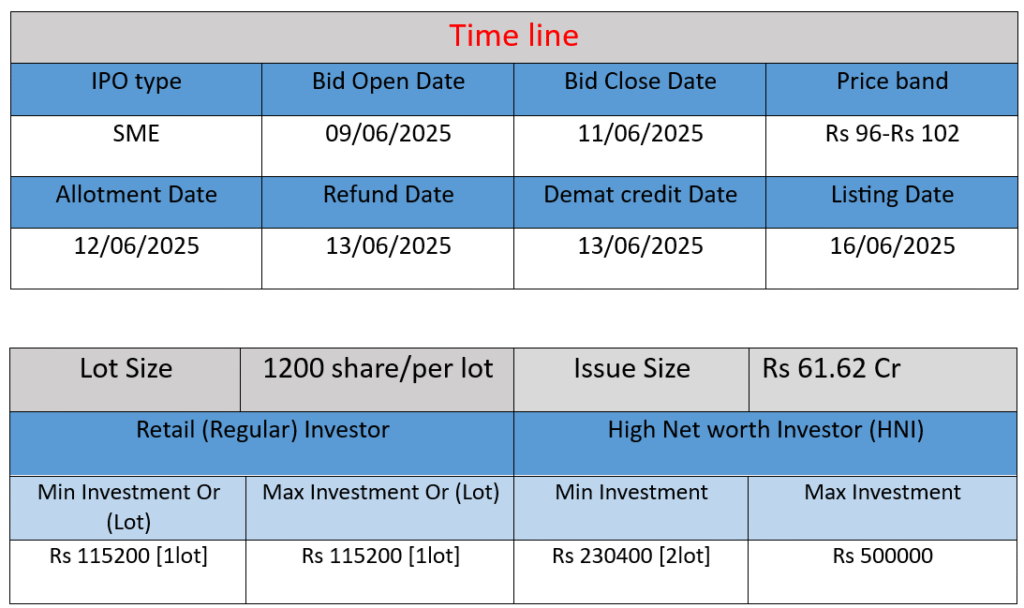

Sacheerome Limited IPO opens on June 9 and closes on June 11, 2025. The issue size is ₹61.62 crore, with shares priced at ₹95 each. The IPO proceeds will be used to set up a new manufacturing facility in Uttar Pradesh, fund general corporate purposes, and meet working capital needs. Sacheerome is a fragrance and flavour manufacturer with strong financial growth and a focus on innovation and exports. Listing is scheduled for June 16, 2025.

Work (What They Do)

- Fragrances & Flavours Manufacturing

Sacheerome is an India-based B2B company specializing in designing and manufacturing concentrated fragrances and flavours. Their products cater to a wide range of industries, including personal care, home care, beverages, bakery, confectionery, dairy, health & nutrition, and more. Their client base includes both domestic leaders in FMCG and international customers across the Middle East (UAE) and Africa - R&D-driven Operations

They boast a dedicated R&D facility staffed with around 54 specialists, supported by advanced QC labs and robotic production systems. This enables the company to innovate products like emulsion, encapsulated flavours, and enhanced fragrance delivery technologies (e.g., “Sach/Maxicaps,” “Sach/Veda”) - Growth Strategy via IPO

Sacheerome’s recent SME IPO (June 9–11, 2025) intends to raise ₹61.62 crore. Proceeds will finance a new manufacturing plant in Gautam Buddha Nagar, Uttar Pradesh, and support general corporate requirements. The listing is scheduled for June 16, 2025, on the NSE SME platform

✅ Strengths

- Strong Financial Growth & Profitability

- FY 25 revenue rose ~25% YoY to ₹108 crore; PAT nearly doubled (~50%) to ₹16 crore

- EBITDA margin around 20%, PAT margin near 14%; ROE ~26%, ROCE ~33%—above industry norms

- Value-generating balance sheet: low debt, growing net worth ~₹53 cr; strong cash flows from operations .

- Efficient Operations & Experienced Team

- Almost debt-free with efficient working capital management (cash conversion cycle dropped from 84 to ~36 days)

- Founders and leadership have decades of experience; the company exhibits strong sales, marketing, and raw-material sourcing capabilities

- Scalable R&D and Manufacturing Capabilities

- Advanced R&D center with innovation-led delivery solutions and automated production improves product differentiation

- Expansion plans include a new facility in UP to boost production—heightening capacity and geographic reach.

Risks & Challenges

- Customer Concentration

Roughly half of revenue comes from the top 5 customers. This reliance means losing any major client could significantly impact revenues - Geographic Dependency

Significant business originates in Uttar Pradesh and Maharashtra, exposing the firm to regional economic fluctuations - Industry Competition & Market Structure

The flavours & fragrances sector is highly fragmented and competitive, with larger players (e.g., S H Kelkar) potentially eroding margins. Additionally, heavy dependency on the fragrance segment (90%+ of revenue) may pose risks if demand shifts - Raw Material & Regulatory Risks

Volatile raw material prices and dependence on select suppliers could pressure margins. Moreover, stricter regulations in food and cosmetics might escalate compliance costs and impact operations

Conclusion:

Sacheerome Limited presents a compelling growth story backed by solid financial performance, operational strength, and strategic expansion. However, investors should weigh risks like client concentration, geographic dependency, and industry competition. The upcoming IPO on June 16, 2025, offers an entry point—subject to investor risk appetite and vision for long-term earnings stability.

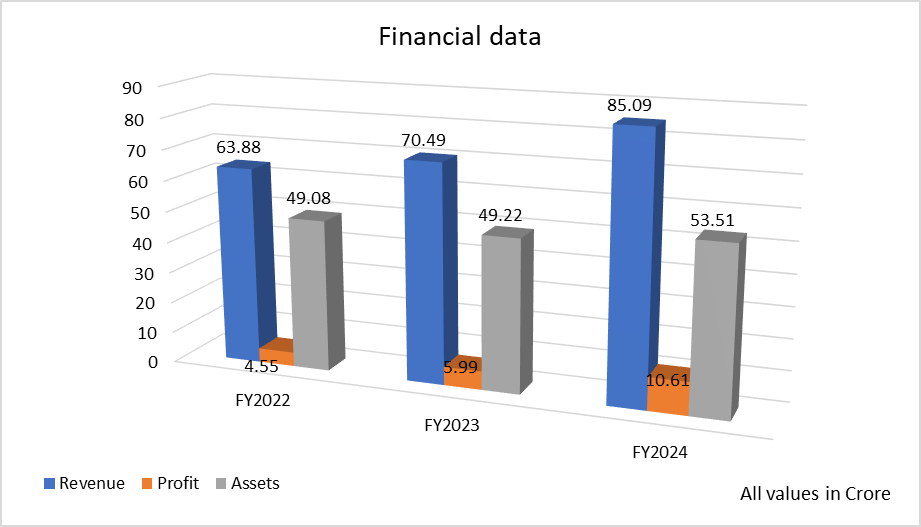

Based on the data provided for Sacheerome Limited, here is a brief financial performance analysis across FY2022 to FY2024:

📈 Revenue

- FY2022: ₹63.88 crore

- FY2023: ₹70.49 crore

- FY2024: ₹85.09 crore

Analysis:

Revenue has grown consistently year over year.

- FY2023 vs FY2022: ↑ ₹6.61 crore (10.35%)

- FY2024 vs FY2023: ↑ ₹14.6 crore (20.71%)

➡️ This shows strong demand and effective business expansion.

Profit

- FY2022: ₹4.55 crore

- FY2023: ₹5.99 crore

- FY2024: ₹10.61 crore

Analysis:

Profit has increased significantly, with margins improving.

- FY2023 vs FY2022: ↑ ₹1.44 crore (31.65%)

- FY2024 vs FY2023: ↑ ₹4.62 crore (77.13%)

➡️ Indicates better cost control, pricing strategy, and possibly higher-margin products.

🏢 Assets

- FY2022: ₹49.08 crore

- FY2023: ₹49.22 crore

- FY2024: ₹53.51 crore

Analysis:

Assets have remained steady with a noticeable rise in FY2024.

- FY2023 vs FY2022: ↑ ₹0.14 crore (0.29%)

- FY2024 vs FY2023: ↑ ₹4.29 crore (8.71%)

➡️ Reflects asset base strengthening, likely due to reinvestment of profits.

📊 Summary

| Metric | FY2022 → FY2023 | FY2023 → FY2024 |

| Revenue | +10.35% | +20.71% |

| Profit | +31.65% | +77.13% |

| Assets | +0.29% | +8.71% |

✅ Conclusion

Sacheerome Limited is showing strong and consistent financial growth. The company has significantly improved profitability and has started to expand its asset base, indicating solid financial health and readiness for further growth post-IPO.