Optivalue Tek Consulting IPO Overview

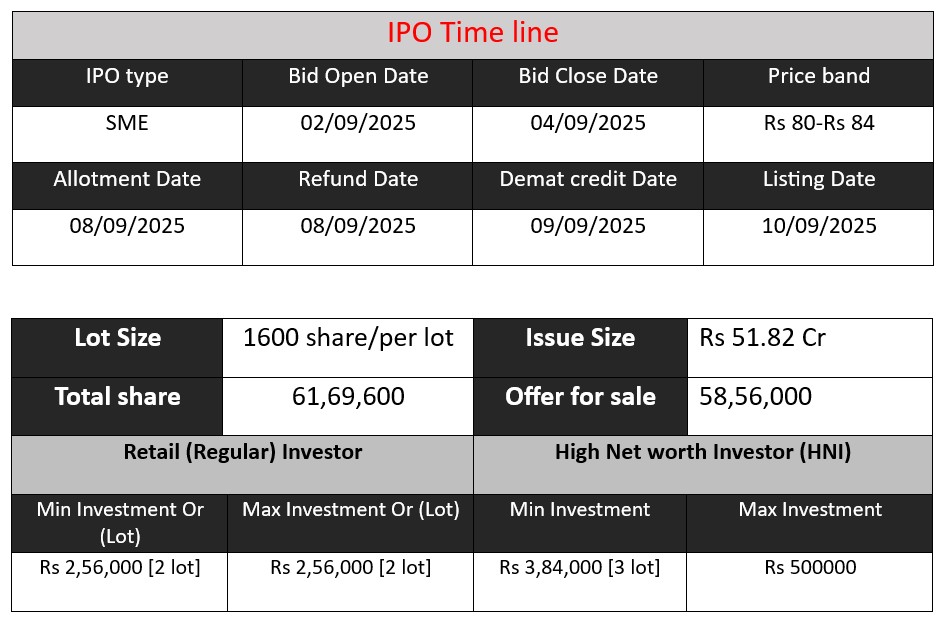

Optivalue Tek Consulting Ltd. IPO opens on September 2, 2025 and closes on September 4, 2025. The issue size is ₹51.82 crore, offering 6,169,600 equity shares at a face value of ₹10 each, with a price band of ₹80–₹84. Net proceeds are earmarked for product development, setting up a Bangalore office, upgrading IT infrastructure, working capital, and general corporate purposes.

Optivalue Tek Consulting Subscription and GMP Status

| Category | Subscription (x) |

| QIBs | 17.11 |

| NIIs | 98.77 |

| Retails | 39.16 |

| Total | 42.50 |

| Last Updated: 04 Sep 2025- 5 PM Source: NSE/BSE | |

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 6 | 80-84 |

| Last Updated: 04 Sep 2025- 5 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Date

Optivalue Tek Consulting Core Business & Overview

Incorporated in 2011, Optivalue Tek Consulting is a global technology consulting firm offering an extensive range of IT and digital transformation services.

Service Portfolio

The company specializes in:

- Managed services

- Enterprise Application Integration (EAI)/API management

- Telecom OSS/BSS solutions

- Core banking applications

- Cloud solutions

- DevOps and Site Reliability Engineering (SRE)

- Data engineering, data science, and AI/analytics

- Web and mobile application development

- Digital engineering, including generative AI initiatives.

Geographical Reach & Resources

Optivalue has a global footprint with offices in Bengaluru (India), Texas or Sugar Land (USA), and Australia.

As of September 2024, the company employed 71 full-time professionals, supported by 40–80 contractual staff.

It has executed over 500 integration projects across more than 20 countries.

Strengths

- Wide & Growing Service Spectrum

The company’s diverse offerings—from cloud, AI, data science to telecom integration—allow for cross-industry relevance and adaptability. - Low Financial Leverage

The debt-to-equity ratio stands at just 0.17, indicating limited reliance on borrowing. - Proven Execution & Global Presence

With extensive global delivery and over 500 completed integrations, the company demonstrates strong execution capabilities.

Risks

- Revenue Concentration

A substantial portion of revenue is tied to top customers: the top five accounted for over 60% of revenues, making the business vulnerable to client turnover. - Lack of Long-Term Contracts

Operating mostly on work orders rather than binding long-term contracts adds variability to revenue streams. - Foreign Exchange Exposure

Nearly 100% of its revenues are in foreign currencies—primarily USD—making it sensitive to exchange-rate fluctuations. - Increasing Receivables

Trade receivables rose from ₹10.50 cr (FY24) to ₹16.22 cr (Sept 2024). Delays or defaults in payment could impact cash flow. - Negative Cash Flows

- Operating: –₹3.96 cr (FY22)

- Investing: –₹0.21 cr (FY23)

- Financing: negative cash flows in FY23–24 and as of Sept 2024.

- Legal & Compliance Concerns

The company and its promoters face ongoing tax proceedings, which, if unfavorable, may hurt business operations.

Additionally, the company did not initially fulfill its CSR obligations for FY22, though the shortfall has since been made good—and possible regulatory repercussions remain

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Assets |

| FY 2022 | 29.14 | 5.26 | 22.47 |

| FY 2023 | 38.84 | 2.77 | 23.01 |

| FY 2024 | 36.56 | 5.49 | 28.97 |

Revenue

- FY 2022: ₹29.14 crore

- FY 2023: ₹38.84 crore (growth of 33%)

- FY 2024: ₹36.56 crore (decline of 6%)

Revenue grew sharply in FY 2023 but dipped slightly in FY 2024, showing fluctuations in topline performance.

Profit

- FY 2022: ₹5.26 crore

- FY 2023: ₹2.77 crore (drop of 47%)

- FY 2024: ₹5.49 crore (growth of 98%)

Profits dipped in FY 2023 but rebounded strongly in FY 2024, reflecting improved cost management and operational efficiency.

Assets

- FY 2022: ₹22.47 crore

- FY 2023: ₹23.01 crore (stable)

- FY 2024: ₹28.97 crore (growth of 26%)

Asset base has consistently expanded, indicating steady growth in company strength and investment.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.