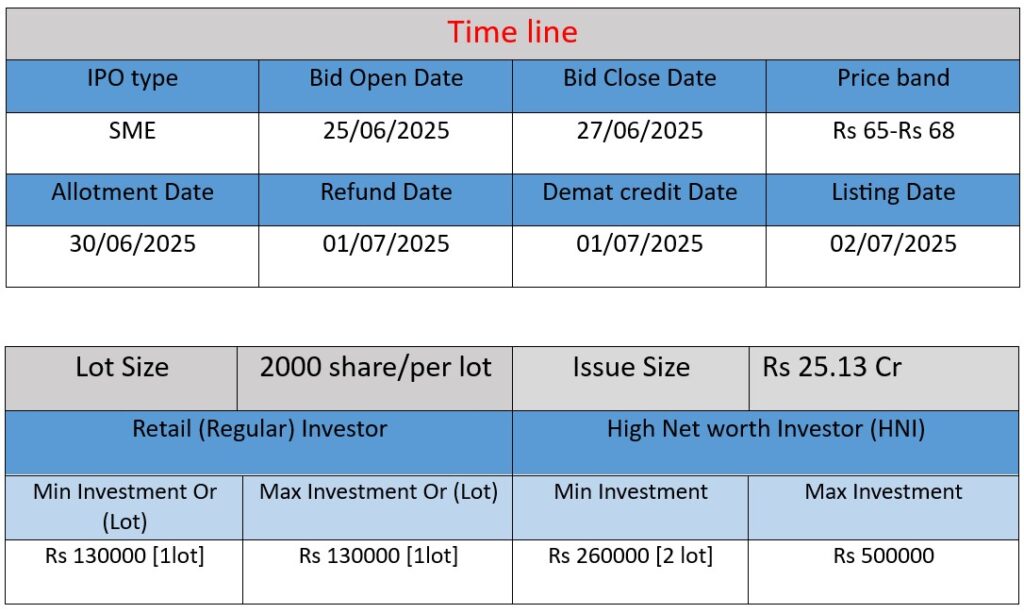

Rama Telecom Limited’s SME IPO opens on June 25, 2025, with an issue size of ₹25.13 crore through a fresh issue of 19.8 lakh shares. The IPO aims to fund working capital, repay borrowings, and meet general corporate purposes. The company specializes in telecom infrastructure projects including OFC laying, HDD, and tower installations across India. Listing will be on NSE SME platform.

Work (Business Operations & Projects)

Core Services & Expertise

- Established in 2004, Rama Telecom operates in the telecom and data‑communications sector, offering turnkey engineering solutions: optical fiber cable (OFC) laying, micro‑trenching/drilling, splicing/termination, rack installation, telecom tower and transmission infrastructure, especially across the Indian Railways and telecom players like Airtel, Jio, IOCL, and the Airport Authority of India.

- Techniques include advanced Horizontal Directional Drilling (HDD), aerial ADSS cable deployment, and synchronous transport module (STM)/MUX commissioning.

Geographic Reach & Partnerships

- Over the past two decades, the company has expanded from Eastern India to a pan‑India presence.

- Collaborates with major OEMs and distributors—including Nokia, D‑Link, Tejas Networks, Exide, Aaram Plastics, Mescab, Mrotek, Puncom, Statcon, Team Engineers, and Webfil—for comprehensive project delivery.

Strength

Project Expertise & Track Record

- Draws on 20+ years of field experience: OFC laying, drilling, telecommunications, and data‑communication works.

- Institutional-recognized partners (Railways, telecom giants) indicate solid domain credibility.

Human Capital & Workplace Reputation

- Staff strength around 29–40 employees, led by specialized managerial teams.

- Highly rated by employees (4.8⁄5 on AmbitionBox), with strong marks for skills (4.8), promotion (4.6), pay (4.1), and culture (4.0), though note slightly lower ratings for job security (3.1).

Risk

Financial Leverage

Low debt-equity ratio (0.49) and modest borrowing (~₹5–6 cr) suggest manageable leverage, but being capital-intensive leaves limited buffer if growth slows .

Competitive & Sector Risk

- Faces intense competition from large telecom infrastructure firms amid aggressive tendering and price pressure.

- Industry-wide threats include cybersecurity concerns, pricing wars, and disruption from over‑the‑top (OTT) services.

Execution & Client Dependency

Heavily reliant on project execution in public (Railways, airports) and select telecom clients—delays, regulatory changes, or contract losses could significantly impact business.

5SME Market Scale Limitations

As a small-scale SME (₹40 cr annual revenue), the company may struggle with scaling, capital raising, and economies of scale, compared to larger players.

By positioning itself as a specialist telecom infra provider with strong technical capabilities, growth trajectory, and employee goodwill, Rama Telecom shows promise. However, small-scale SME dynamics, market competition, and execution risks are central factors to carefully evaluate—especially for investors eyeing their SME-IPO.

Here is a brief financial performance analysis across FY2023 to FY2025:

| Particulars (₹ Cr) | FY2023 | FY2024 | FY2025 |

| Revenue | 33.10 | 37.19 | 41.76 |

| Profit | 1.08 | 2.61 | 5.53 |

| Total Assets | 16.40 | 19.44 | 28.65 |

Revenue

- FY2023: ₹33.10 Cr

- FY2024: ₹37.19 Cr → 12.3% growth

- FY2025: ₹41.76 Cr → 12.3% growth again

Analysis:

Consistent 12%+ annual growth shows strong project acquisition and execution across India’s telecom infrastructure segment. The steady increase reflects both expansion and operational efficiency.

Profit

- FY2023: ₹1.08 Cr

- FY2024: ₹2.61 Cr → 141.7% growth

- FY2025: ₹5.53 Cr → 111.8% growth

Analysis:

Profit has grown more than 5x in just two years, indicating better cost control, project margins, and possibly repayment or reduction of interest costs. This trend makes the company attractive in the SME space.

Assets

- FY2023: ₹16.40 Cr

- FY2024: ₹19.44 Cr → 18.5% growth

- FY2025: ₹28.65 Cr → 47.3% growth

Analysis:

Significant rise in total assets in FY2025, likely supported by IPO funding and reinvested earnings. This growth suggests expansion in infrastructure and project handling capacity.

✅ Summary

- Strong revenue and exponential profit growth show robust operational performance.

- Assets growth aligns with expansion and increased project capacity.

- The company is scaling efficiently and preparing for a broader market footprint post-IPO.