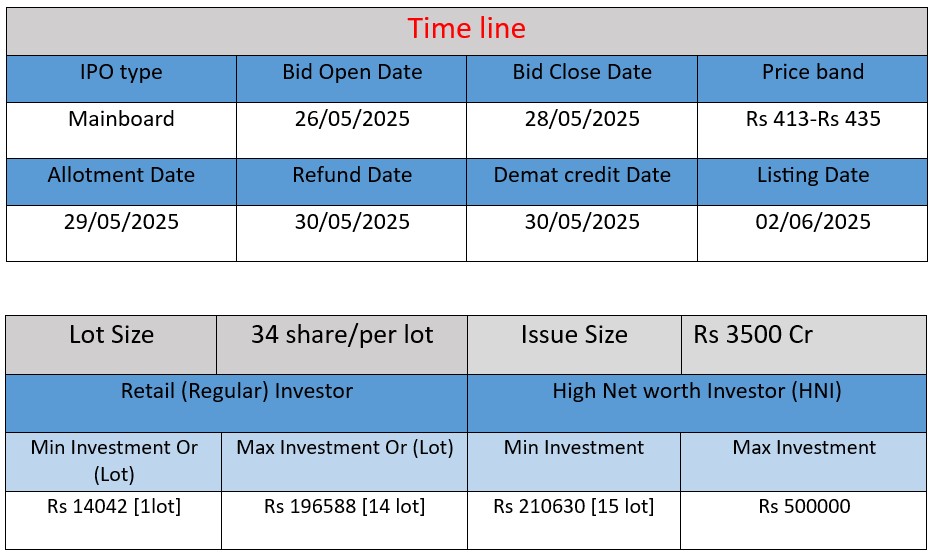

Schloss Bangalore Ltd, operator of The Leela hotels, launches a ₹3,500 crore IPO (₹2,500 crore fresh issue + ₹1,000 crore OFS) to repay ₹3,900 crore debt and fund expansion, including 8 new hotels by 2028. IPO opens May 26–28, 2025, with a price band of ₹413–₹435 per share.

Schloss Bangalore Limited, the operator of The Leela Palaces, Hotels & Resorts, is a prominent luxury hospitality company in India. Backed by Brookfield Asset Management, the company is preparing for a significant initial public offering (IPO) to reduce debt and fund expansion plans. Below is an analysis of Schloss Bangalore’s operations, strengths, and risks, based on information from multiple sources.

Company Overview

Established in 2019, Schloss Bangalore Limited operates under “The Leela” brand, which has been synonymous with luxury hospitality in India since 1986. The company manages a portfolio of 12 operational hotels with 3,382 keys across 10 major Indian cities, including Bengaluru, Chennai, New Delhi, Jaipur, and Udaipur. Their portfolio comprises five owned hotels, six managed through long-term agreements, and one franchise-operated hotel. Schloss plans to expand by adding eight new properties by 2028, targeting wildlife, spiritual, and heritage tourism segments.

Strengths

1. Strong Brand Recognition

The Leela brand has received over 250 industry awards since 2021 and is consistently ranked among the world’s best hotels by leading travel publications.

2. Strategic Property Locations

Schloss owns marquee hotels in high-barrier-to-entry markets, such as Bengaluru, Chennai, New Delhi, Jaipur, and Udaipur. These locations are prime business and leisure destinations, contributing to a higher Revenue Per Available Room (RevPAR) growth compared to the industry average.

3. Diversified Revenue Streams

The company’s comprehensive luxury ecosystem includes accommodations, curated experiences, award-winning dining, wellness offerings, and event venues. This diversification attracts a broad clientele, with room revenues in FY24 comprising 51.9% from retail and leisure guests, 17.1% from corporate bookings, and 31% from group bookings.

4. Operational Efficiency

Schloss has implemented an active asset management approach, investing ₹654.6 crore in refurbishments and upgrades across its owned portfolio. These initiatives have enhanced performance and guest experiences.

5. Financial Backing

Being backed by Brookfield Asset Management provides Schloss with strong financial support and strategic guidance, aiding in its expansion and operational strategies.

Risks

1. High Debt Levels

As of May 2024, Schloss had a consolidated debt of ₹4,052.5 crore. While the IPO aims to reduce this burden, high leverage remains a concern.

2. Dependence on Key Properties

A significant portion of revenue is generated from five flagship hotels. Any operational disruptions or market downturns in these locations could adversely affect financial stability.

3. Historical Losses

Despite narrowing losses, the company reported a net loss of ₹2.13 crore in FY24, down from ₹61.68 crore in FY23 and ₹319.8 crore in FY22. Sustained profitability is yet to be achieved.

4. Industry Cyclicality

The hospitality sector is susceptible to economic cycles, seasonal fluctuations, and unforeseen events like pandemics, which can significantly impact occupancy rates and revenues.

5. Regulatory and Operational Challenges

The company faces risks related to regulatory compliance, hotel renovations, and potential delays in new constructions, which could affect operations and growth plans.

Schloss Bangalore Limited, through its operation of The Leela brand, holds a strong position in India’s luxury hospitality sector. The company’s strategic locations, diversified offerings, and operational efficiencies are significant strengths. However, high debt levels, dependence on key properties, and the cyclical nature of the industry pose risks. The upcoming IPO is a critical step towards financial restructuring and expansion, aiming to position Schloss for sustainable growth in the evolving hospitality landscape

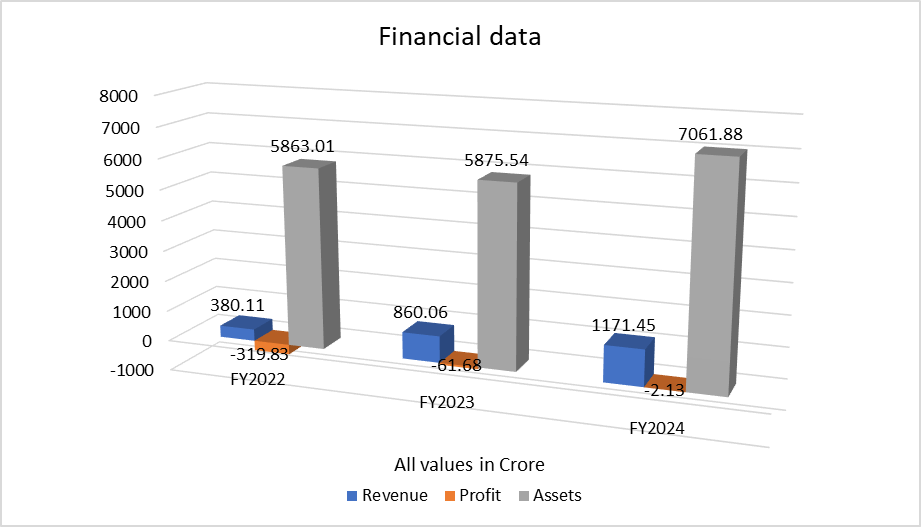

Based on the data provided for Schloss Bangalore (Leela Hotels) Limited, here is a brief financial performance analysis across FY2022 to FY2024:

Financial Analysis

Revenue

- FY2024: ₹1,171.45 crore

- FY2023: ₹860.06 crore

- FY2022: ₹380.11 crore

Analysis: Revenue has consistently grown, increasing 36% in FY24 over FY23 and over 200% since FY22. This shows strong demand recovery in the luxury hospitality sector post-COVID and improved occupancy rates.

Profit (Net Loss)

- FY2024: ₹-2.13 crore

- FY2023: ₹-61.68 crore

- FY2022: ₹-319.83 crore

Analysis: The company is rapidly reducing its losses. FY24 shows near break-even, a major improvement from previous years. This indicates better cost control, higher operating efficiency, and growing room revenue.

Total Assets

- FY2024: ₹7,061.88 crore

- FY2023: ₹5,875.54 crore

- FY2022: ₹5,863.01 crore

Analysis: Asset base has expanded by ~20% in FY24, reflecting investments in hotel refurbishments and expansion. This supports the company’s plan for future growth and higher valuation.

✅ Summary

- Revenue tripled in three years, reflecting business growth and market recovery.

- Losses have sharply declined, showing a path to profitability.

- Asset growth supports expansion plans and IPO valuation.