हिंदी में पढ़ने के लिए मेनू बार से हिंदी भाषा चयन करें।

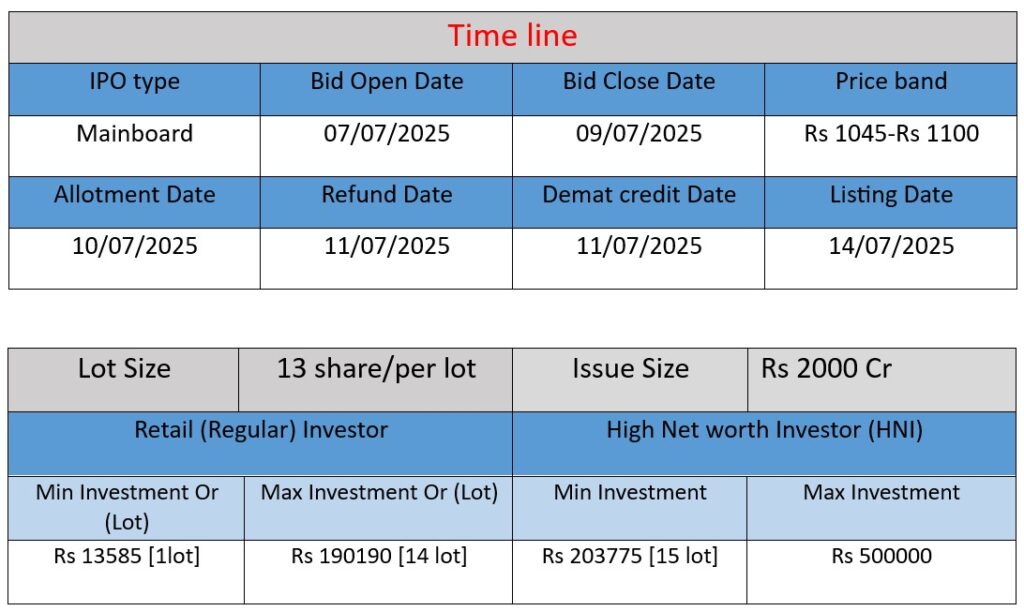

Travel Food Services Ltd’s IPO opens July 7, 2025, and closes July 9, 2025. The ₹2,000 crore issue is a 100% offer-for-sale by Kapur Family Trust (no fresh shares), at a price band of ₹1,045–₹1,100/share. The proceeds will go to existing shareholders; the company itself receives no funds. Listing is scheduled for July 14, 2025, on BSE & NSE.

Company Core Work

TFS is India’s leading travel-focused food & beverage and lounge services provider. Established in 2009 and headquartered in Mumbai, it operates across airports, railway stations, and highways in India, Malaysia, and Hong Kong.

- Manages ~397 quick‑service restaurant outlets and 30+ lounges (as of June 2024).

- Offers a diversified portfolio: 90–117 F&B brands (both in-house and international), including KFC, Pizza Hut, Krispy Kreme, Wagamama, Subway.

- Implements innovations like “Food@Gate” for food delivery within airport terminals.

Strengths

Market leadership & scale

- Largest travel-QSR operator in India (~26% market share) and top private lounge provider (45% revenue share).

- Operates in 14 Indian airports that handle ~89% of India’s major airport traffic.

Strong brand & partner network

- Dual backing from SSP (FTSE‑250 global travel F&B specialist) and Mumbai-based K Hospitality enhances credibility and operational reach.

- Diverse portfolio of in-house and licensed brands tailored to traveler needs.

Innovation and operational excellence

Proprietary tech (e.g. Food@Gate) and use of celebrity & executive chefs highlight emphasis on customer experience.

Risks & Challenges

Customer concentration & asset risk

Heavy dependence on high-traffic airports; any downturns in air travel (e.g. regulation or pandemics) could impact business .

Concession renewal uncertainty

Although contract retention is strong (93–94%), concession terms average ~6–8 years, necessitating continuous bidding and negotiations.

Competition & margin pressures

Competitive travel retail environment with global and local operators may fuel pricing pressure and margin erosion, especially in lounges.

Macroeconomic exposure

Economic slowdown affecting discretionary spending or travel demand could reduce passenger volume, hurting sales, especially premium segments.

Travel Food Services Limited stands out as a market-leading, financially strong, and innovative travel F&B service provider in India, bolstered by global expertise via SSP and decades of domestic hospitality experience. Its diversified brand portfolio, technological initiatives, and high contract retention signal a platform built for sustainable growth.

However, its reliance on travel volumes, concession-based model, and potential competitive pressures remain key industry-specific risks—especially in light of unpredictable external factors.

Overall, TFS presents a well-positioned, resilient business, though stakeholders should watch travel trends and concession renewals closely.

Travel Food Services Ltd – Financial Summary (₹ in Crore)

| Financial Year | Revenue | Profit (PAT) | Total Assets |

| FY2022 | 389.61 | 5.03 | 1056.49 |

| FY2023 | 1067.15 | 251.30 | 1332.32 |

| FY2024 | 1396.32 | 298.02 | 1623.39 |

Revenue Analysis

- FY2022 to FY2023: Revenue jumped from ₹389.61 Cr to ₹1067.15 Cr, a growth of +174%, signaling strong post-COVID recovery and airport footfall normalization.

- FY2023 to FY2024: Grew further to ₹1396.32 Cr, a +31% increase, driven by higher traveler demand, expanded outlet count, and lounge services.

Profit Analysis

- Profit surged from ₹5.03 Cr in FY2022 to ₹251.3 Cr in FY2023 — a massive turnaround attributed to operating leverage and cost efficiencies.

- FY2024 PAT rose to ₹298.02 Cr, a +19% increase YoY, indicating sustained margin strength and better resource utilization.

Assets Analysis

- Total assets grew steadily:

- FY2022: ₹1056.49 Cr

- FY2023: ₹1332.32 Cr

- FY2024: ₹1623.39 Cr

- Reflects reinvestment into infrastructure (lounges, kitchens, digital upgrades) and network expansion.

Conclusion

Travel Food Services has shown remarkable financial growth over three years. Its revenue has more than tripled, and profitability has dramatically improved, highlighting the strength of its travel-centric business model and execution capabilities. With rising assets and minimal debt, it stands financially sound and well-positioned for long-term growth in the airport F&B space.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.