हिंदी में पढ़ने के लिए मेनू बार से हिंदी भाषा चयन करें।

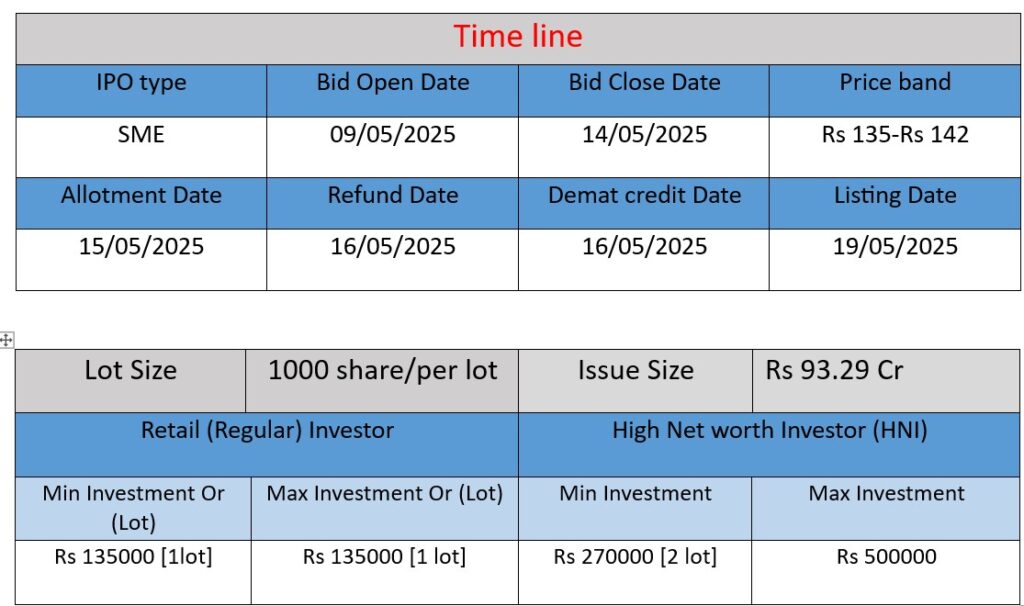

Virtual Galaxy Infotech Limited’s SME IPO opens from May 9 to May 14, 2025, with a price band of ₹135–₹142 per share. It includes a fresh issue of 66 lakh equity shares to raise ₹93.29 crore. The funds will be used for setting up a development facility in Nagpur (₹34.26 Cr), product upgrades (₹18.9 Cr), marketing and business expansion (₹14.06 Cr), data center hardware (₹5.05 Cr), debt repayment (₹3 Cr), and general corporate purposes.

Core Business Focus

Virtual Galaxy Infotech Limited (VGIL), founded in 1997 by Avinash Shende and Sachin Pande in Nagpur, Maharashtra, is a prominent fintech and enterprise software company. Specializing in banking, financial services, ERP, and e-governance solutions, VGIL has established a significant presence across India and East Africa. Below is an overview of VGIL’s operations, strengths, and potential risks, based on information from multiple sources.

Operations

VGIL provides a range of technology solutions tailored for financial institutions, government bodies, and SMEs. Key products include:

- E-Banker: An AI-powered, web-based core banking solution catering to banks, NBFCs, microfinance institutions, and cooperative societies.

- V-Pay: A comprehensive digital payment suite integrating UPI, PoS, payment gateways, and more.

- IBS ERP: Industry-specific ERP solutions for SMEs in sectors like sugar, solvex, and textiles.

- E-Governance Software: Designed for Agricultural Produce Market Committees (APMCs) and other government organizations.

- V-SOC: A robust Virtual Security Operations Center for BFSI and government sectors.

VGIL has implemented its solutions in over 150 clients, including banks, microfinance companies, and NBFCs, and serves the government and SME sectors. The company has a presence in 20 Indian states and East Africa, with a team of approximately 300 professionals.

Strengths: Competitive Advantages

1. Diverse Product Portfolio

VGIL’s comprehensive suite of products addresses various sectors, enabling it to cater to a broad client base. This diversification reduces dependency on a single revenue stream and enhances market resilience.

2. Global Expansion and Strategic Partnerships

The company has successfully expanded into international markets, particularly in Africa, with projects in countries like Malawi, Tanzania, and Ethiopia. VGIL’s strategy includes collaborations with channel partners to enhance market reach.

3. Adoption of SaaS Model

Transitioning to a Software-as-a-Service (SaaS) model has allowed VGIL to generate recurring revenue and scale efficiently. As of mid-2024, SaaS accounts for about 50% of the company’s revenue, with plans to increase this share.

4. Positive Employee Feedback

Employee reviews highlight a supportive work environment, opportunities for professional growth, and a positive company culture. On platforms like AmbitionBox and Glassdoor, VGIL has received favorable ratings, indicating strong internal satisfaction.

Risks: Potential Challenges

1. Management and Operational Concerns

Some employee reviews point to issues with management practices, including delayed salary payments and inadequate communication. These concerns could impact employee morale and retention.

2. Dependence on Specific Markets

While VGIL has diversified its client base, a significant portion of its operations is concentrated in specific regions and sectors. Economic or regulatory changes in these areas could affect the company’s performance.

3. Intensifying Competition

The fintech and enterprise software sectors are highly competitive, with numerous players offering similar solutions. VGIL must continuously innovate to maintain its market position.

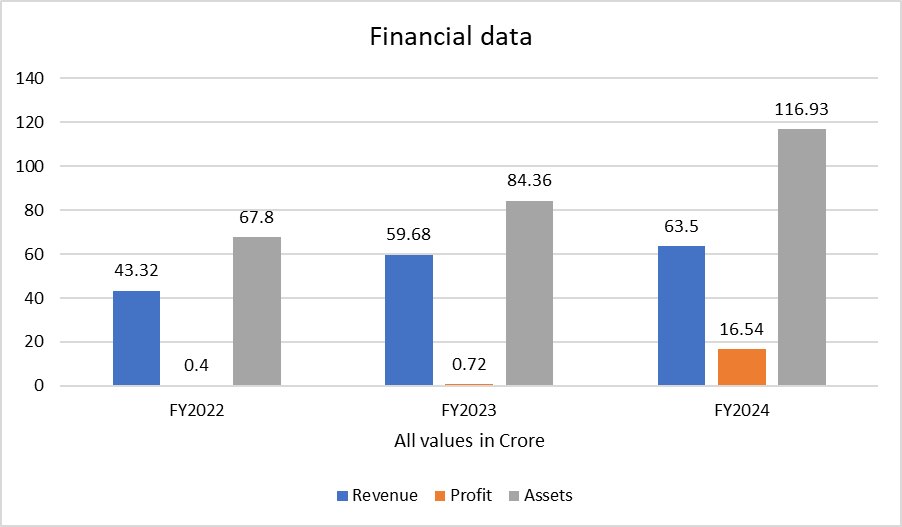

Financial Analysis of Virtual Galaxy Infotech Limited (FY2022-FY2024)

📊 Revenue

- FY2022: ₹43.32 crore

- FY2023: ₹59.68 crore

- FY2024: ₹63.50 crore

Analysis:

Revenue grew steadily over the years — 37.8% growth from FY22 to FY23 and 6.4% growth from FY23 to FY24. While growth slowed in FY24, the company maintained upward momentum.

💰 Profit (Net Profit After Tax)

- FY2022: ₹0.40 crore

- FY2023: ₹0.72 crore

- FY2024: ₹16.54 crore

Analysis:

Profit grew marginally in FY23 but saw a sharp surge in FY24 — over 22x increase, indicating significant improvement in operational efficiency or a one-time gain.

🏢 Total Assets

- FY2022: ₹67.80 crore

- FY2023: ₹84.36 crore

- FY2024: ₹116.93 crore

Analysis:

Total assets increased year-over-year, showing business expansion and a stronger asset base to support future operations.

📌 Summary

- Consistent revenue growth shows a stable demand for services.

- FY24 profit jump is a standout performance, possibly reflecting product success, cost control, or extraordinary income.

- Increasing asset base supports scalability and long-term growth.