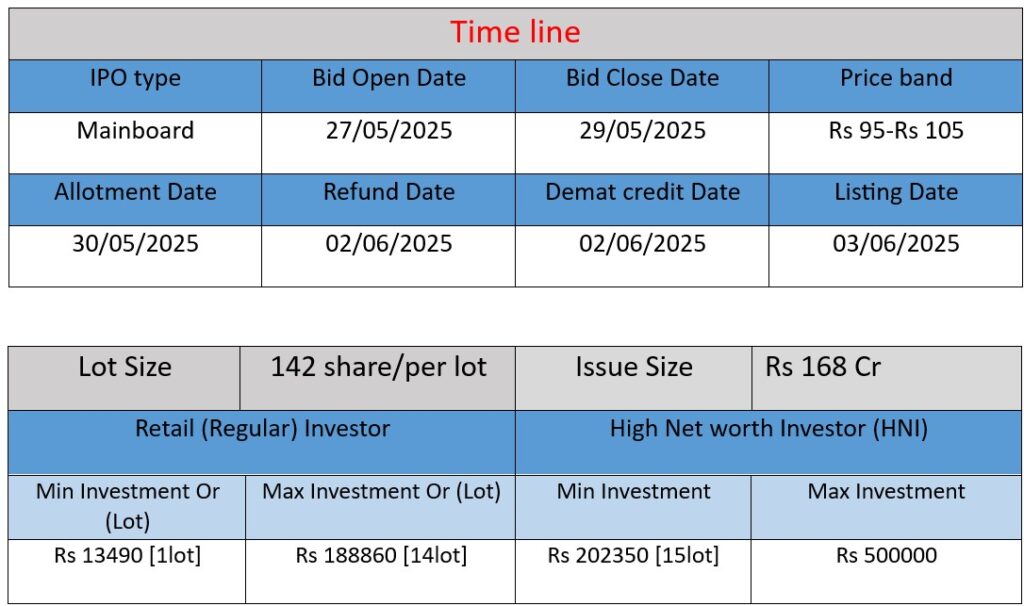

Prostarm Info Systems Limited has launched its Initial Public Offering (IPO) to raise ₹168 crore through a fresh issue of 1.6 crore equity shares. The IPO is open for subscription from May 27 to May 29, 2025, with a price band set between ₹95 to ₹105 per share. The company intends to utilize the proceeds for funding working capital requirements, repaying certain borrowings, pursuing inorganic growth opportunities, strategic initiatives, and general corporate purposes . The shares are proposed to be listed on both BSE and NSE.

Prostarm Info Systems Limited is a Navi Mumbai-based power electronics company established in 2008. It specializes in providing energy-efficient power backup solutions across various sectors in India. Below is an overview of the company’s operations, strengths, and potential risks, compiled from multiple sources.

Work: Operations and Offerings

Core Products and Services

Prostarm manufactures a range of power solutions under the ‘Prostarm’ brand, including:

- Uninterruptible Power Supply (UPS) systems

- Inverter systems (including lift and solar hybrid inverters)

- Lithium-ion battery packs

- Servo-controlled voltage stabilizers and isolation transformers

- Rooftop solar photovoltaic power plant projects on an EPC basis

The company also offers Annual Maintenance Contracts (AMCs) for its products.

Manufacturing and Reach

With three ISO-certified manufacturing facilities in Maharashtra, Prostarm has a significant presence across India, operating in over 22 cities and more than 170 districts.

Clientele and Industry Presence

Prostarm has served over 700 clients in FY24, including prominent companies like Larsen & Toubro, Tata Power, and Bajaj Finance. Its solutions cater to diverse sectors such as healthcare, aviation, BFSI, railways, defense, education, renewable energy, IT, and oil & gas.

Strengths

Financial Performance

In FY24, Prostarm reported:

- Net profit increase of 18% to ₹22.8 crore

- Revenue growth of 12% to ₹257.9 crore

- EBITDA margin expansion by 190 basis points to 13.7%

Quality Certifications

The company’s manufacturing units hold multiple ISO certifications, including ISO 9001:2015, ISO 14001:2015, ISO 45001:2018, and ISO 50001:2018, reflecting its commitment to quality, environmental management, occupational health and safety, and energy management standards.

Market Position and Expansion Plans

Prostarm is an empanelled vendor for several government bodies, including the Airports Authority of India and NTPC Vidyut Vyapar Nigam Limited. The company has also initiated exports to neighboring countries like Bangladesh and Nepal and is exploring markets in Dubai and Africa.

Risks

Employee Concerns

Employee reviews indicate an average satisfaction level, with a rating of 3.9 out of 5. While company culture is rated at 3.7, job security is a concern, rated at 3.6. Additionally, only 6% of employees have the option to work from home permanently, suggesting limited remote work flexibility.

Competitive Landscape

Prostarm operates in a competitive market, facing challenges from established players like Servotech Power System and Sungarner Energies. Maintaining and growing its market share requires continuous innovation and strategic planning.

Dependence on Government Initiatives

The company’s growth is partly tied to government initiatives like ‘Digital India’ and infrastructure development projects. Any slowdown or policy changes in these areas could impact Prostarm’s business prospects.

In summary, Prostarm Info Systems Limited has established itself as a significant player in the power electronics sector in India, with a diverse product portfolio and a broad client base. While the company shows strong financial performance and quality standards, it faces challenges related to employee satisfaction, market competition, and reliance on government initiatives.

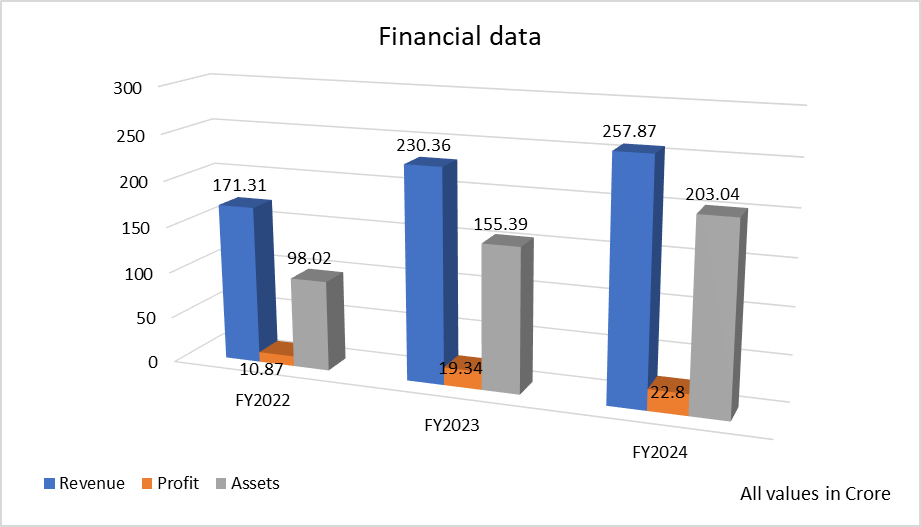

Based on the data provided for Prostarm Info Systems Limited, here is a brief financial performance analysis across FY2022 to FY2024:

Revenue

- FY2022: ₹171.31 crore

- FY2023: ₹230.36 crore

- FY2024: ₹257.87 crore

Analysis:

Prostarm’s revenue has shown consistent growth:

- FY23 saw a 34.4% increase from FY22.

- FY24 saw a 12% increase from FY23.

This indicates a healthy and steady expansion in business operations.

Profit

- FY2022: ₹10.87 crore

- FY2023: ₹19.34 crore

- FY2024: ₹22.8 crore

Analysis:

Net profit nearly doubled from FY22 to FY23 (up 78%) and further increased by 17.9% in FY24, reflecting improved operational efficiency and profitability.

Total Assets

- FY2022: ₹98.02 crore

- FY2023: ₹155.39 crore

- FY2024: ₹203.04 crore

Analysis:

Asset base more than doubled in three years:

- 58.5% increase in FY23

- 30.7% increase in FY24

Indicates ongoing investments in infrastructure and potential capacity expansion.

Summary

- Prostarm has shown robust financial performance with:

- Rising revenue and profit

- Strengthening asset base

- The trend suggests strong business fundamentals and operational growth ahead of its IPO.