Repono IPO Overview

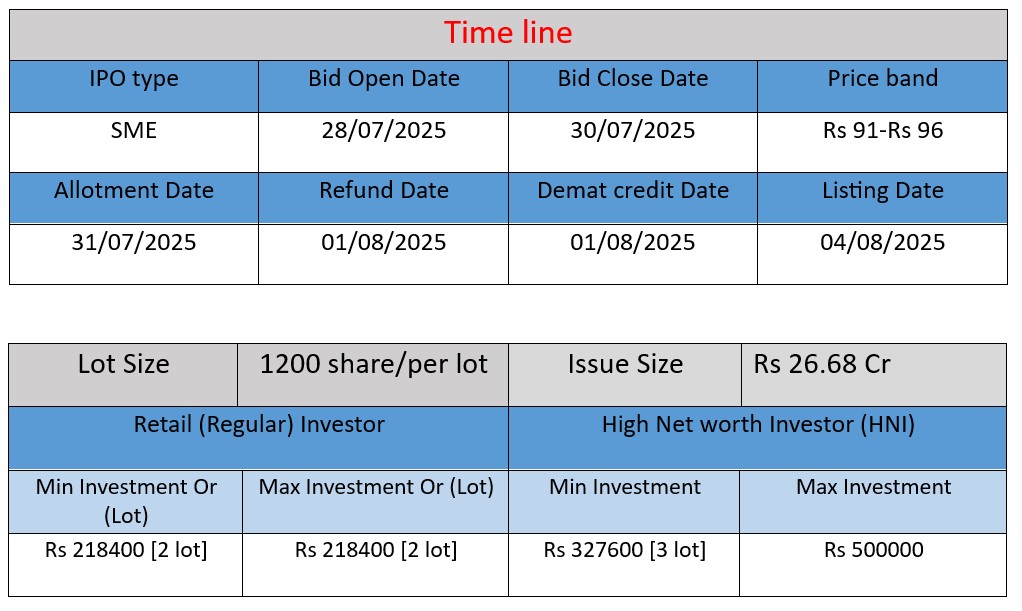

Repono Limited IPO opens 28 Jul 2025, closes 30 Jul 2025, and targets ₹26.68 crore via a fresh issue of approximately 27,79,200 shares at ₹91–96 per share. Proceeds will fund acquisition of forklifts, pallet trolleys, reach stackers; warehouse packing systems; development of warehouse management software; working capital; and general corporate purposes. Listing on BSE SME planned for 4 Aug 2025.

Repono IPO Subscription Status

| Category | Subscription (x) |

| QIBs | 23.58 |

| NIIs | 101.17 |

| Retails | 60.25 |

| Total | 38.93 |

| Last Updated: 30 July 2025 Time: 5 PM (Note: This data is updated every 2 hours) Source: NSE/BSE | |

| GMP (₹) | IPO Price (₹) |

| 23 | 96 |

| Last Updated: 30 July 2025 Time: 5 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Date

Core Business & Overview

- Founded in 2017, Repono Limited specializes in warehousing, liquid terminal services, and integrated logistics across India’s oil & petrochemical industries.

- Offers a 360° service suite: consultancy, design & engineering (including EPC), operations & maintenance, secondary transportation, plus packaging solutions like FFS bagging lines.

- Manages over 5 million tonnes each of polymers and petroleum products, reinforcing its position as one of the largest 3PL providers in the sector.

- Recognized as a Top 10 3PL Logistics Service Provider for 2024 by Industry Outlook, and supported by key global partnerships (e.g., Schmidt Logistics, AVENTUS GmbH).

Strengths

- Domain Expertise & Integrated Solutions

Deep experience across oil, gas, polymers, specialty chemicals, and lube oil, enabling customized, scalable end-to-end logistics operations. - Asset-Light and Cost-Efficient Model

Reliance on partnerships and third-party networks lowers capital expenditure and financial leverage. - Innovation & Customer-Centric Approach

Agile in adapting services and pioneering packaging and automation technologies to meet evolving client needs. - Reputation & Compliance Recognition

ISO-certified (ISO 9001, ISO 14001, ISO 45001) for quality, environmental, and safety management; high HSE standards throughout operations.

Potential Risks

- Legal and Regulatory Proceedings

Outstanding legal cases involving the company or its directors could potentially impact finances and operations. - Tender Reliance & Competitive Pressures

Heavily dependent on winning competitive government/public-sector contracts, which may affect revenue predictability. - Service-Liability Exposure

Errors or deficiencies in logistics or terminal operations could lead to customer claims, reputational damage, or financial penalties. - Financial Flexibility Constraints

Exposure to unsecured working capital loans may create pressure on cash flows, especially with rapid expansion plans

Financial Performance Table

| Financial Year | Revenue | Profit (PAT) | Total Assets |

| FY 2023 | ₹13.01 Cr | ₹0.52 Cr | ₹7.68 Cr |

| FY 2024 | ₹34.00 Cr | ₹4.18 Cr | ₹17.65 Cr |

| FY 2025 | ₹51.11 Cr | ₹5.15 Cr | ₹25.87 Cr |

Revenue Growth

- FY 2023 → FY 2024: Revenue grew 161% (₹13.01 Cr to ₹34 Cr).

- FY 2024 → FY 2025: Revenue increased further by 50.3%.

Strong, consistent top-line growth driven by expanded logistics and warehousing services.

Profit Growth

- FY 2023 → FY 2024: Profit jumped from ₹0.52 Cr to ₹4.18 Cr (703% growth), indicating better operational efficiency.

- FY 2024 → FY 2025: Moderate rise of 23.2%, suggesting stabilization.

Profit margins have improved with scale, showing good cost control and service pricing.

Total Assets

Assets nearly doubled each year:

- FY 2023 to FY 2024: +130%

- FY 2024 to FY 2025: +46.5%

Reflects significant reinvestment into infrastructure, machinery, and warehouse expansion.

| ✅ Pros of Repono IPO |

| Fast-Growing Financials – Revenue increased from ₹13.01 Cr in FY23 to ₹51.11 Cr in FY25; profit rose from ₹0.52 Cr to ₹5.15 Cr. Focused in High-Demand Sectors – Specializes in logistics for oil, gas, polymers, and petrochemicals, which are essential and niche industries. End-to-End Logistics Solutions – Offers complete services including consulting, packaging, warehousing, and terminal operations. Asset-Light Model – Operates efficiently through third-party partnerships, minimizing capital investment and maximizing returns. International Certifications & Recognition – ISO 9001, 14001, and 45001 certified; featured in “Top 10 3PL Providers – 2024.” Clear Use of IPO Funds – Proceeds will be used for equipment purchase, software development, working capital, and business expansion. |

| ⚠️ Cons of Repono IPO |

| Pending Legal Cases – The company and some directors are involved in ongoing legal proceedings, posing regulatory risks. High Dependence on Tenders – A significant portion of revenue comes from government and large corporate contracts; losing bids can impact revenue. Listed on BSE SME Platform – Lower liquidity on SME exchanges may make buying or selling shares difficult for investors. Service-Based Operational Risks – Delays or errors in logistics services could harm the company’s reputation and financials. Exposure to Unsecured Loans – Heavy reliance on working capital loans; any strain on cash flow may affect repayment capacity. |

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.