हिंदी में पढ़ने के लिए मेनू बार से हिंदी भाषा चयन करें।

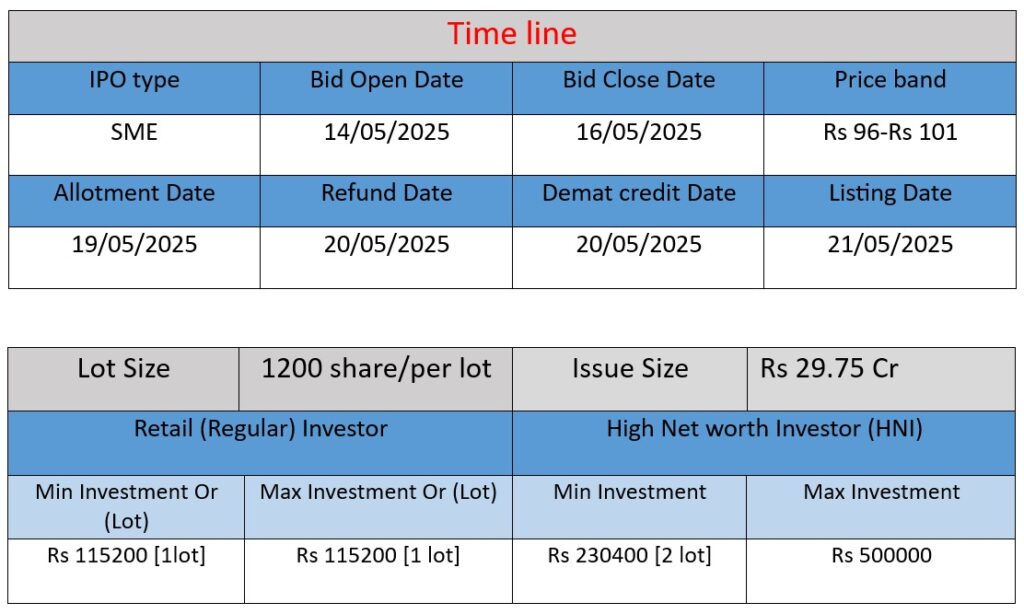

Accretion Pharmaceuticals Ltd IPO opens on May 14 and closes on May 16, 2025, with an issue size of ₹29.75 crore via NSE SME platform. The price band is ₹96–₹101 per share. Proceeds will fund machinery purchase, facility upgradation, debt repayment, working capital, and general purposes. The company manufactures tablets, capsules, liquids, and topical drugs, and exports to 20+ countries. Registrar: KFin; Lead Manager: Jawa Capital.

Core Business Focus

Accretion Pharmaceuticals Limited is an emerging pharmaceutical company based in Ahmedabad, Gujarat, India. It operates across various healthcare segments, including pharmaceuticals, nutraceuticals, and Ayurveda. Below is an analysis of the company’s operations, strengths, and risks, compiled from multiple sources.

Work: Operations and Business Model

Manufacturing Capabilities

Accretion Pharmaceuticals operates a 50,000 sq. ft. manufacturing facility in Ahmedabad, equipped with state-of-the-art machinery and compliant with WHO-cGMP standards. The facility includes separate Air Handling Units (AHUs) for each zone, in-house purified water plants, and fully equipped physiochemical and microbiology laboratories. The company has a production capacity of 650 million tablets, 200 million capsules, 18 million bottles of oral liquid, 9 million tubes of external preparations, and 15 million bottles of oral powder annually.

Services Offered

Accretion provides contract manufacturing, loan licensing, and dossier preparation services. It caters to over 200 clients worldwide, offering products in tablets, capsules, oral liquids, ointments, and powders. The company also supports PCD Pharma operations, providing promotional materials and incentives to business associates.

Global Presence

The company has established a presence in over 20 countries and is actively expanding its global footprint. It focuses on delivering high-quality, affordable, and innovative medicines to meet international standards.

Strengths

Experienced Leadership

The company’s leadership team comprises professionals with extensive experience in the pharmaceutical industry. Promoters like Mr. Vivek Patel, Mr. Harshad Rathod, Mr. Hardik Prajapati, and Mr. Mayur Sojitra bring diverse expertise in production, marketing, finance, and international business.

Quality Certifications

Accretion’s manufacturing facility is accredited with ISO 9001:2015, ISO 22000:2005, and ISO 14001:2015 certifications, reflecting its commitment to quality management, food safety, and environmental management systems.

Positive Work Culture

Employee reviews on AmbitionBox rate the company 5.0 out of 5, highlighting a positive work environment, job security, and opportunities for skill development. Employees appreciate the company’s supportive culture and work-life balance.

Risks

Modest Scale of Operations

As per a CRISIL rating report, the company had a revenue of ₹19.84 crore in fiscal 2017, indicating a modest scale of operations. This limited scale may expose the company to intense competition from larger pharmaceutical players, potentially affecting its pricing power and profitability.

Working Capital Intensity

The company’s operations are working capital intensive, with a Gross Current Asset (GCA) of 120 days as of March 31, 2017. High inventory and debtor days can strain liquidity and affect operational efficiency.

Regulatory Compliance

Operating in multiple countries requires adherence to various regulatory standards. Ensuring compliance across different jurisdictions can be complex and resource-intensive, posing a risk if not managed effectively.

In summary :- Accretion Pharmaceuticals Limited is a growing pharmaceutical company with a strong foundation in manufacturing and a commitment to quality. While it benefits from experienced leadership and a positive work culture, challenges related to its scale of operations and working capital requirements need to be addressed to sustain and enhance its growth trajectory.

Financial Analysis of Accretion Pharmaceuticals Limited (FY2022-FY2024)

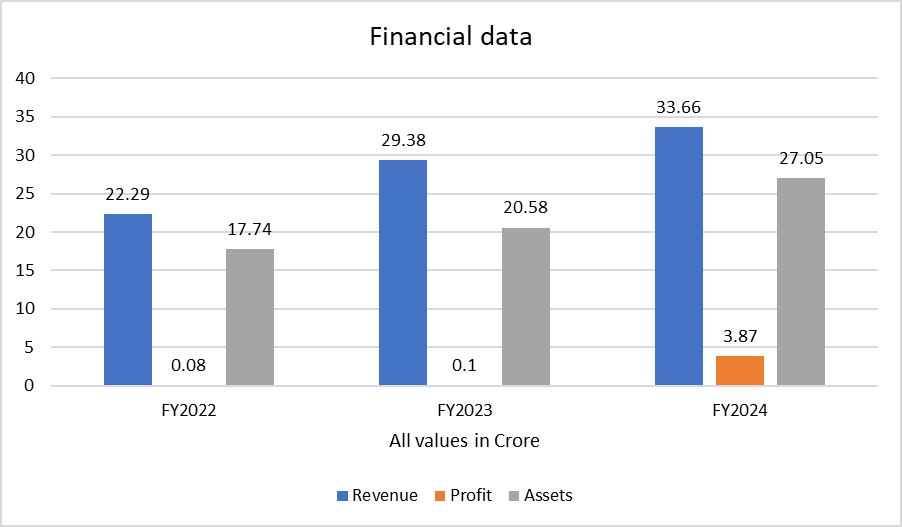

📊 Revenue

- FY2022: ₹22.29 crore

- FY2023: ₹29.38 crore

- FY2024: ₹33.66 crore

Analysis: Revenue has shown consistent growth over the past three years:

- 32% growth from FY2022 to FY2023

- 15% growth from FY2023 to FY2024

This indicates steady market expansion and demand for the company’s products.

Profit (PAT)

- FY2022: ₹0.08 crore

- FY2023: ₹0.10 crore

- FY2024: ₹3.87 crore

Analysis: The profit saw a massive jump of over 3700% in FY2024. This suggests a sharp improvement in operational efficiency or cost control, or possibly a change in pricing, product mix, or customer base.

Total Assets

- FY2022: ₹17.74 crore

- FY2023: ₹20.58 crore

- FY2024: ₹27.05 crore

Analysis: Assets grew steadily, indicating capital investment in operations and capacity. From FY2022 to FY2024, assets increased by around 52%, reflecting the company’s expansion strategy.

Summary

- Strengths: Strong revenue and asset growth, dramatic profit improvement in FY2024.

- Positive Indicators: Likely increase in operating margin, better asset utilization.

- Investor View: FY2024 performance shows the company might now be reaching financial maturity, which supports confidence in its IPO.