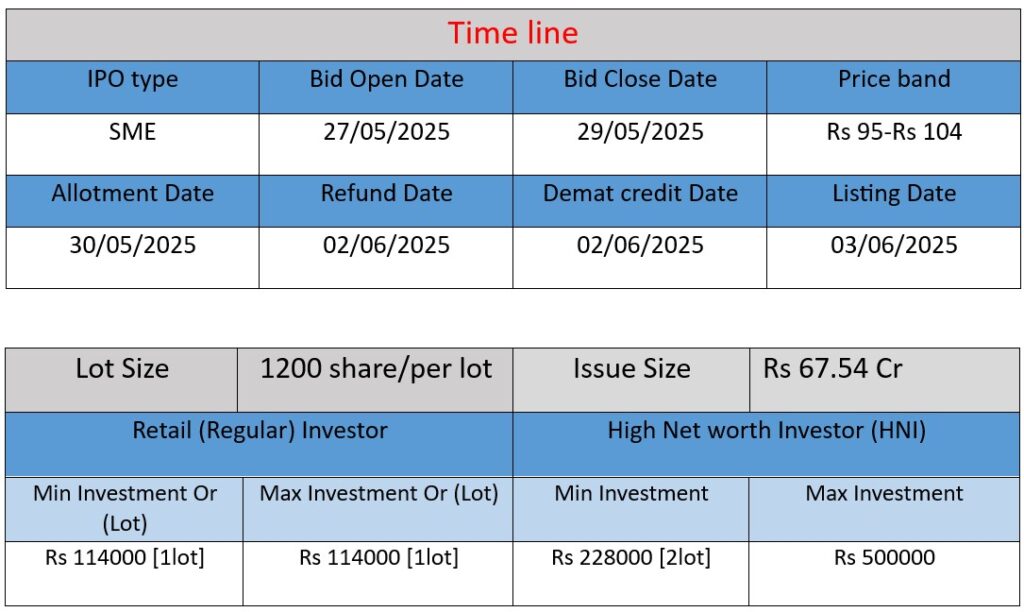

Nikita Papers Limited’s IPO opens on May 27 and closes on May 29, 2025, aiming to raise ₹67.54 crore through the issuance of 64.94 lakh equity shares. Priced between ₹95–₹104 per share, the funds will support a new power plant, working capital, and general corporate purposes. Shares will be listed on NSE Emerge.

Nikita Papers Limited is a prominent Indian manufacturer specializing in recycled kraft paper. With a strong emphasis on sustainability and innovation, the company has established itself as a key player in the paper industry. Below is a comprehensive overview of Nikita Papers Limited, focusing on its operations, strengths, and potential risks.

Operations and Business Overview

Established Legacy and Growth

Founded in 1989, Nikita Papers Limited commenced its kraft paper production in 1992 with an initial capacity of 3,500 tonnes per annum (TPA). Over the years, the company has significantly expanded its production capacity to 180,000 TPA, reflecting its robust growth trajectory .

Product Portfolio

The company specializes in manufacturing high-quality kraft paper in various shades, bursting factors, and grammage ranges to cater to diverse market needs. Their products are known for their high ductile and tensile strength, making them suitable for multiple applications, including wrapping and packaging .

Global Presence

Nikita Papers exports its products to over 15 countries, showcasing its international reach and commitment to meeting global standards .

Sustainable Practices

A pioneer in eco-friendly manufacturing, Nikita Papers operates as a “Zero Liquid Discharge” unit, ensuring that all wastewater produced during the manufacturing process is treated and reused, thereby minimizing environmental impact .

Strengths: Competitive Advantages

1. Environmental Commitment

Nikita Papers is ISO 14001:2015 certified for Environmental Management Systems, underscoring its dedication to sustainable operations. The company also holds Forest Stewardship Council (FSC) certification, ensuring responsible sourcing of raw materials .

2. Robust Financial Performance

In the fiscal year 2023, Nikita Papers reported an 11.77% increase in total revenue and a 20.64% rise in profit, indicating strong financial health and operational efficiency .

3. Experienced Leadership

The company’s leadership comprises seasoned professionals, including Chairman Sudhir Kumar Bansal and Managing Director Ashok Kumar Bansal, who bring extensive industry experience and strategic vision to the organization .

4. Technological Advancements

By integrating cutting-edge technology into its manufacturing processes, Nikita Papers ensures high-quality production while maintaining environmental sustainability .

Risks: Potential Challenges

1. High Debt Levels

As per the latest available data, Nikita Papers has open charges totaling ₹225.93 crore, indicating a significant debt burden that could impact its financial flexibility .

2. Market Competition

The paper manufacturing industry is highly competitive, with numerous players vying for market share. This intense competition could pressure Nikita Papers to continuously innovate and maintain cost-effectiveness.

3. Raw Material Price Volatility

Fluctuations in the prices of raw materials, such as waste paper and chemicals, can affect production costs and profit margins. Managing these fluctuations is crucial for maintaining profitability.

4. Regulatory Compliance

Operating in multiple jurisdictions exposes the company to varying environmental and industrial regulations. Ensuring compliance across all operational regions is essential to avoid legal and financial penalties.

In summary, Nikita Papers Limited stands out for its commitment to sustainable manufacturing, strong financial performance, and experienced leadership. However, the company must navigate challenges related to debt management, market competition, raw material price volatility, and regulatory compliance to sustain its growth trajectory.

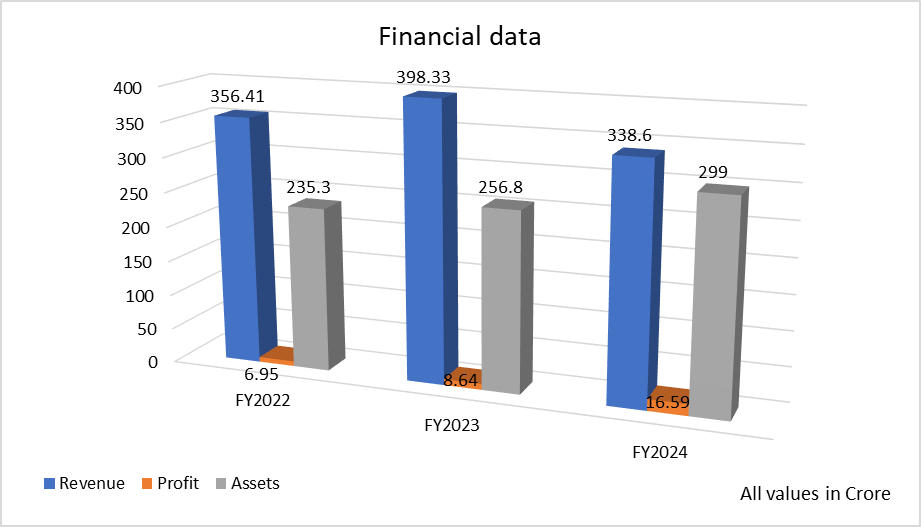

Based on the data provided for Nikita Papers Limited, here is a brief financial performance analysis across FY2022 to FY2024:

Revenue

- FY2023 saw a growth of 11.76% over FY2022.

- FY2024 saw a decline of 15% in revenue from FY2023.

- Despite the dip in FY2024, the company may have focused on higher-margin or efficient operations.

Profit

- Profit rose steadily from ₹6.95 Cr in FY22 to ₹8.64 Cr in FY23.

- A sharp jump to ₹16.59 Cr in FY24, showing a 91.96% YoY increase, indicating significant operational efficiency or cost control.

Assets Growth

- Total assets increased consistently:

- FY22 to FY23: +9.14%

- FY23 to FY24: +16.37%

- This shows continuous investment or asset buildup—possibly for capacity or future growth.

🧾 Summary

- Revenue peaked in FY23 but declined in FY24.

- Profit more than doubled in FY24 despite lower revenue—reflecting strong margin control or improved efficiency.

- Assets consistently increased, supporting the company’s future growth trajectory.