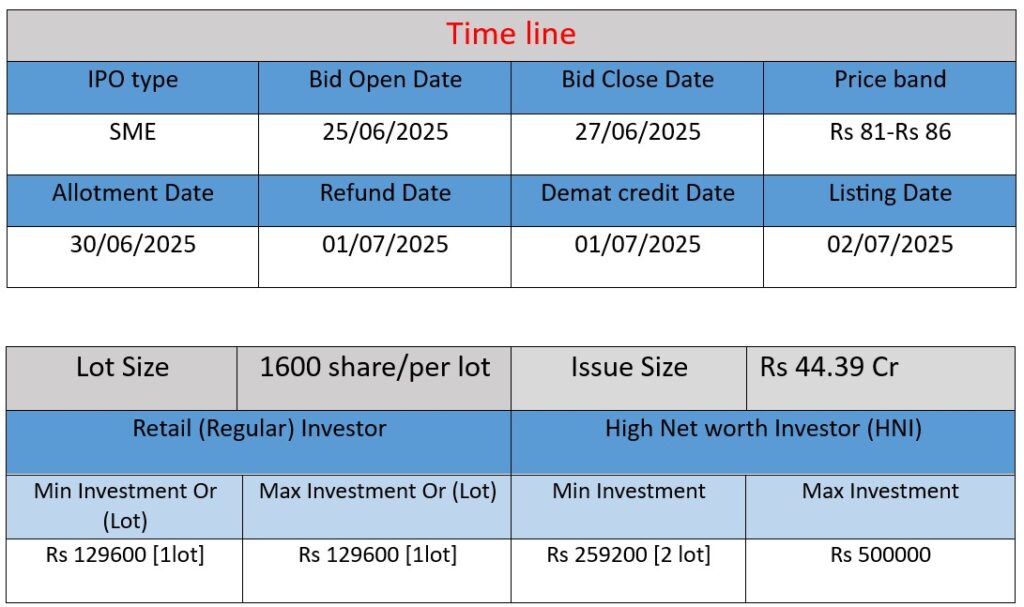

Suntech Infra Solutions Ltd has launched its IPO (June 25, 2025) to raise ₹44.39 crore, comprising a fresh issue of 39.74 lakh shares (₹34.18 cr) and an Offer-for-Sale of 11.87 lakh shares (₹10.21 cr) by early investors. Proceeds will fund working capital, purchase of new infrastructure equipment, and provide exit liquidity. The issue opens investor participation in a growing B2B civil construction business.

Company Overview & Operations

- Incorporated on April 27, 2009, headquartered in Delhi .

- SISL specializes in infrastructure services such as heavy-duty drives: hydraulic cranes, forklifts, piling, diaphragm walls, load testing, structural pipe‑laying, and construction equipment rentals (cranes, dozers, mixers) .

Strengths

A. Strong Financial Growth & Backing by Parent

- Robust FY 2023 performance—with high growth in revenue, profit, and EBITDA—demonstrates solid operational progress .

- CRISIL highlights strong cash flows from lease rentals, maintaining a high Debt-Service Coverage Ratio (>1.5×) .

- Adequate liquidity: no significant debt pressure; new project partly funded through parent preference shares and unsecured loans .

- “Stable” outlook—benefitting from strong group support .

B. Market Position & Asset Expertise

- Considered a reliable player in infrastructure, SISL has executed marquee projects such as piling in DMRC metro corridors, World Trade Center Noida, NTPC, and Yamuna Expressway .

- Owns and operates a large fleet: diaphragms, cranes up to 200 T, rotary-piling rigs, concrete boom placers—reflecting diverse in‑house capabilities .

Risks & Weaknesses

A. Project Execution & Leverage Risk

- The ongoing Thiruvananthapuram office development (

₹220–₹150 crore cost) relies heavily on bank debt (₹89 crore) and parent funding. Delays or overruns could erode cashflows and hamper credit profile . - Cash flow tied exclusively to SunTec group occupancy, amplifying concentration risk in case of disrupted tenancy .

B. Customer Concentration & Sector Competition

- Limited customer base: lease income dependent on group entity—lack of external lessees limits revenue diversity .

- In adjacent tech/software services, group faces pricing pressures and margin erosion (FY 2019 margins fell from 20% to 10%) .

C. Employee Satisfaction & Culture Challenges

Rated 3.2/5 on AmbitionBox; culture (2.7/5), job‑security (2.8/5), and pay & benefits (3.0/5) hover around average or below — suggesting internal challenges in retention/morale .

Final Takeaway

SISL is on a growth trajectory: strong financial performance, abundant asset capability, and solid backing from its parent group. However, crucial risks include project execution, tenant dependency, and internal HR pressures. If SISL can successfully execute its Thiruvananthapuram project while reducing customer concentration and improving organizational culture, it stands to solidify its position as a reliable mid-sized infrastructure operator in India.

Here is a brief financial performance analysis across FY2022 to FY2024:

| Metric | FY2022 | FY2023 | FY2024 | Growth (FY22–24) |

| Revenue (₹ Cr) | 71.67 | 85.67 | 95.59 | +33.3% |

| Profit (₹ Cr) | 3.02 | 5.76 | 9.24 | +206.0% |

| Assets (₹ Cr) | 77.93 | 100.38 | 120.28 | +54.3% |

Revenue

- FY2022 to FY2024: Revenue grew from ₹71.67 Cr to ₹95.59 Cr (approx. 33.3% increase).

- Indicates consistent business growth, especially in B2B infrastructure services.

Profit

- Jumped from ₹3.02 Cr in FY2022 to ₹9.24 Cr in FY2024 (over 3x growth).

- Suggests better cost control, pricing power, and improved operational efficiency.

Assets

Increased from ₹77.93 Cr to ₹120.28 Cr (+54.3%), reflecting capital expansion and a growing asset base (likely in machinery/equipment).

📌 Summary

- Suntech Infra Solutions is growing steadily in terms of revenue and expanding its asset base.

- Profit growth is outpacing revenue, a strong indicator of internal financial health.

- The company appears financially stable and well-positioned for future expansion, especially with the current IPO aiming to strengthen working capital and asset purchases.