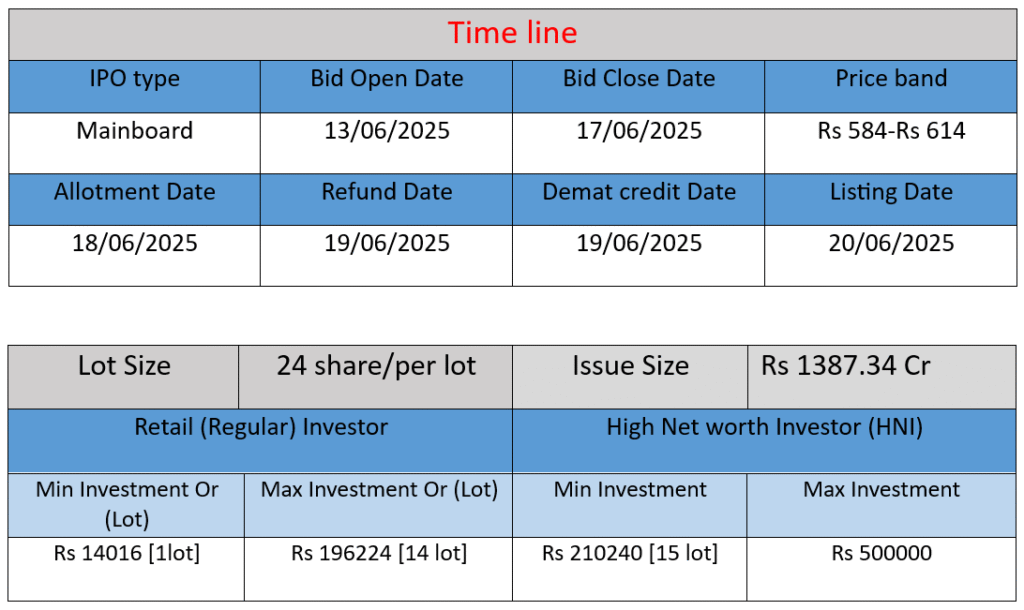

Oswal Pumps IPO opens on June 13 and closes on June 17, 2025. The issue size is ₹1,387 crore, including a fresh issue of ₹1,000 crore and an offer for sale of ₹387 crore. The IPO aims to fund capital expenditure, working capital needs, and general corporate purposes. Investors can bid within a price band of ₹584–₹614 per share. Don’t miss this opportunity to invest in a growing pump and solar solutions manufacturer.

Company Information & Core Operations (“Work”)

Business Segment & Products

Oswal Pumps, founded in 2003 and headquartered in Haryana/Delhi, is a vertically integrated manufacturer of a wide range of pumps and related electrical equipment.

It produces:

- Solar submersible & monoblock pumps

- Grid‑connected submersible pumps

- Pressure/boiler pumps, sewage pumps, and electric motors

Their capability spans domestic, agricultural, industrial, and international markets. They also manage in‑house production for components like winding wires, cables, and SS pipes .

Manufacturing Footprint

The flagship plant covers ~41,076 m², equipped with advanced stamping, casting, winding, and molding units — enabling end‑to‑end production with strong quality control under ISO 9001/14001, ISI, CE, and BEE certifications .

Market Reach & Revenue Sources

Oswal Pumps serves over 2,000 dealers in India and exports to 17–20 countries, including Australia, Bangladesh, Cyprus, and the UAE . It has executed large-scale solar pump orders under the PM Kusum Scheme (26,270 turnkey systems)

Strengths

Vertical Integration & Quality Standards

Complete internal control over components enhances manufacturing efficiency and consistency in product quality. Multiple ISO, ISI, CE, and BEE marks reflect strong compliance and energy efficiency.

Product Diversity & Certifications

A portfolio exceeding 1,000 SKUs across various pump types and accessories, backed by prestigious awards like the National Udyog Rattan and Bhartiya Udyog Rattan, demonstrate credibility in both domestic and export markets .

Fast Growth & Support from Government Policies

Rapid growth in solar‑pump revenue, export house status, and significant contracts under PM Kusum reflect favourable positioning within India’s renewable and agricultural infrastructure push.

Risks & Challenges

Financial Transparency & Profit Margins

Financial data disclosures are limited. As of March 2024, margins appear slim: ZaubaCorp reports operating margin ~2.78% and net margin ~2.63%, pointing to vulnerability in cost fluctuations.

Execution Risk from IPO

While the company seeks to raise ₹1,387 cr via IPO (₹1,000 cr fresh issue + OFS), the influx of capital raises investor expectations. Failure to optimally deploy funds could expose Oswal to scrutiny or market pressure.

Competitive and Regulatory Pressure

The pump and solar equipment industry is intensely competitive, tied closely to commodity prices, subsidies, and renewable energy policies. Any reversal in government incentives (e.g., PM Kusum) would compress margins or order pipelines.

✅ 4. Summary Matrix

| Criteria | Highlights |

| Operations | Vertically integrated manufacturing of diverse, energy-efficient pumps |

| Strengths | Strong quality certifications, export reach, government-recognized growth |

| Risks | Thin profit margins, reliance on policy and effective use of IPO proceeds |

| Recent Update | IPO opens June 13, 2025, price band ₹584–₹614/share; total raise ~₹1,387 cr |

Final Take

Oswal Pumps stands on a solid foundation: integrated manufacturing, diverse product lines, and growth clout from renewable government schemes. Its strengths are well‑aligned with India’s drive for sustainable infrastructure. However, investors and stakeholders should watch profitability margins, dependence on subsidies, and the strategic deployment of IPO capital as critical factors shaping its future trajectory.

Here is a brief financial performance analysis across FY2022 to FY2024:

Revenue

- FY2022: ₹360.38 crore

- FY2023: ₹385.04 crore

- FY2024: ₹758.57 crore

Analysis:

Revenue more than doubled in FY2024 compared to FY2023, showing a 96.98% year-on-year growth. This sharp rise reflects strong demand—likely driven by solar pump contracts, growing export orders, and government schemes like PM-Kusum.

Profit (Net Profit)

- FY2022: ₹16.93 crore

- FY2023: ₹34.20 crore

- FY2024: ₹97.66 crore

Analysis:

Net profit grew almost 3 times in FY2024 over FY2023, indicating not only increased revenue but also better cost management and operational efficiency. Profit margins have improved significantly, suggesting a positive outlook for sustainability.

Total Assets

- FY2022: ₹221.84 crore

- FY2023: ₹252.30 crore

- FY2024: ₹511.28 crore

Analysis:

Total assets have more than doubled in two years, which shows strong expansion in physical infrastructure, inventory, or receivables—often seen in scaling manufacturing businesses.

📌 Summary

| Financial Metric | FY2022 | FY2023 | FY2024 | Growth (FY23 to FY24) |

| Revenue (₹ Cr) | 360.38 | 385.04 | 758.57 | ↑ 96.98% |

| Profit (₹ Cr) | 16.93 | 34.20 | 97.66 | ↑ 185.55% |

| Assets (₹ Cr) | 221.84 | 252.30 | 511.28 | ↑ 102.60% |

Conclusion

Oswal Pumps has shown exceptional financial performance in FY2024, with sharp increases in revenue and profit. The company appears to be scaling fast while maintaining profitability. Its IPO arrives at a time of high momentum, making it attractive—but investors should also consider sustainability of such rapid growth.