हिंदी में पढ़ने के लिए मेनू बार से हिंदी भाषा चयन करें।

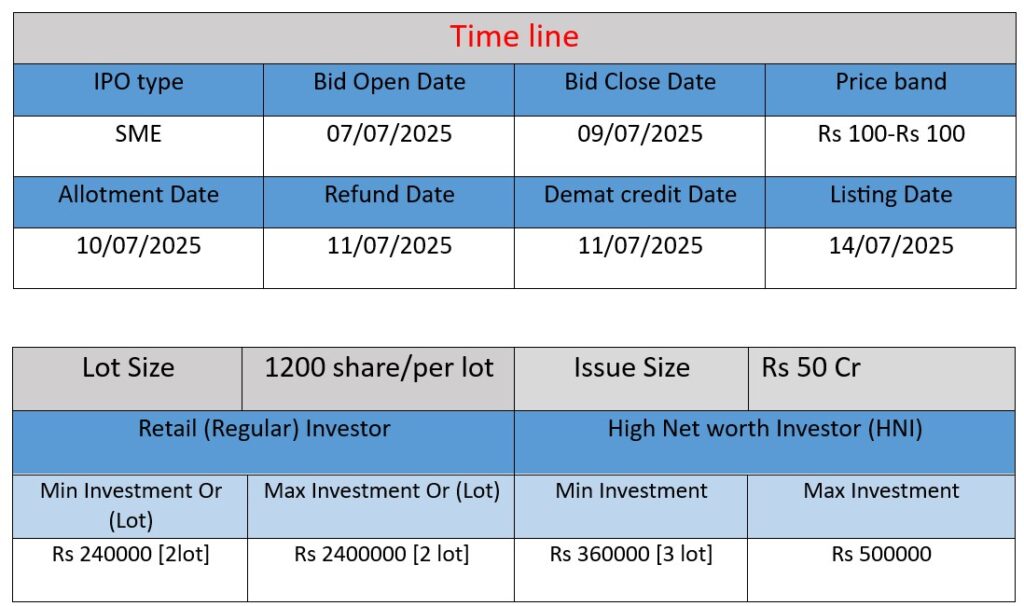

Smarten Power Systems Ltd’s SME IPO opens on July 7, 2025, and closes on July 9, 2025, with a fixed price of ₹100 per share. The company aims to raise ₹50 crore through a mix of fresh equity (₹40 cr) and an offer-for-sale (₹10 cr). Funds will support movable assets for a battery-manufacturing unit, working capital, debt repayment, CAPEX, and general corporate needs. Listing on NSE‑SME is expected on July 14, 2025

Company Core Work

- Design & Assembly

Specializes in home UPS systems, solar inverters, solar power-conditioning units (PCUs), and solar charge controllers, all assembled in Gurugram, India. It also trades in solar panels and batteries domestically. - Product Range & SKUs

Offers a diversified portfolio of 372 SKUs across six main categories: home UPS, inverters, PCUs, charge controllers, panels, and batteries. - Market Network

Operates in 23 Indian states + 2 UTs, with exports (excluding panels) to over 17–18 countries across the Middle East, Africa, and South Asia. It maintains a vast distribution network: ~382 distributors and 52 service centers supporting after-sales.

Strengths

- Diverse & Innovative Product Portfolio

- Covers complete home to commercial solar-backup solutions.

- Emphasis on R&D and product innovation (“innovation capabilities” highlighted in IPO documents).

- Extensive Distribution & After‑Sales

- Deep market presence in India and key developing markets abroad thanks to its distributor and service network.

- Experienced Leadership Team

- Promoted by veterans with over 20 years of experience from companies like Su‑Kam, Delta Energy, and Sony.

Risks

- Battery Manufacturing Dependence

- Currently only trades batteries; plans to start manufacturing which exposes the company to supply chain, quality control, and regulatory challenges.

- Leased Facilities

- The company’s main facilities—office, assembly plant, warehouse—are rented, which may affect long-term asset security .

- Geographical Revenue Concentration

- Heavy reliance on key states like Haryana and Uttar Pradesh; adverse regional conditions (regulatory, economic) can significantly impact results .

- Import Dependency & Supplier Risk

- Relies on imported components (notably from China). Any disruption in supply chains or trade issues could hamper performance .

- Competitive & Valuation Risk

- IPO P/E ratio ~12x is low compared to industry average ~41x—suggesting undervaluation, but performance must justify this in the future.

Smarten Power Systems stands out as a rapidly growing and financially healthy player in India’s solar and power-backup industry. With diversified products, strong leadership, and a solid distribution network, the company is well-positioned for further expansion.

However, new manufacturing plans, dependence on leased infrastructure, regional revenue focus, and global supply vulnerabilities present notable risks. Investors and stakeholders should monitor the battery manufacturing transition, real estate strategy, and supply chain resilience closely.

Overall, Smarten offers a compelling growth-forward opportunity with managed risks—making robust IPO metrics all the more critical to watch in the near term.

Smarten Power Systems Ltd – Financial Overview (₹ in Crore)

| Financial Year | Revenue | Profit | Total Assets |

| FY2023 | 179.93 | 5.16 | 76.01 |

| FY2024 | 195.19 | 11.29 | 79.28 |

| FY2025 | 201.75 | 12.77 | 97.23 |

📌 Financial Analysis – Key Points

- Consistent Revenue Growth:

- Revenue increased from ₹179.93 Cr in FY2023 to ₹201.75 Cr in FY2025.

- This shows a steady growth of over 12%, indicating rising demand and stable operations.

- Strong Profitability Improvement:

- Profit more than doubled from ₹5.16 Cr to ₹12.77 Cr in just two years.

- This reflects better cost control, improved efficiency, or stronger product margins.

- Asset Expansion:

- Total assets grew significantly, especially from FY2024 to FY2025 (~22% growth).

- Likely due to capital investments in infrastructure like the new battery manufacturing facility.

- Financially Strong Before IPO:

- The company enters its IPO phase with consistent growth in revenue, profits, and assets.

- These trends indicate a strong financial foundation and potential for future scalability.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.