substantial portion of the company’s customer base is concentrated in Gujarat, which could pose risks if regional demand fluctuates.

Dependence on Imports

Borana Weaves relies on imported raw materials, primarily from China, which may expose the company to supply chain disruptions and currency exchange risks.

Industry Competition

The textile industry is highly competitive, with numerous players vying for market share. Maintaining competitive pricing and innovation is crucial for sustained growth.

In summary, Borana Weaves Limited has rapidly established itself as a significant player in the textile manufacturing sector, leveraging technological advancements and vertical integration to drive growth. However, the company must navigate financial liabilities, market concentration, and industry competition to sustain its upward trajectory.

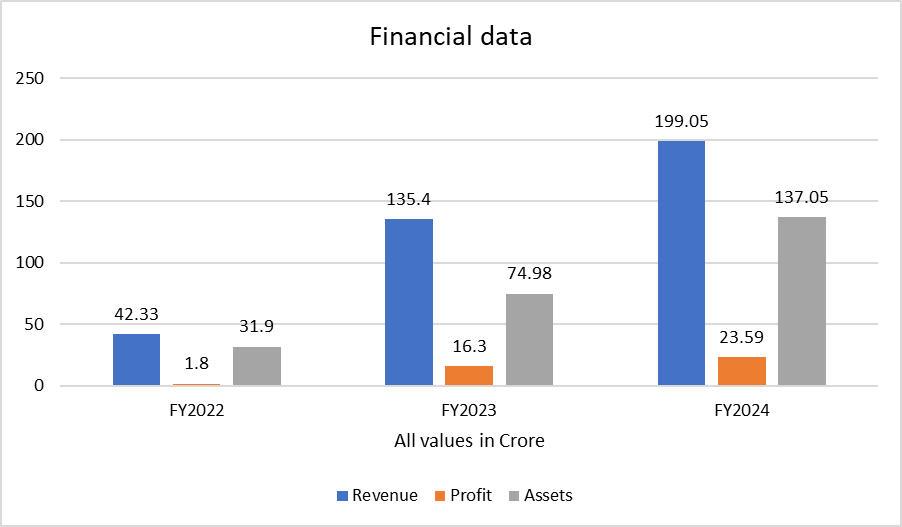

Financial Analysis of Borana Weaves (FY2022-FY2024)

📊 Revenue

- FY2022: ₹42.33 crore

- FY2023: ₹135.40 crore

- FY2024: ₹199.05 crore

Analysis:

Borana Weaves’ revenue has grown nearly 4.7 times in just two years. The jump from ₹42.33 crore in FY22 to ₹199.05 crore in FY24 reflects aggressive expansion and growing market demand.

💰 Profit

- FY2022: ₹1.80 crore

- FY2023: ₹16.30 crore

- FY2024: ₹23.59 crore

Analysis:

Profitability has shown a sharp rise, with more than 13x increase from FY22 to FY24. This indicates improving margins, efficient operations, and better cost management.

🏢 Total Assets

- FY2022: ₹31.90 crore

- FY2023: ₹74.98 crore

- FY2024: ₹137.05 crore

Analysis:

Assets have more than quadrupled over the last three years, suggesting large investments in machinery, infrastructure, and working capital—aligning with their growth strategy.

📌 Summary

- The company is in high-growth mode, with strong top-line and bottom-line performance.

- Asset expansion supports future scalability.

- Growth is consistent and backed by capital investments, making the IPO attractive to investors.