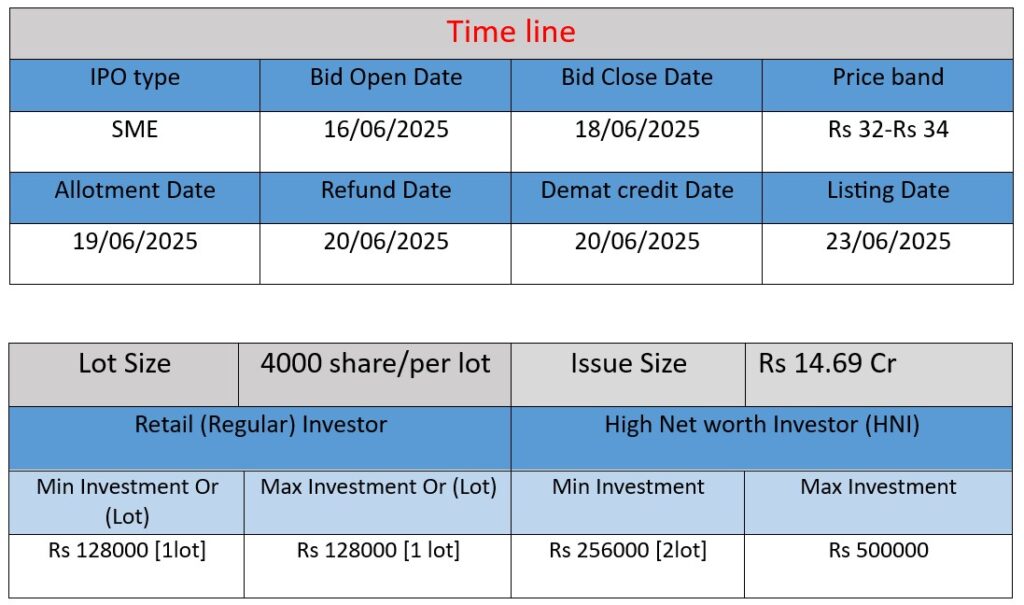

Samay Project Services Ltd’s SME IPO (June 16–18, 2025) aims to raise ₹14.69 cr via a fresh issue of 43.2 lakh shares priced at ₹32–34 each. Entire proceeds will be used for working‑capital needs and general corporate purposes. The offer carries no OFS component and lists on NSE EMERGE under book‑building.

What the Company Does (Work)

Samay Project Services Ltd. is a Chennai‑based EPC (Engineering, Procurement & Construction) firm founded in 2001. It offers turnkey solutions spanning:

- Design, fabrication and commissioning of tanks and tank farms (API 650), piping systems, fire‑detection and protection systems, cross‑country water/hydrocarbon pipelines, STP/ETP/desalination projects, system automation, and Electro‑Mechanical & instrumentation setups

- Recent ventures include EPC contracts for Bio‑CNG plants, integrating project engineering from feedstock sourcing to automated operations.

- The company has executed over 120–200 projects across India, the Middle East, and Africa, typically managing 10–15 ongoing projects at once

Strengths

a) Technological & Domain Expertise

- Equipped with an experienced engineering & design team using advanced software tools for precise EPC delivery.

- A diversified service portfolio across multiple EPC segments (tanks, pipelines, fire safety, Bio‑CNG, automation) boosts market versatility.

b) Financial Performance & Valuation

- FY25 revenue: ₹ 37.72 Cr, PAT: ₹ 4.19 Cr. Moderate profitability: EBITDA ~ 15%, PAT ~ 11%.

- Low debt-to-equity (~ 0.10x), solid ROCE (~24.6%), and attractive valuation (P/E ~ 8.9x vs sector average ~20x) suggest financial stability and room for growth.

c) Growing Market Interest & Brand Trust

- IPO seen strong demand—78% subscribed on Day 1, 1.89× subscription by Day 2, especially among retail/HNIs.

- Extensive client base: top five customers contributed over 63% of FY25 revenue, pointing to deep relationships.

Risks & Challenges

a) Customer Concentration

- Heavy reliance on top 5–10 clients (over 63% & 84% of revenue in FY25 and FY24, respectively). Loss of these could greatly impact revenues.

b) Operational & Cost Pressures

- Labour shortage risks and potential for cost-overruns—especially in remote/large project sites.

- Market remains competitive: fragmented landscape with small contractors competing aggressively.

c) Project Award & Cash Flow Risks

- Revenue depends on winning government or industrial EPC contracts via competitive bidding—any dips could delay revenues .

- Historical negative cash flow periods cited; sustained negative cash flows could hamper growth.

d) Legal & Market Risks

- The company and promoters face ongoing litigations—unfavourable outcomes could hurt finances.

- Broader sector risks include fluctuating raw material costs, inflation, and regulatory changes.

Here is a brief financial performance analysis across FY2022 to FY2024:

Detailed Financial Analysis

| Financial Year | Revenue (₹ Cr) | Profit (₹ Cr) | Assets (₹ Cr) |

| FY2022 | 18.87 | 1.90 | 14.93 |

| FY2023 | 20.36 | 3.44 | 21.28 |

| FY2024 | 40.75 | 4.61 | 24.83 |

Revenue

- FY2022 to FY2023: Grew from ₹18.87 Cr to ₹20.36 Cr — a 7.9% increase.

- FY2023 to FY2024: Jumped significantly to ₹40.75 Cr — a 100.2% increase.

- Analysis: Indicates strong expansion in business execution, possibly due to higher project inflows or larger EPC contracts, especially in FY2024.

Profit

- FY2022 to FY2023: Rose from ₹1.90 Cr to ₹3.44 Cr — a 81.05% increase.

- FY2023 to FY2024: Increased to ₹4.61 Cr — a 33.9% growth.

- Analysis: Profitability has steadily improved, reflecting cost control and better operational efficiency, though not as sharp as revenue growth in FY2024, suggesting some margin compression.

Assets

- FY2022 to FY2023: Increased from ₹14.93 Cr to ₹21.28 Cr — a 42.5% rise.

- FY2023 to FY2024: Further rose to ₹24.83 Cr — a 16.7% increase.

- Analysis: Asset growth aligns with business scale-up. Moderate increase in FY2024 indicates controlled capital deployment despite strong revenue growth.

Conclusion

Samay Project Services Ltd. has shown:

- Consistent and strong revenue growth, particularly in FY2024.

- Improved profitability, though FY2024 margins may have tightened.

- Healthy and controlled asset expansion, indicating capital efficiency.

Overall, the financial trend shows robust growth momentum, improving fundamentals, and strong scalability potential — key positives for IPO investors.